Our Japanese stock market outlook - High expectations for 2013 and results that produce a strong rally in 2014

Prime Minister Shinzo Abe’s initiative is about to succeed. There is no doubt that his reflationary measures are working as planned. We will probably see a strong stock market rally as the yen continues to weaken and stock prices climb through the remainder of 2013. The January ‘joint statement of the government and Bank of Japan’ that the prime minister described as ‘epoch-making’ did not create any specific obligation for the Bank of Japan. The statement briefly raised concerns that the monetary easing stance of the Bank of Japan was nothing more than taking the easy way out. However, these worries disappeared following the actions of the prime minister immediately after this announcement (statement that the next Bank of Japan governor must be, “someone who will tackle the issue of ending deflation with resolute decisiveness and skill” and that, “amending the Bank of Japan Law is still a possibility”).

The next question is if Abenomics can actually end deflation and return Japan to growth. If Abenomics produces the desired results, stock prices will be strong again in 2014. Most people believe that Japan cannot end deflation and achieve structural reforms by using monetary initiatives alone. However, we believe that these initiatives will be a decisive factor for accomplishing these two goals. As a result, Abenomics will be able to produce results. That means the current surge in stock prices is merely the beginning of an extended upturn (I will explain why ending deflation will lead to structural measures in another report).

The U.S. DJIA closed at $14,010 on February 1, only 1% short of the all-time high of $14,164 that was reached on October 9, 2007. The prospects for stocks rising to a new record high are improving. Strong stock prices are more than just proof of a full-scale U.S. economic recovery. People will probably start talking about whether or not the United States may have entered a new era of growth. The shift in the FOMC statement is also attracting attention. A resurgent U.S. economy and strong dollar are the best possible support for Abenomics. The strengthening U.S. alliance in the face of China’s emergence is also underpinning Abenomics.

Figure 1: Equity market trends in U.S. and Japan

Figure 2: Exchange rate of major currencies against Japanese Yen

Why is Abenomics off to such a strong start?

The Nikkei Average has surged by 30% and the yen weakened by 15% over the period of slightly more than two months from November 2012, when Japan’s general election was called. The economic measures referred to as Abenomics that are expected to be implemented by the Cabinet led by Prime Minister Abe have triggered a major shift in market sentiment. Prior to this rally, stocks in Japan were abnormally undervalued. One reason was that the yen was much stronger than other currencies in the world. Even so, the magnitude of the market’s shift was far greater than anticipated. By using a dramatic policy shift to spark a big change in expectations, the first act of Abenomics has been a huge success.

However, there are still strong doubts about whether or not stocks will continue to climb as the yen weakens and if Japan can really break away from deflation. Investors who have learned their lesson from multiple false dawns in the past obviously will not easily believe in this change of direction. Furthermore, the yen’s recent downturn of only 15% has already led to constant criticism of Japan’s exchange rate guidance. Criticism is coming from the central bank governor of Korea and German Central Bank Governor Jens Weidmann, the U.S. Alliance of Automobile Manufacturers, and other organizations. There is considerable criticism within Japan, too. The media, many economists, some business leaders and even some high-ranking Liberal Democratic Party members disapprove of the prime minister’s pressure on the Bank of Japan. Clearly, it is difficult to say that a consensus has been achieved for Abenomics even in Japan.

So why is Prime Minister Abe stubbornly pushing for Abenomics? And why did this stance succeed in rapidly turning around stock and foreign exchange markets and altering public opinion? The answer is support from the United States. The Obama administration wants to generate jobs by increasing exports. If the president had been highly critical of the yen’s weakness relative to the dollar, all of the prime minister’s hard work would most likely have been for nothing. In fact, we have not heard one word of criticism from the United States.

