Japan’s stock markets are probably on the verge of a rally even though we are in the midst of a technical correction that is using the Volcker rule, Greek financial crisis, minor adjustments to Chinese monetary policy and other events as an excuse. Strong signals are coming from indicators associated with three factors that largely determine the overall economic picture: (1) the U.S. economy, (2) foreign exchange rates and (3) the end of deflation in Japan.

(1) U.S. economy – A sharp upturn in the ISM index

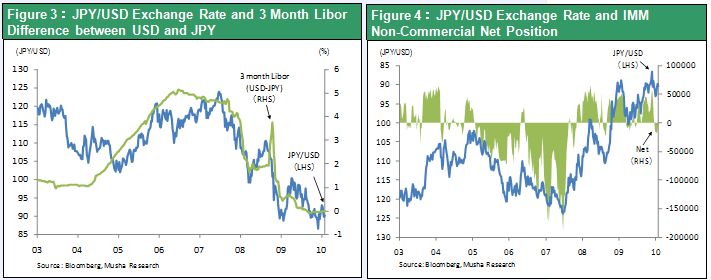

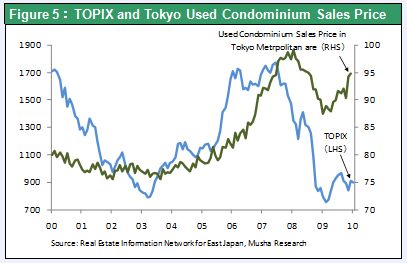

Japanese stocks have generally mirrored the ups and downs of the U.S. economy since 2000. Starting in 2009, there has been a strong rebound in the ISM (Institute of Supply Management) index, an indicator that reflects the health of the U.S. economy. Surprisingly, Japanese stock price movements are more closely linked to the ISM Purchasing Managers Index (PMI) than U.S. stock prices. As you can see in Figure 1, the current recovery in Japan’s stock markets has fallen far behind the rebound in the PMI. The emergence of this gap indicates that Japanese stocks will probably rally to catch up with the index. Incidentally, Deutsche Bank raised its 2010 U.S. economic growth forecast last week from 3.6% to 3.8% because of recent announcements of strong GDP and ISM figures.

(2) The strong correlation between a weaker yen and stronger stock prices – The U.S. economic recovery will bring down the yen’s value

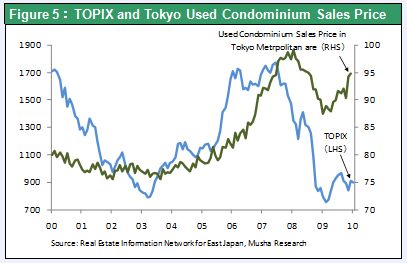

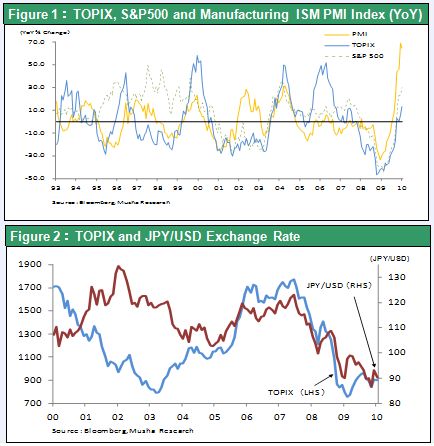

As you can see in Figure 2, there has been a very high correlation between Japanese stock prices and the yen-dollar exchange rate since 2004. Consequently, the rapid rise in the yen’s value from ¥110 to the dollar to less than ¥90 (as well as the deflation in Japan that accompanied this appreciation) probably explains why Japanese stocks have fallen so far behind the global stock market rally. But the yen-dollar exchange rate is about to stage a major turnaround following this big increase in the yen’s value. The reason is a shift in two factors that fueled the yen’s strength. First, the gap between short-term interest rates in Japan and the U.S. has stopped narrowing. As the U.S. economy recovers, we will probably see a reversal in the short-term interest rates of these two countries (Figure 3). Second, net yen speculative positions have started to become negative (Figure 4). If we assume that a full-scale recovery will take place in the U.S., then we are very likely to see a major reversal in exchange rates that significantly weakens the yen.

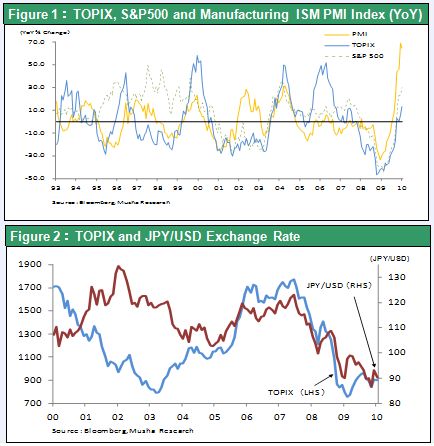

(3) Watch deflation and real estate prices; deflation continues but signs of a resumption of risk-taking are emerging

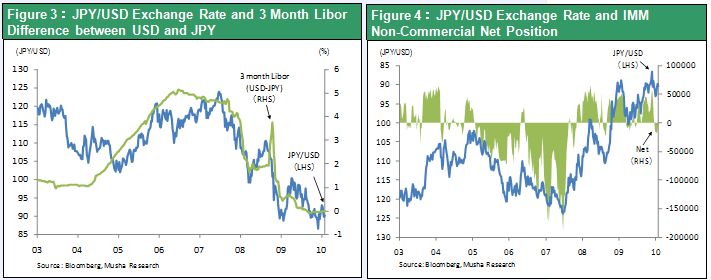

Although Japan is still mired in deflation, there are several signs that deflation is about to end. First is the clear anti-deflationary stance of the Bank of Japan. Second is the end of the yen’s appreciation. Third, there are indications of a recovery in real estate prices. Overall, Japan’s real estate market is still stagnant. But market prices of existing condominiums in the Tokyo area are starting to climb (Figure 5). Furthermore, some condominiums are selling out immediately (Nikkei Business, February 1, 2010). A big drop in the supply of new condominiums since 2007 is the main reason that prices are beginning to rebound. But this recovery is probably also linked to a decline in prospective buyers’ aversion to risk due to the availability of bargain-priced condominiums and loans at low interest rates. This may very well be the first sign that Japan’s deflationary period is finally coming to an end in 2010.