We are undoubtedly at a historic turning point, but prospects for the future and opportunities will depend on the actions of people.

The points I have raised thus far make it clear that the world has reached a historic turning point. No one can deny this due to a number of events: (1) stock prices (the DJIA) has remained flat at about $10,000 since 1999, about a decade; (2) during this period, stock and bond prices have been extremely volatile (rising and falling rapidly) due to frequent crises, including the end of the IT bubble, the collapse of Lehman Brothers and the crisis involving Greece and the euro; (3) gold has staged the third powerful rally in modern history; and (4) yields of long-term bonds of major countries have fallen to historic lows. Looking back, history tells us that policies and strategies play a decisive role during a period of transition. That means we can control our own fate. The actions of people can alter the direction in which the world goes in the coming years.

In other words, there is no need to believe that a bleak future is our destiny merely because we face challenges right now. In fact, as I explained in previous reports, our current difficulties have been caused by the inability of systems and demand creation to keep up with the rapid increase in productivity (growth in the ability to supply goods and services). Driving this progress in productivity are globalization (rapid advances in the international division of labor) and the Internet revolution. But these are intrinsically positive changes. We can compare this situation with the development of an insect at the point the pupa’s shell begins to restrict the larva’s growth. If this view is correct, we can convert this crisis into an opportunity by altering systems to match the initiatives taken in past crises and create demand at a faster pace.

A plethora of mistaken policies are causing demand to fall

Dramatic changes in the global financial markets during the past three months have been triggered solely by major shifts in government policies. Economic growth is slowing in the United States and elsewhere due to the earthquake in Japan, the higher cost of crude oil and other events. But this is not a serious problem. Fear about the possibility of problems in Europe sparking a global financial panic is what is paralyzing markets. Investors fear that enacting exit measures too early would destroy the dike protecting Greece, Europe’s weakest country, and inundate all of Europe with economic problems.

Opinion leaders, politicians and policy makers worldwide are trapped by “debt hysteria” that cannot be justified by actual economic conditions. The result is a series of erroneous policies.

The global economy is suffering from inadequate demand. But demand will be limited even more by the medicine governments are prescribing: (1) fiscal tightening, (2) monetary tightening and (3) stricter regulations for banks (suppressing the creation of credit). We can classify all of these actions as liquidationism, which is a philosophy that places priority on resolving problems that occurred in the past. This thinking is the villain that caused the global depression of the 1930s to deepen. Adopting this stance is certain to take the global economy from a recession to a depression. The next events are obvious. Stocks would plummet, the credit risk premium would surge and the rush by investors to avoid risk would cause the yen alone among the world’s currencies to strengthen. Consequently, we can transform the current situation only by ending the public’s “debt hysteria” and wiping out liquidationism.

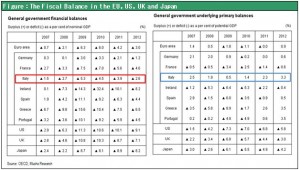

Sound U.S. policies, liquidationism in Europe

Much progress has been made with corrections to the real economy in the United States. Furthermore, government policies are sound (The Fed and the Obama administration have not been poisoned by liquidationism.). As a result, the United States is well positioned for consistent economic growth. The U.S. economy is experiencing growth, although slow, in jobs, consumption, industrial output and investments. Only the housing sector is still sluggish (I will discuss the United States in my next report.). Obviously, the problem is Europe, where everyone is wrapped up in “debt hysteria.” Greece, which had defaulted in the past, joined the EU through deceit by using fictitious information about its national debt. The Greek fiscal crisis then spread to Portugal, Ireland and Spain. With the crisis now affecting even Italy, it is quite obvious that budget deficits are not the fundamental reason that the crisis is deepening. Italy has substantial outstanding debt . But the country ranks first among European countries with a primary balance surplus of 2% (in 2010). Since primary balance is the difference between government income and expenditures less interest payments, this figure is equal to the amount of money that a government needs to procure from financial markets. However, investors are selling off the Italian government bonds despite this surplus. Fundamentals are not behind this selling. The mindset of “debt hysteria” is what is controlling the actions of investors. If nothing is done, speculative selling will move on to France and Germany. It should be clear to everyone that these events would cause the euro to collapse.