The success or failure of Abenomics hinges on U.S. events

This time, Japan will probably succeed at last in terminating the yen’s strength and deflation. Why? The United States is likely to support Japan’s policies because of the health of the U.S. economy and for a geopolitical reason. First, the U.S. economy is finally beginning to stage a real recovery and the dollar is at the start of an upswing. The fiscal cliff that worried everyone has been postponed. Now the focus of attention in the United States has shifted to (1) improving demand for housing and the turnaround in housing prices; (2) the wealth effect resulting from higher prices of stocks and houses; (3) the increasing number of jobs (especially in the service sector); and (4) the continuing strength in corporate earnings (fueled by rising productivity because of the ongoing new industrial revolution and the advance of globalization).

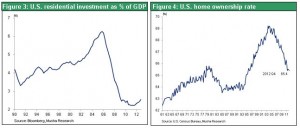

The impact of the improving housing market is particularly significant. After the Lehman shock, the U.S. housing investment/GDP ratio fell from 6% to the 2% level. Furthermore, the housing and construction sectors accounted for half of the 4.4 million jobs lost from when U.S. employment peaked. Simply returning the housing sector to normal will increase the U.S. GDP by 2% to 3%. Once housing prices start rising, we will probably see a boom in home buying by individuals in today’s low interest rate environment. The root cause of the deterioration of supply and demand dynamics in the housing market was the sharp drop in the home ownership rate from 69% in 2006 to 65%. If this figure starts climbing, there will probably be a rapid improvement in the balance between supply and demand.

Downward pressure on inflation from the shale gas revolution and the outlook for a smaller trade deficit are also good news for the U.S. economy. In the second half of 2013, the U.S. economy may grow at an annual rate of 4% to more than 5%. Employment is improving steadily; data in November and December 2012 for jobs were revised upward significantly. There are also clear signs of an emerging improvement in the ISM new orders index and other indicators of industrial activity. The fourth quarter GDP downturn (-0.1%) was only temporary. There were positive contributions to GDP of 1.5% from personal consumption, 1.2% from investments (equipment + housing) which means 3% underline growth with private-sector final demand continues. The lack of growth was the result of several one-time factors: (1) lower defense spending (contribution of -1.3%), (2) lower inventory investments (contribution of -1.3%) and (3) a decrease in net exports (contribution of -0.3%). All three of these categories will probably support a return to economic growth going forward.

The Fed’s significant switch to a positive stance

Now that the U.S. economy has reached this point, moves to end quantitative easing are within sight. The shift in the FOMC statement released last week caught the attention of investors. In December 2012, the Fed said that without sufficient policy accommodation, economic growth might not be strong enough for job creation. But in January, there was a big change in tone to the position that, with appropriate policy accommodation, economic growth will proceed at a moderate pace and the unemployment rate will gradually decline.

If the U.S. economy recovers and the Fed cuts back on buying Treasuries, there is certain to be a sharp increase in interest rates from the current level that is so low it can be called a bubble. Higher interest rates would also make the dollar stronger. But in Japan, where quantitative easing has been lagging behind other countries, more easing is likely to occur under the leadership of Prime Minister Abe and the new Bank of Japan chief, who will back reflation. These events will probably produce a large gap between U.S. and Japanese interest rates within about six months. This gap is the most fundamental condition of all for a prolonged downturn of the yen and upturn of the dollar.

Figure 3: U.S. residential investment as % of GDP

Figure 4: U.S. home ownership rate

A geopolitical factor, the ‘cooler’ U.S.-China relationship, is the second reason that the United States is likely to support Japan’s policies. The United States wants very much to restore the strength of the Japanese economy in order to reinforce the Japan-U.S. alliance. In other words, helping Japan end the strong yen-deflation that has been holding back the economy is in the national interest of the United States. Therefore, Prime Minister Abe’s national security statement about strengthening the Japan-U.S. alliance was decisive with regard to making the yen weaker.

