The U.S. economy overshadows all other issues

Financial markets worldwide have been destabilized by fears about sovereign risk, particularly concerning Greece. But the sustainability of the U.S. economic is still the most important issue for investors. On average, economists are predicting a 3% growth rate for the U.S. economy in 2010 (Deutsche Bank is the most bullish with a 3.8% growth forecast.) Fears about W dip recession in the U.S. economy have dissipated. Nevertheless, the consensus outlook is for the U.S. economy to recover at only a moderate pace that is only about half the speed of a normal recovery.

Consumers are no longer pessimistic about the future

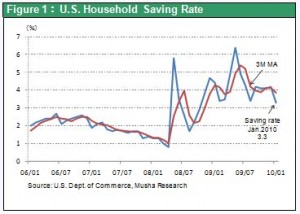

There is a growing likelihood that the consensus growth forecast will be raised. The primary reason is the ongoing drop in the U.S. household saving rate. This was confirmed recently with the announcement of a 3.3% saving rate in January, a sharp drop from December. Due to mounting pessimism sparked by the financial crisis, the saving rate rose from 1.2% in the first quarter of 2008 to 4.9% in April 2009 and then skyrocketed to 6.4% in May. In the remainder of 2009, the household saving rate has been lower: 4.9% in June, 4.3% in July, 3.4% in August, 4.2% in September, 4.1% in October, 4.1% in November and 4.2% in December. But in January 2010, this figure fell to 3.3%. This is the same level as before the Lehman shock, demonstrating that consumer pessimism will soon be eliminated. Looking ahead, the improvement in consumer sentiment is almost certain to continue. One reason is that the loss of jobs is nearing the end. U.S. job losses totaled 740,000 in January 2009 but only 20,000 in December. Another reason is that consumers are starting to benefit from the wealth effect because of the stock market rally and the end of the decline in housing prices.

Nine-month growth in household net wealth was half of GDP

Net wealth of U.S. households reached a peak of $66 trillion in the second quarter of 2007 and then fell all the way to $48.5 trillion in the first quarter of 2009. But net wealth rebounded to $53.4 trillion in the third quarter of 2009, an increase of $5 trillion in only six months. About another $2 trillion may have been added in the fourth quarter. Overall, growth in household net wealth over the final nine months of 2009 was $7 trillion, which is approximately half of the U.S. GDP. The impact of this upturn in net wealth should not be underestimated.

Companies are fully prepared for a recovery

Why is the household saving rate so important right now? The reason is that the possibility of a loss of consumer confidence is the only significant source of concern about the U.S. economy. But U.S. companies are performing very well. For example, labor’s share of income has dropped to an all-time low, excess liquidity on balance sheets is at an all-time high, and many companies have been signaling strong earnings. Companies have stored up a massive amount of energy. Consumer confidence holds the key to when the full-scale creation of demand will begin. Companies have more than enough resources to make investments and increase their workforces. Once executives see an upturn in consumer spending, they are prepared to issue the green light for investments and hiring. This is why the household saving rate is critical. Now that we have seen a big improvement (decline) in the saving rate, I think that companies will finally start recruiting workers in fairly large numbers. Investors should not overlook the significance of this shift in the economic picture.