Sep 20, 2012

Strategy Bulletin Vol.79

Central Banks vs. the Black Swan ?

The BOJ Falls Behind

Fed Chairman Ben Bernanke and ECB President Mario Draghi have started using an unlimited supply of bullets to kill the “black swan” (the predilection for currency). “Don’t fight the Fed” is a well-known rule among investors. This is why investors probably will not be able to go against the risk-taking trend. However, BOJ Governor Masaaki Shirakawa, who is hesitant and has identified no enemies to fight, still has no clear plan for ending Japan’s position as the world’s only loser (strong-yen deflation).

The Governing Council of the ECB decided on September 6 to use outright monetary transactions (OMT) for indefinite purchases of government bonds of southern European countries. One requirement for these purchases is a request by a government for European Stability Mechanism (ESM) aid. Taking this action eradicated the underlying cause of the euro crisis: the black swan scenario (the possibility of a collapse of the financial system due to growing panic). Market sentiment is expected to undergo a fundamental shift as a result. The euro crisis that started in 2010 is linked to the imbalance between southern and northern Europe and the reckless economies (low productivity, large budget deficits) of countries in southern Europe. But this is not all. Another cause was the effective paralysis of financial market functions (a widespread predilection for currency) triggered by investors who decided a collapse of the euro was inevitable. OMT is aimed squarely at this problem.

The Governing Council of the ECB decided on September 6 to use outright monetary transactions (OMT) for indefinite purchases of government bonds of southern European countries. One requirement for these purchases is a request by a government for European Stability Mechanism (ESM) aid. Taking this action eradicated the underlying cause of the euro crisis: the black swan scenario (the possibility of a collapse of the financial system due to growing panic). Market sentiment is expected to undergo a fundamental shift as a result. The euro crisis that started in 2010 is linked to the imbalance between southern and northern Europe and the reckless economies (low productivity, large budget deficits) of countries in southern Europe. But this is not all. Another cause was the effective paralysis of financial market functions (a widespread predilection for currency) triggered by investors who decided a collapse of the euro was inevitable. OMT is aimed squarely at this problem.

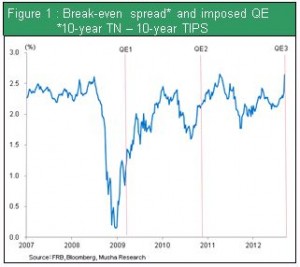

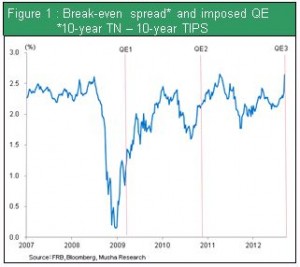

The unlimited ammunition of the Fed and ECB

The Fed announced the start of QE3 on September 13. This will involve open-ended purchases of $40 billion of MBS every month. Obviously, the Fed’s intent is to achieve sustained growth in employment and the economy by raising prices of assets. Two factors clearly differentiate QE3 from the preceding QE1 and QE2. First, the amount of assets purchased was fixed for both QE1 and QE2. This time, there is no limit. Second, the primary objective of QE1 and QE2 was to protect the United States from becoming mired in deflation. But the Fed is implementing QE3 even though the risk of deflation has been sufficiently reduced. As you can see in the figure 1, QE1 and QE2 took place during a steep drop in U.S. expected inflation (10-year Treasury note yield ? yield of 10-year Treasury Inflation-Protected Securities). But QE3 is starting when expected inflation is climbing at an adequate rate. Consequently, QE3 is not a passive measure meant to shield the United States from deflation. Instead, this is an offensive action aimed at stimulating a recovery in jobs. Benefits will most likely first emerge in the form of recoveries in housing demand and home prices. Figure 1 : Break-even spread* and imposed QE (*10-year TN -10-year TIPS) The Governing Council of the ECB decided on September 6 to use outright monetary transactions (OMT) for indefinite purchases of government bonds of southern European countries. One requirement for these purchases is a request by a government for European Stability Mechanism (ESM) aid. Taking this action eradicated the underlying cause of the euro crisis: the black swan scenario (the possibility of a collapse of the financial system due to growing panic). Market sentiment is expected to undergo a fundamental shift as a result. The euro crisis that started in 2010 is linked to the imbalance between southern and northern Europe and the reckless economies (low productivity, large budget deficits) of countries in southern Europe. But this is not all. Another cause was the effective paralysis of financial market functions (a widespread predilection for currency) triggered by investors who decided a collapse of the euro was inevitable. OMT is aimed squarely at this problem.

The Governing Council of the ECB decided on September 6 to use outright monetary transactions (OMT) for indefinite purchases of government bonds of southern European countries. One requirement for these purchases is a request by a government for European Stability Mechanism (ESM) aid. Taking this action eradicated the underlying cause of the euro crisis: the black swan scenario (the possibility of a collapse of the financial system due to growing panic). Market sentiment is expected to undergo a fundamental shift as a result. The euro crisis that started in 2010 is linked to the imbalance between southern and northern Europe and the reckless economies (low productivity, large budget deficits) of countries in southern Europe. But this is not all. Another cause was the effective paralysis of financial market functions (a widespread predilection for currency) triggered by investors who decided a collapse of the euro was inevitable. OMT is aimed squarely at this problem.