The positions of the new U.S. Secretary of State John Kerry and the likely new Secretary of Defense Chuck Hagel are still unclear. But there will probably be no change in the emphasis on Japan as a counterbalance against China in Asia. The United States wants to keep China in check while continuing to exert pressure for internal reforms. Accomplishing this will require heightening the presence of neighboring country Japan in order to maintain the proper balance. A prolonged economic stagnation could cause the people of Japan to lose faith in capitalism and a market-based economy. If Japan started to drift because of this, instability in Eastern Asia would increase greatly. This is why a resurgence of the Japanese economy is vital as well for the United States, the world’s superpower. An erosion of Japan’s presence and subsequent decline to a second-rate nation is viewed as a serious danger by many opinion leaders involving U.S. strategy, including former Deputy Secretary of State Richard Armitage and Harvard Professor Joseph Nye. This view is also a reason for allowing a correction to end the extremely strong yen that had served as a penalty for Japan’s abnormally strong competitive position in the past.

Financial markets are becoming increasingly confident about the implementation of Abenomics. Consequently, stock prices in Japan will probably continue to climb.

Figure 5: Dollar real effective rate

A geopolitical factor, the ‘cooler’ U.S.-China relationship, is the second reason that the United States is likely to support Japan’s policies. The United States wants very much to restore the strength of the Japanese economy in order to reinforce the Japan-U.S. alliance. In other words, helping Japan end the strong yen-deflation that has been holding back the economy is in the national interest of the United States. Therefore, Prime Minister Abe’s national security statement about strengthening the Japan-U.S. alliance was decisive with regard to making the yen weaker.

The positions of the new U.S. Secretary of State John Kerry and the likely new Secretary of Defense Chuck Hagel are still unclear. But there will probably be no change in the emphasis on Japan as a counterbalance against China in Asia. The United States wants to keep China in check while continuing to exert pressure for internal reforms. Accomplishing this will require heightening the presence of neighboring country Japan in order to maintain the proper balance. A prolonged economic stagnation could cause the people of Japan to lose faith in capitalism and a market-based economy. If Japan started to drift because of this, instability in Eastern Asia would increase greatly. This is why a resurgence of the Japanese economy is vital as well for the United States, the world’s superpower. An erosion of Japan’s presence and subsequent decline to a second-rate nation is viewed as a serious danger by many opinion leaders involving U.S. strategy, including former Deputy Secretary of State Richard Armitage and Harvard Professor Joseph Nye. This view is also a reason for allowing a correction to end the extremely strong yen that had served as a penalty for Japan’s abnormally strong competitive position in the past.

Financial markets are becoming increasingly confident about the implementation of Abenomics. Consequently, stock prices in Japan will probably continue to climb.

Figure 5: Dollar real effective rate

A geopolitical factor, the ‘cooler’ U.S.-China relationship, is the second reason that the United States is likely to support Japan’s policies. The United States wants very much to restore the strength of the Japanese economy in order to reinforce the Japan-U.S. alliance. In other words, helping Japan end the strong yen-deflation that has been holding back the economy is in the national interest of the United States. Therefore, Prime Minister Abe’s national security statement about strengthening the Japan-U.S. alliance was decisive with regard to making the yen weaker.

The positions of the new U.S. Secretary of State John Kerry and the likely new Secretary of Defense Chuck Hagel are still unclear. But there will probably be no change in the emphasis on Japan as a counterbalance against China in Asia. The United States wants to keep China in check while continuing to exert pressure for internal reforms. Accomplishing this will require heightening the presence of neighboring country Japan in order to maintain the proper balance. A prolonged economic stagnation could cause the people of Japan to lose faith in capitalism and a market-based economy. If Japan started to drift because of this, instability in Eastern Asia would increase greatly. This is why a resurgence of the Japanese economy is vital as well for the United States, the world’s superpower. An erosion of Japan’s presence and subsequent decline to a second-rate nation is viewed as a serious danger by many opinion leaders involving U.S. strategy, including former Deputy Secretary of State Richard Armitage and Harvard Professor Joseph Nye. This view is also a reason for allowing a correction to end the extremely strong yen that had served as a penalty for Japan’s abnormally strong competitive position in the past.

Financial markets are becoming increasingly confident about the implementation of Abenomics. Consequently, stock prices in Japan will probably continue to climb.

Figure 5: Dollar real effective rate