Mar 12, 2012

Strategy Bulletin Vol.65

2012 Is the Year of Japan ? Throw Off the Shackles of Pessimism!

Another look at the tailwind of globalization for the US, Germany and Japan

The time has come to abandon the paradigm of pessimism

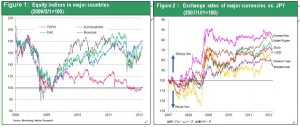

Market participants have reacted strongly to changes that have occurred as the Greek debt crisis quietens down. Stocks have staged a powerful rally. In New York, stocks surpassed their high prior to the Lehman Brothers collapse. Furthermore, the yen has been weakening consistently since February. We have also seen an impressive performance by Japanese stocks, which had been lagging behind the stocks of other countries for many years (according to The Wall Street Journal, Japanese stocks, as of March 9, were up 19% in 2012 on a dollar basis, the best global performance in the past 12 months). Most market observers did not expect these movements in both the yen and Japan’s stocks. However, the majority of people also believe that stock prices in Japan have gone too far and think that a downward correction is unavoidable. This is probably true. But this belief is based on a paradigm that incorporates the recent global economic crisis. Consequently, the conclusion that a correction is inevitable is wrong if a change in this paradigm takes place. Major logical frameworks (paradigms) are often what determine the direction of financial markets. When a shift in a paradigm occurs, the previous market logic is no longer valid. Investors who continue to buy stocks based on their past successes will lose everything when the inevitable plunge in stock prices begins. Furthermore, people who continue to base their investments on their past failures will be left behind. Valuations have reached unprecedented levels. For example, stock earnings yields are five times higher than corporate bond yields and dividend yields are twice as high as long-term government bond yields. But these figures are nothing more than symbols of a brief period during which prices were determined by a crisis mentality. Individuals who create medium and long-term market forecasts must first of all decide which paradigm to use. The success or failure of an investment strategy depends above all on the ability to select the right paradigm. Figure 1: Equity indices in major countries (2009/3/1=100) Figure 2: Exchange rates of major currencies vs. JPY (2007/1//1=100)

The rapid shift of capital from bonds to stocks

Global financial markets, particularly financial markets in Japan, have reached a major turning point due to the end of the crisis mentality. We can conclude that the era of unusually high risk premiums (the era of living with the fear of a depression) is over. If this era has indeed ended, we should see a massive migration of capital from safe assets to assets with risk. The result will be a global stock market rally accompanied by a weaker yen. Japanese stocks were the greatest victims of the era when investors feared a depression may occur. Now Japanese stocks will be the greatest beneficiary of the end of this era. This is why I have consistently stated in my strategy bulletins since 2009 that a major recovery in Japanese stocks is about to begin.

Growth is shifting from emerging countries to industrialized countries, especially the US, Germany and Japan

The paradigm shift is not limited to the financial sector. A change is also taking place in the composition of global economic growth due to the resurgence of the core industrialized countries (US, Germany, Japan). There was excessive risk-taking in emerging countries after the demise of Lehman Brothers. In contrast, we witnessed excessive aversion to risk in industrialized countries. Distortions like accelerating inflation and asset bubbles that are associated with an overheating economy began to appear in China. The Chinese government cut its 2012 economic growth forecast to 7.5%, the lowest since 2004. In industrialized countries, economic corrections have been largely completed. For instance, corporate earnings are improving, household savings are growing and asset prices are declining in the United States, Germany and Japan. Moreover, monetary easing has reached extreme levels in all these countries in response to lackluster demand and high unemployment. As a result, the United States, Germany and Japan have accumulated “the power to create demand,” which is what the world needs most of all right now.

A revision in how globalization is viewed

These developments require making a revision in the widely accepted perception of globalization. Globalization, which equates to the international division of labor, is normally equated to rapid growth in emerging countries and stagnation in industrialized countries. Instead, globalization should be viewed as a process that contributes to the growth of both emerging and industrialized countries. Under the international division of labor, emerging countries supply cheap labor. But this alone is not enough to support economic vitality. Industrialized countries supply technologies, capital, management know-how and marketing. All are vital to economic growth. This explains why industrialized countries should benefit from globalization just as much as emerging countries do. Rising wages are rapidly improving the standard of living in emerging countries. In industrialized countries, globalization is enabling companies to increase earnings. After earnings plunged following the Lehman shock, U.S. corporate earnings have rebounded to an all-time high. At the same time, Japanese companies have staged a powerful recovery in earnings even as the yen appreciated sharply. Both of these recoveries represent the benefits of globalization.

Strong earnings and rising stock prices are the starting points of a virtuous economic cycle in industrialized countries

How should industrialized countries transform the benefits of globalization into the greatest possible amount of demand? There are many potential methods. Examples include (1) the wealth effect from rising stock prices, (2) knowledge-intensive investments in industrialized countries, (3) high salaries for people with the highest levels of knowledge in the world, and (4) a higher standard of living in industrialized countries and the associated service industries needed to support that standard of living. All are challenges that industrialized countries must tackle. But one point is obvious. The engine for economic growth in industrialized countries is higher corporate earnings and the resulting upturn in stock prices.

The new phase of globalization that is driven by industrialized countries

A look back at progress in globalization reveals that this process has gone through a number of clearly defined phases. The first phase was characterized by explosive growth in U.S. demand and the take-off of the Chinese economy (2000 to 2007). Capital flowed to industrialized countries, and particularly the United States, and interest rates were low. An asset bubble emerged as this climate pushed up asset prices. The Chinese economy took off as exports to the United States skyrocketed. During the second phase, the bubble burst and demand in emerging countries surged (2007 to 2011). The end of the U.S. asset bubble caused a sharp contraction in global demand. In response, China increased public-sector expenditures and the United States adopted an ultra-easy-money policy. Investors responded by channeling their capital to emerging countries. Economic growth accelerated in these countries as a result, producing asset bubbles and inflation. Today, I believe we are on the verge of the third phase (starting in 2012). During this phase, economic growth will start to return to the industrialized countries. Directing the benefits of globalization to industrialized countries will most likely spark a new cycle for the creation of demand. Thus we have been benefiting from the powerful follow-wind of globalization for many years even historical financial occurs. Sustained expansion of the US economy is now in sight. Growth will be backed by a rebound in jobs, an upturn in the housing market, the success of new Internet businesses and other favorable events. Germany now has negative real interest rates for the first time in its history. The resulting investment boom taking place in this country has clearly positioned Germany as the sole winner in the European economic zone. In Asia, economic distortions like inflation, asset bubbles and widening gaps between rich and poor are appearing in China and Korea. At the same time, the relative superiority of the Japanese economy is becoming increasingly apparent. In 2012, Japan’s economy will benefit from growth of the US economy along with several other factors that include (1) the end of the impacts of the 2011 earthquake and tsunami and flooding in Thailand; (2) monetary easing, a weaker yen and the slowdown of deflation (causing a downturn in real interest rates); and (3) demand created by earthquake reconstruction activities. Japan continues to benefit from the strong tailwinds of globalization. But investors must pay attention to the ongoing shift in the primary driving force behind global economic growth to the United States, Germany and Japan. Instrumental to this shift is the prolonged downward pressure on unit labor costs in these three countries. I will discuss this point at another time. Feb. 11, 2011 (Vol.39) The United States, Germany and Japan are remarkable beneficiaries of globalization this year