Happy New Year

Stock prices worldwide have doubled since 2009 as the world avoided the crisis of an economic depression. But we are still in a period that has the distinctive signs of a turning point. For example, long-term interest rates in major countries are at historic lows, the price of gold has surged, and stock prices are fluctuating wildly with no clear direction. I believe that this turning point is very likely to lead to an extended period of prosperity and rising stock prices. But apparently all the pieces are not yet in place.

The problem is a mismatch. Productivity and business opportunities are increasing on an unprecedented scale because of the global division of labor and IT network revolution. But the reinvestment of capital is not going smoothly due to the absence of proper systems and frameworks. This mismatch is making financial markets volatile and holding down demand.

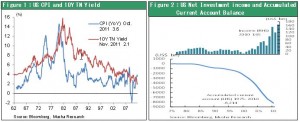

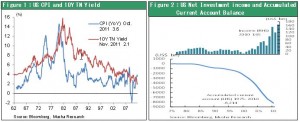

In 2012, as long as the situation in Europe can be stabilized, I expect to see many favorable economic developments. I foresee a sustained U.S. recovery, measures by China to stimulate economic growth, a stronger recovery in Japan backed by earthquake reconstruction demand, renewed investor interest in undervalued stocks, and other good news. The Intelligent Investor, Benjamin Graham’s bible for value investing, was first published in 1949. At that time, stocks were extremely undervalued because the earnings yield of stocks was five times higher than the return on bonds. Warren Buffet, who followed Graham’s instructions, subsequently achieved a remarkable 1600-fold return on his investments over a 37-year period. Right now, the United States and Japan are very similar in two ways. First, 20 years have gone by since a major drop in stock prices. Second, stocks are extremely undervalued because the earnings yield of stocks is five times higher than the return on bonds. These two similarities indicate that we are at a stage where investors can expect to earn significant returns at some point in the future. Consequently, I believe that this is a time to pursue investment value aggressively rather than swing between hope and fear along with short-term problems.

January 1, 2012

Is this dollar buying during a crisis? But stocks and bonds are also high (long-term interest rates are falling).

Europe will probably avoid a catastrophic crisis. Emerging countries will continue to post solid economic growth. China will shift emphasis to easing monetary policy and stimulating the economy before a change in leadership. Even in Japan, the economic growth rate will rise because of earthquake reconstruction demand. If all these predictions come true, the U.S. economy will hold the key to 2012. But right now a triple-high (a strong dollar, rising stock, and bond prices) is taking place in the United States. In fact, the United States was the only country in the world where stock prices rose in 2011. Isn’t this upturn telling us that the vitality of the U.S. economy and financial markets will return in 2012? I cannot deny the possibility that the numerous political events that will take place in 2012 may make the global economic crisis even worse. But I think that the world economy is likely to come back from fear.

The triple high has a sound economic basis

A stronger dollar:

The real effective exchange rate of the dollar has been climbing rapidly since the middle of 2011. One explanation is that people are buying the dollar during this period of crisis situations. When fears about financial instability become pervasive, investors prefer the dollar rather than gold as the ultimate means of making payments. However, U.S. companies are earning the world’s highest returns on capital as they benefit from global economic growth. Consistently robust growth is taking place in the U.S. international investment income, a fact that is concealed by the U.S. government’s debt. The only explanation for this improvement is the global activities of U.S. companies. These companies are core components of any global investment portfolio, which explains why investors like the dollar. A strong dollar makes it possible for the United States to further ease monetary policy. As a result, the United States is ready to act just in case a financial crisis in Europe suddenly begins.

Declining long-term interest rates:

Investors are still buying U.S. government debt even after S&P cut its credit rating and U.S. long-term interest rates remain at an unprecedented low. There are three reasons. (1) There is an unprecedented amount of excess private-sector savings. U.S. companies have an enormous capital surplus because they are generating record-high earnings while holding down capital expenditures. In U.S. households, the savings rate increased significantly after the collapse of Lehman Brothers and is still about 4%, the highest level in more than 10 years. (2) There are no worries about inflation in the United States. (3) Investors have faith in the management of the economy. Since the United States has avoided deflation, interest rates are well into negative territory because prices are rising. Companies can procure funds at an extremely low cost and the same is true for households.

The world’s only rising stock market:

Rising U.S. stock prices are a reflection of the record-high earnings of U.S. companies. Nevertheless, stocks remain undervalued. The earnings yield (forecast) is 9.2% while the real long-term interest rate is -1.3%. The resulting risk premium of 10.5% is the highest in the postwar era (Figure 3). A high risk premium shows how much investors dislike exposure to risk. Viewing this situation as a risk to the economy, the Fed is currently enacting a quantitative easing program.

This unprecedented gap between corporate profit margins and interest rates is still widening (Figure 4). There are only three ways this situation could end: (1) higher interest rates, (2) lower corporate earnings and (3) higher stock prices. (1) Interest rates will rise only if there is inflation, a strong economic recovery, a rebound in demand for funds to invest or a loss of faith in the government. None of these events is likely to occur in the near future. (2) Corporate earnings would fall if a financial panic in Europe triggered a global economic downturn. But this is also very unlikely to happen due to the rapid pace of political measures in Europe to deal with the debt crisis. Consequently, we are very likely to see (3) higher stock prices.

