A strong dollar ? The last resort during a liquidity crisis

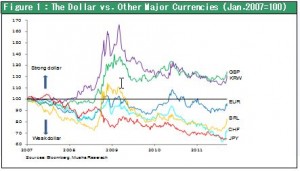

The dollar’s strength against other major currencies is increasingly conspicuous. At the same time, the price of gold is beginning to show signs of weakness. The tendency to buy only the dollar as a financial crisis deepens is therefore gradually emerging. Investors also shifted funds to the dollar during a similar liquidity crisis that occurred when the Lehman shock sparked fears of financial instability. These events demonstrate that financial institutions and market participants use the dollar as the final means of making payments because no other asset has higher liquidity. This view has two important ramifications.

First, the dollar’s strength is an indication that worries about liquidity in Europe are likely to be even greater. For instance, the Financial Times reported on September 20 that Siemens had withdrawn its deposits from a French bank and transferred the funds to the ECB. As a result, the risk of a bank turning illiquid due to the inability to procure funds has become a reality. Markets have given a sigh of relief for the time being. The reason is that the Fed will use swaps to provide an unlimited amount of dollars to the ECB until the end of 2011. However, the ability, centering on the ECB, to supply funds is not unlimited. Only a dramatic infusion of funds can end concerns in financial markets about liquidity. One way, for instance, would be to double the supply of funds by increasing the size of, and enhancing the function of the European Financial Stability Facility (EFSF), which can provide capital to national governments. Another dramatic move would be the infusion of public funds following the determination of losses resulting from a Greek default and other events.

The dollar is still the nucleus of the international currency system ? Differences between today and the 1930s

Second, the dollar’s strength is evidence that, during a crisis like this one, investors view the dollar as the last resort for making payments and have faith in the dollar. In response, the Fed is meeting the need for dollars by supplying liquidity. Consequently, all of these events demonstrate that the global currency system centered on the dollar is still sound. Furthermore, since the Fed is continuing to supply more dollars, the possibility of an explosion that produces a severe liquidity crisis like the one that occurred during the Great Depression of the 1930s is very small. During the 1930s, the United States replaced Great Britain as the world’s superpower. There was no last resort for the provision of credit during this transitional phase. The strength of the dollar that we are now witnessing shows that we cannot eliminate worries about liquidity in Europe over the short term. At the same time, however, the strength demonstrates that there are no fears about the dollar-based currency system from a long-term perspective.

Operation Twist ? Benefits and concerns

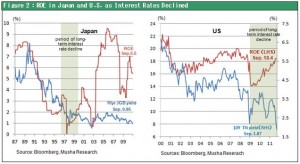

Yesterday the Fed announced “Operation Twist.” The plan is to encourage risk-taking without increasing the Fed’s balance sheet by purchasing long-term Treasuries and selling short-term notes. By lowering long-term interest rates, Operation Twist may boost stock prices, increase purchases of housing loans or lead to more risk-taking. However, there are concerns about a negative impact of this operation resulting as narrowing interest margins reduce the ability of banks to create credit. This same negative impact emerged when Japan’s yield curve flattened out, so these fears are justified.

Differences between the U.S. and Japan

But there are two major differences between the U.S. and Japan. First, earnings at U.S. companies are very strong. As a result, there is good reason to expect that falling long-term interest rates will trigger risk taking as companies borrow funds to buy stocks. In Japan, though, earnings were extremely weak. So there was no reason to use lower long-term interest rates to borrow money for buying stocks.

The second difference is that companies in Japan use primarily indirect financing to procure funds. Reliance on loans caused earnings at Japanese banks to fall as the yield curve became flatter. The result was a negative impact on credit creation. In the U.S., though, direct financing accounts for about 70% of fund procurement. As a result, the positive impact of lower long-term interest rates, as low rates stimulate aggressive purchases of assets, will probably be much greater than the negative impact of the credit crunch caused by falling earnings at financial institutions.

Operation Twist will obviously have some negative consequences. But this operation is very likely to stimulate substantial risk-taking. We can expect to see more measures by the Fed to encourage risk-taking. Moreover, stock valuations have retreated to extremely attractive levels. Consequently, despite the liquidity crisis in Europe, I do not think stock prices will keep falling day after day. Investors will probably start testing the waters to locate the bottom of this downturn as they watch to see if the liquidity crisis in Europe can be resolved.