Signs emerge of a supply excess in China = Deflationary pressure

Concerns about a global economic slowdown are appearing once again. This time deflationary pressure from China is what is making people worry. Economic indicators are turning downward even in Germany, which was the bright spot of the eurozone. A shift in business with China is one reason. In the United States as well, with exports weakening, signs of a decline in the performance of the overseas operations at multi-national corporations, the principal drivers for the economy, are appearing. A wave of deflation is sweeping over global commodity markets, as is evident in the sharp downturn in the price of iron ore. An excess of supply is emerging in China, which rapidly increased its manufacturing output to serve as the factory of the world. As a result, clear signs of surpluses are beginning to appear in global supply chains for resources, basic materials, manufactures, ships and other products. Exemplifying this trend is China’s steel industry, which raised production capacity by seven times over the past decade and now accounts for half of global steel output capacity. Demand for steel has peaked with respect to China’s exports and domestic investments (capital expenditures, real estate, public-works projects). This has caused the price of iron ore and maritime cargo transport rates to plunge. Furthermore, earnings are falling at companies in industrialized countries with operations in the natural resources, basic materials, marine transport and other sectors associated with steel. Events in China are also lowering trade surpluses and rapidly reducing economic growth in emerging countries like Australia and Brazil that had benefited from exports to China.

Figure 1: Trend of iron ore price

Figure 2: Trend of Baltic dry index

China: Mounting social unrest and the unavoidable need for economic measures

Recent anti-Japan demonstrations and violence in China are most likely indications of the country’s contradictions. One factor behind the increasing criticism of Japan is encouragement by the Chinese government. But violent acts like burning factories of Japanese companies go against the Chinese government’s support for liberalism and its sensitivity to criticism from other countries. Furthermore, many anti-Japan demonstrators carry pictures of Mao Zedong. This may be an expression of tacit criticism of China’s current leaders, who are worried about a revival of Mao’s Cultural Revolution. Consequently, slowing economic growth is probably responsible for the increasingly serious turmoil in China.

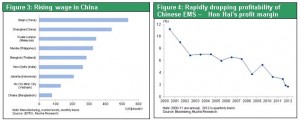

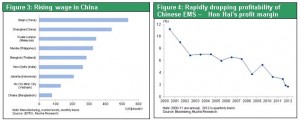

Employment is the greatest contradiction of all. There are mutual contractions for the supply and demand of labor concerning three trends: (1) the shortage of migrant workers and rising wages in China’s coastal cities; (2) the excess of labor in rural villages; and (3) the inability of many college graduates to find jobs. China’s market for properly allocating labor is not functioning. The shortage of migrant workers is making China’s exports less competitive and lowering the trade surplus, foreign currency reserves and corporate earnings. The result is a big decrease in funds for investments (this is evident in the steep drop in the earnings of the Foxconn Technology Group shown in Figure 4 and in the high wages in China’s coastal cities shown in Figure 3). But the labor surplus in other areas of China is fueling deflationary pressure along with increasing demands for more public-works and real estate investments in the interior of China. In addition, the lack of jobs for college graduates is a source of social unrest. China must do whatever is needed to stimulate the economy in order to end these problems and establish a stable political base as a new leadership team takes over. This is why the Chinese economy will most likely stage a temporary upturn that starts late in 2012 and continues into the first half of 2013 (but China will still be unable to avoid its long-term problems).

Figure 3: Rising wage in China

Figure 4: Rapidly dropping profitability of Chinese EMS – Hon Hai’s profit margin

A reflation race in the U.S., Germany and Japan, the world’s major industrialized countries

In response to rising global deflationary forces from China, industrialized countries must enact reflationary policies. Tokyo will host the annual meetings of the IMF and World Bank next week. The central theme will be how to create demand on a global scale. With interest rates at all-time lows in the United States, Germany and Japan, these countries can enact demand-creation policies that utilize excess capital. There are two channels for demand creation. The first is using monetary easing to increase prices of assets with risk, which in turn produces benefits from the wealth effect and an improvement in sentiment. The second channel is increasing government spending. Even Japan has room to increase public-works expenditures.

Among these three countries, the United States has the strongest commitment to creating demand. Stock prices are high as a result. Prospects are very good for the United States to avoid the fiscal cliff. In Europe as well, deflationary pressure from financial rebuilding measures peaked in 2012 and the ECB’s outright monetary transactions (OMT) will probably function adequately as a safety net. However, Japan is adopting policies that are detrimental for demand creation one after another. Japan has the most negative stance about monetary easing and is hiking taxes to rebuild public-sector finances in a deflationary environment. No one should be surprised that Japan has the world’s worst-performing stocks.

Will a new administration be the breakthrough to the full-scale reflation measures that people hope to see?

Despite these problems, no country in the world has more potential for demand creation than Japan. In Europe and the United States, growth is restricted by non-performing loans and inadequate bank capital. But these are not issues in Japan. Furthermore, with its extremely undervalued assets, Japan has the potential to generate huge capital gains if a correction in asset prices occurs. Japanese stocks have an average PBR of 0.9. If this multiple rises to the global average of 1.7, stock prices will almost double and stock market capitalization will increase by more than ¥200 trillion. This rally would probably end deflation by bringing about a resumption of risk-taking and interest rate arbitrage in Japan’s financial markets. Now is precisely when Japan needs to enact financial policies for weakening the yen, boosting stock prices and increasing investments in real estate and other assets. Japan should use demand creation to make a contribution to the global economy.

By stating that she welcomes quantitative easing by the Bank of Japan and understands Japan’s position regarding foreign exchange intervention, IMF chief Christine Lagarde expressed her hope for Japan to enact reflationary measures. Seiji Maehara, the Minister of State for Economic and Fiscal Policy, has said that he will attend policy meetings of the Bank of Japan. He is an advocate of allowing the bank to buy foreign bonds. Furthermore, the Liberal Democratic Party, which is very likely to return to power in the next general election, has made a major shift to backing reflation. LDP president Shinzo Abe has stated that amendments to the Bank of Japan Law should be considered. The Bank of Japan is increasingly under siege. A shift in the bank’s policies may significantly alter the background for Japan’s economy and financial markets.

Figure 5: Trend of equity markets in US, Japan, Germany and China (2007/01/01=100)

Figure 6: Trend of LT interest rates in US, Japan and Germany