The gap between enigmatic European bonds and the stock market

Stock prices are remaining solid despite tension in Europe’s bond markets. What does this tell us? The October 27 Euro zone summit resulted in a comprehensive plan with three elements: (1) support for Greece and the reorganization of its debt; (2) expansion of the European Financial Stability Facility; and (3) an increase in banks’ capital. But even after an ECB interest rate cut on November 3 investors are still selling Italian government bonds. The yield on these bonds reached a crisis level of 6.7% on November 8. Tension is rising quickly because investors fear that if the yield tops 7%, there will be repercussions for French government bonds and ultimately the collapse of the euro. Investors are even anticipating a flight of capital to prepare for the euro’s demise. Yesterday, Germany’s DAX index closed at 5,961, 17.5% above the low this index reached on September 12. Even the MIB (Milano Italia Borsa) index in Italy is up 16% to 15,664. Furthermore, stocks rose even more following reports of the upcoming resignation of Italian Prime Minister Silvio Berlusconi.

Stock investors expect massive monetary easing and market intervention

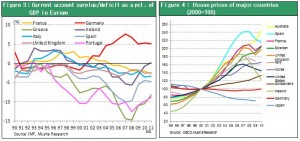

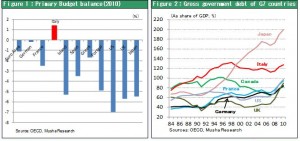

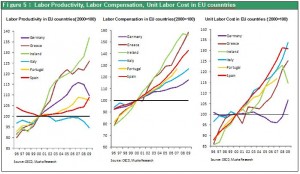

Stock markets may be factoring in the restoration of trust in Italy along with unlimited purchases of Italian government bonds by the ECB. The expectation for a fiscal restructuring program by the new Italian government is the pretense for this belief. Intervention by the ECB, which has unlimited ammunition due to its ability to issue money, is very likely to bring down the yield on Italian government bonds significantly. As Figure 1 shows, Italy’s primary balance surplus was +1.4% in 2010, the highest among the world’s major countries (the primary balance is the budget balance or difference between government income and expenditures, less interest payments, that indicates how much a government needs to procure from financial markets.) This shows that Italy is financially sound. The problem, as shown in Figure 2, is that Italy’s cumulative government debt is now a very high 120% of GDP. But this debt was created in the 1990s, so Italy only needs to meet the demand for funds to refinance this debt now. As a result, if the yield on government bonds stabilizes, there should be no problem at all with Italy’s fiscal fundamentals. Italy is now on the brink of becoming the fuel that feeds financial market fears. But it is inconceivable that the ECB will allow this to happen. The reason is that if the ECB hesitates because its action would go beyond the scope of its responsibilities on the grounds moral hazard or for some other reason, the euro will almost certainly collapse and destroy the ECB, too.

Correct the euro imbalance with German expansion and asset and wage inflation

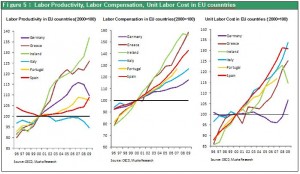

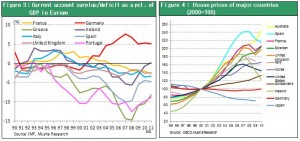

For the time being, Europe may be able to avoid a crisis by using extreme market intervention and monetary easing by the ECB. But the enormous imbalance among eurozone countries (Figure 3) is the cause of the debt crisis. The imbalance is the result of Germany alone being the eurozone’s sole winner (resulting in the need for Germany to channel its huge current account surplus to countries in southern Europe). Even if a crisis is avoided, this situation will not change at all. However, it may be impossible to channel funds to southern Europe through the bank system and direct financial support may be politically difficult. Without these options, the only way for Germany to reduce its competitive edge over southern Europe would be to use inflation (which is the position of Thomas Mayer, chief economist of Deutsche Bank). Therefore, extreme monetary easing by the ECB would trigger a boom in prices of real estate and other assets in Germany, as well as wage inflation. The question is whether, in doing so, rising prices and wages would lead to growth in Germany’s domestic demand.

Germany is already attracting capital from real estate investors

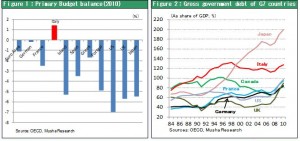

In fact, Germany’s remarkable competitive edge and trade surplus in the eurozone are the result of measures for more than the past decade to hold down wages and unit labor cost along with asset deflation for more than a decade. A comparison of housing prices in major countries is shown in Figure 4. As you can see, housing prices declined only in Germany and Japan during the past decade even as the world frantically struggled with an economic bubble. Figure 5 is a comparison of wages, productivity and unit labor cost in European countries. Once again, the figures clearly demonstrate how Germany has held down costs. Therefore, the euro cannot be preserved unless Italy and other southern European countries boost productivity as Germany enacts expansionary economic policies. Today’s Wall Street Journal has an article about the strong activity in Germany’s real estate market. In the first nine months of 2011, real estate investments for all of Europe are up 13% from one year earlier. But in Germany, investments have increased 31% (source: BNP Paribas Real Estate). Germany is emerging as the frontier for investments in Europe.