Progress with “creative destruction” in the United States

Progress with “creative destruction” is the primary reason for the record-high earnings at U.S. companies. Even though the U.S. economy is not yet staging a broad-based recovery, earnings have been at record high levels since 2010.

Companies are benefiting from a big improvement in productivity and a sharp decline in operating expenses. Both are the result of a shift in the global economic foundation driven by globalization and the Internet revolution. As companies competed to cut costs, they were forced to reduce their workforces in order to establish new business models rather than simply as a ruthless measure to improve earnings.

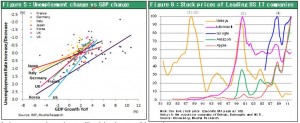

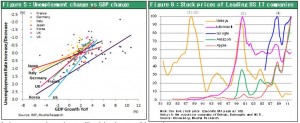

The economic downturn that followed the collapse of Lehman Brothers resulted in the loss of 8.8 million jobs, the biggest decline in the postwar era. Losing these jobs caused labor’s share of income (the share of a corporate added value received by workers) to fall significantly to an even lower point. This severe decline in jobs is a distinctive feature of the U.S. economy. But this same feature is also proof that the process of “creative destruction” progressed faster in the United States than anywhere else in the world. Figure 5 shows the elasticity of the labor market in major countries. As you can see, elasticity is very high in the United States. Substantial progress with “creative destruction” signifies that a country is very close to the start of the next phase of economic growth. Furthermore, weekly applications in the U.S. for initial unemployment claims have been consistently under 400,000 (the level that has been a turning point in unemployment in the past). This may be a sign that the number of jobs is about to start climbing.

Against this backdrop, there has been a rapid replacement of flagship companies in the United States as the Internet, smartphones and other developments created new business models. This is why U.S. companies have a high investment value. As you can see in Figure 6, the most successful U.S. companies are still young companies.

An improvement in sentiment will end the shortage of demand

The problem is that strong earnings and substantial cash holdings at U.S. companies has not produced growth in domestic demand or jobs (at least not yet). Discretionary expenditures that fluctuate with the economy, such as purchases of consumer durables, capital expenditures and housing investments, have dropped from 26% of GDP at the peak of the bubble to only 19% to 20%, the lowest level in the postwar era. Falling to this point shows that U.S. demand cannot be compressed any more. In Japan, there is a Japanese saying that roughly translates as “you can’t use what you don’t have.” However, the United States has something but is unable to use it. In other words, the United States is in a situation where it has money but is unable to use that money. The willingness to take bold actions has disappeared because of worries about the future and the aftershocks of the Lehman Brothers collapse.

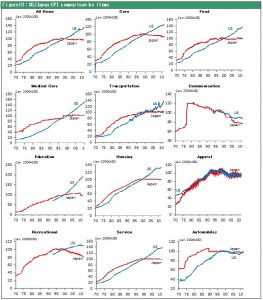

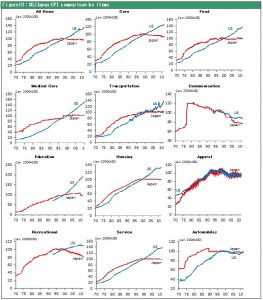

Declining housing prices are probably the most significant factor that is holding back consumer sentiment. But numerous indicators show that housing in the United States is currently undervalued. For instance, (1) the affordability index is at an all-time high, (2) the ratio of US house price to CPI owners equivalent rent(adjusted for the improvement in housing quality) is at an all-time low(Figure 7), and (3) the market value of house hold held real estate as a percentage of GDP has returned to the 2000 level. Despite these positive signs, the housing market remains soft because of the worsening balance between supply and demand. Causes include the large volume of foreclosed properties for sale and the end of the tax credit for home buyers. Many people are delaying the purchase of a home because they think prices may fall even more. Home ownership has decreased from a high of 69% in the mid-2000s to 66% 2011 as a result (Figure 8). Risk-taking was undoubtedly excessive during the boom in subprime loans. However, today’s risk-avoidance is just as excessive. In 2012, we will probably see a clear rebound in housing demand and prices as the market hits bottom due to low prices, falling interest rates and a decline in unemployment.

An advanced country growth pattern emerges in the United States

U.S. economy growth since the 1980s has been led by globalization, which involved the hollowing out of the U.S. manufacturing sector. The most recent economic downturn was severe by the enormous shock from the collapse of the housing bubble. But I believe there are no significant problems with the structure of long-term growth for the U.S. economy. This structure has the following elements: (1) improving productivity and corporate earnings backed by globalization and technological advances; (2) growth in income from overseas investments, higher prices of stocks and other assets and growth in household financial income; (3) growth in consumer spending supported by the wealth effect and household financial income; and (4) growth in the service sector and associated jobs (health care, education, cultural and amusement activities, housing, business services, and other areas) that is backing up consumer spending. I will discuss this point in another bulletin.

The United States has established a growth pattern for advanced countries that has three elements. First is economic growth that relies on consumer spending. (U.S. consumer spending has increased from almost 60% of GDP in the 1950s to 71% in 2011.) Second is growth in jobs that relies entirely on the service sector. Third is a steady increase in the price of services (shift of income to the service sector). I expect to see this pattern once again begin to drive U.S. economic growth in 2012 or soon afterward.