Why are investors selling the bonds of financially sound Italy?

The systematic contradiction of EU countries of relying on “government spending without a wallet” is the reason that the Greek crisis spread to other countries so easily. Serving as a “wallet for the government” is the primary role of a central bank. Governments can determine and execute their own fiscal policies because they have their own “wallets.” However, the euro zone countries determine their own fiscal actions without having their own wallets. The only way to procure funds is to use financial markets. Using financial markets means that a shift in the investors’ perception of a country can cause interest rates on its bonds to skyrocket, just as with a mere private-sector company. This volatility is creating a liquidity crisis at European banks that hold massive amounts of government bonds that are normally believed to be safe.

Cutting government spending too soon will cause tax revenues to fall as the economy weakens. At the same time, governments would have to spend more to back up banks, making deficits even larger. Naturally, the country’s credit rating would drop and the yield on its bonds would climb. This vicious cycle fueled by “debt hysteria” will continue until we can bring a complete end to “liquidationism.” This time, we must return the wallet that has been taken away from European countries. Returning the wallet would require having the ECB purchase unlimited amounts of bonds issued by member countries. The scale and functions of the European Financial Stability Facility (EFSF) have been expanded. Taking this step allows the public sector to assume responsibility for losses that should be borne by banks. If the EFSF performs its role along with the ECB’s price keeping operation (PKO) in support of government bonds, the debt of governments will be guaranteed and worries about the soundness of banks will disappear.

Will the PKO be effective?

Criticism and hesitance about the ECB’s PKO are inevitable because taking this step could lead to the risk of creating widespread problems such as huge ECB losses, if bond prices fall, and moral hazards. But the euro would collapse and ECB disappear if nothing is done and the vicious cycle of falling government bond prices and a weakening economy cannot be stopped. This is not the time to be worried about the risk of side effects linked to outlooks that are difficult to justify. The patient will definitely die if nothing is done because everyone is paralyzed with fear about side-effects that are nothing more than making mountains from molehills.

Germany, Europe’s most powerful country, holds the key to resolving this problem. I believe that we can assume that allowing the euro to die is not an option for Germany. First, the euro is part of the cost of integrating East and West Germany as well as an act of penance for World War II. Burying the euro would signify that Germany is turning its back to cooperation among European countries. This is not an option from a geopolitical standpoint. Second, the euro allows German companies to conduct business throughout Europe. These companies have also become more competitive as the euro has remained weak. So using the euro is advantageous for Germany for economic reasons, too. These two reasons explain why Germany should be receiving adequate returns from the cost of preserving the euro.

In the past, using public funds has produced a sharp stock market reversal

This kind of situation is similar to that of a chronic disease that advances slowly and steadily and cannot be allowed to continue for long. . At one point, the crisis will almost immediately become much more severe. When this happens, won’t the ECB and EFSF be forced to enact a decisive PKO?

Stock market movements over the years show that stock prices form a bottom in the same way at a time like this. (1) After Lehman Brothers collapsed, the decision to enact a bank rescue program (TARP) amid a firestorm of bank criticism was what stopped the downturn. The U.S. Congress approved TARP in October 2008 and long-term interest rates hit bottom one month later. Stock prices formed a bottom four months later. Investors waited to confirm progress with TARP and considerable time was required to straighten out supply and demand issues involving hedge funds. (2) In Japan, the decision was made to rescue Resona Bank with public funds (although the bank was not completely nationalized) in May 2003 despite intense criticism from the media and other sources. After this move, the prolonged stock market downturn ended and a strong rally started (The major stock market bottom was April 2003.). (3) Even during the Great Depression, a strong stock market rally started after newly elected President Franklin Roosevelt injected public funds in banks in February 1933 (along with bank closings and integrations).

This followed the end of the Hoover administration, which had concentrated on resolving problems of the past. One year later, stock prices had doubled (The major stock market bottom was June 1932.). These events demonstrate that there are excellent prospects for a V-shaped rebound in stock prices after these types of injections of public funds that result in successful PKOs.