A full-fledged U.S. recovery is taking shape

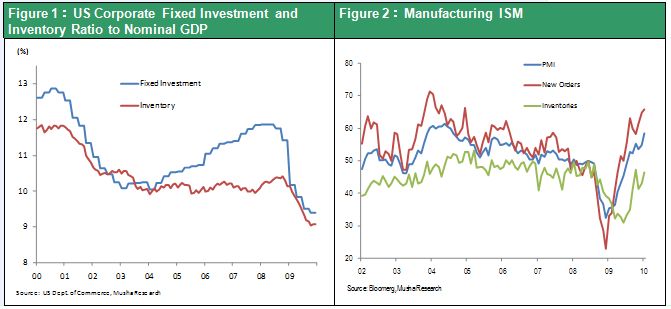

U.S. GDP expanded at an annual rate of 5.7% in the fourth quarter of 2009 and the Institute for Supply Management (ISM) manufacturing index reached 58.4, the highest level since August 2004. Even the most cautious economists cannot deny that the U.S. economy is doing very well. GDP statistics clearly show that a recovery in the U.S. corporate sector has started. Moreover, ISM statistics show that orders have climbed sharply as inventories decreased (at both companies and their customers) and the number of jobs increased. All these numbers point to a further increase in manufacturing output in the months ahead.

Obviously recovery is being driven by the U. S. corporate sector

Inventories made the biggest contribution to the annualized 5.7% GDP growth in the fourth quarter of 2009, accounting for 3.4% (about 60%). The reason is that the decline in inventories during the quarter was smaller than before. Overall, though, inventories continue to decline. In fact, U.S. inventories at companies have dropped to an all-time low as a percentage of GDP. A big rebound in inventories is therefore very likely to fuel GDP growth later this year.

More good news is coming from capital expenditures. Following a big drop, capital expenditures posted the first upturn in six quarters in the final quarter of 2009. Apparently, companies are starting to use their abundant free cash flows to make investments. At one point, the U.S. ratio of capital expenditures to GDP fell to a record low of 9.4%. But now, we may be on the verge of a steep recovery in capital expenditures. Of course, companies are reporting unprecedented earnings growth. Profitability is benefiting from low-cost structures backed by record-low labor share along with growth in production output. In the fourth quarter of 2009, 80% of the S&P 500 companies reported earnings that beat the forecasts. Never before has this percentage been so high (Financial Times, February 2). Significantly, the force behind higher earnings has shifted from cost cutting to sales growth. This is a clear sign that the pace of the recovery is accelerating.

Brightening employment picture and rising consumer confidence suggest that the start of a full-scale recovery is just a matter of time

There is no doubt that we will see a full-scale recovery once this strength in the corporate sector starts producing jobs and raising consumer spending. Rapidly recovering earnings at companies should be reflected in employment and consumer spending statistics soon, if not immediately. I expect to start hearing announcements of strong employment and consumer spending figures between now and April. In fact, I think we are probably witnessing the beginning of an economic recovery right now. Investors must not forget that the beginning of a recovery is when upward momentum in stock markets is the strongest.

Pessimists have no ground to stand on. Public-sector support is shrinking and the credit crunch is easing.

Contrary to the high-profile statements of the ideological pessimists who gathered in Davos, the position of pessimists has been severely eroded. One example that no longer holds water is the position that the economic rebound will come to a halt when governments stop fueling the recovery. But in the fourth quarter of 2009, we saw an end to the contribution of tax cuts to household income. At the same time, local government investments and spending made a negative contribution to economic growth (due to lower defense spending and budget cuts by local governments struggling with falling tax revenues). In other words, the private-sector was responsible for all of the fourth quarter growth. Obviously, there was no need to worry about the end of government economic stimulus programs. In addition, according to the FRB’s quarterly loan officer survey, banks are becoming more willing to extend credit. Asset prices appear ready to increase, too. Consequently, we should soon see an improvement in the availability of credit.

The Volcker Rule is nothing more than a starting point

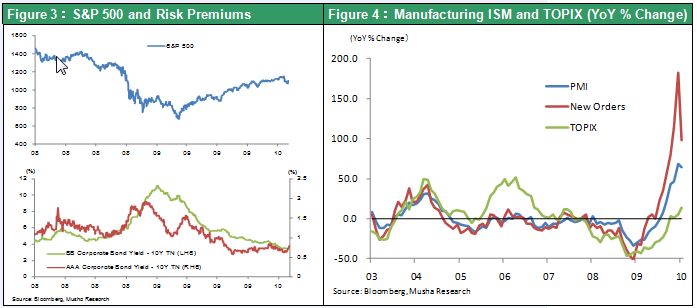

Financial markets were rocked late in January by the sudden announcement by President Obama of his proposed reforms to the financial system (Volcker Rule). But the rough state of the proposal clearly shows that this is nothing more than a starting point. At face value, the proposal would fundamentally alter the entire financial system. No one would have been surprised to see prices on stock and debt markets plunge in response. Instead, financial markets largely ignored the president’s ideas. Stocks retreated less than 10% while there was little change in the credit risk premium in bond markets.

The Volcker Rule has a number of serious problems. First is the complete absence of measures to limit or oversee the causes of the financial crisis and excessive risk-taking by non-bank financial companies. Second, there must be reforms targeting the mammoth international financial institutions. But the U.S. alone will be unable to obtain the necessary international support. Third, does Paul Volcker, who does not even use e-mail, really comprehend the proposed technology reforms (use of electronic data, globalization) for the financial sector? Enactment of the Volcker Rule in its present state would destroy the highly competitive financial institutions and companies that are at the heart of the U.S. economy. I cannot imagine that a pragmatic country like the U.S. would choose a populist policy like this. Finance is the most powerful channel by which the U.S. can reap the benefits of globalization. It is inconceivable that the U.S. would destroy this channel.

The president, Congress and financial institutions will continue to debate the merits of the Volcker Rule. I believe that this process will seek reforms that adequately reflect the strong public criticism of financial institutions. Reaching an agreement on these reforms will probably require much more than just a few months.

Market turmoil linked to the Volcker Rule is most likely behind us. I think the world’s stock markets are just about to reach the “sweet spot” of an earnings-driven rally. Of course, in Japan, there will be no change in the current trend of rising stock prices as the yen weakens.