Feb 13, 2013

Download PDF

Strategy Bulletin Vol.91

Why is Abenomics likely to be successful?

(1) Monetary policy will end deflation, that automatically raises Japan’s economic growth rate

Ending deflation will raise the Nikkei Average to ¥20,000 and further progress with reforms may lead to the ¥30-40,000 range

Constant downward pressure on private-sector wages due to the protracted strength of the yen and the prolonged drop in prices of assets (stocks and real estate) were the causes of Japan’s “lost 20 years.” Abenomics is correct to focus on fixing this problem. Deflation can be eradicated if a weaker yen and higher asset prices boost corporate earnings, thereby enabling a return to normal wage hikes.

Ending deflation itself is a structural policy. Twenty years of deflation paralyzed Japan’s price-setting mechanism (the process of using changes in market prices for the optimum allocation of resources). This paralysis blocked the flow of assets to growing sectors of the economy with enormous latent demand. The economist Friedrich Hayek said that depressions are caused by the inadequate distribution of resources resulting from a distortion of relative prices among different sectors. Japan struggled with this situation for almost 20 years. That means people are wrong to criticize Abenomics by saying that “Japan cannot return to growth by using monetary initiatives alone” and “deflation is not the only cause of Japan’s stagnant economy.” Monetary measures will end deflation, and the demise of deflation will automatically boost economic growth.

We should divide our outlook for Japan into two stages. First is using Abenomics to end strong-yen deflation. Second is using subsequent reforms to restore Japan’s position as an economic powerhouse. Japan’s growing economic sectors of health care, education and agriculture are all dens of vested interests. Deregulation must be used to harness the forces of competition to attract more resources to these three sectors. Japan needs to use participation in the Trans-Pacific Partnership as a springboard for enacting structural reforms and moving forward with reforms to social security systems and labor regulations. If this can be accomplished, Japan will probably once again be one of the world’s most productive economies. The first step will lift the Nikkei Average to ¥20,000. If Japan then makes progress with the second step, we could see this index climb all the way to ¥30-40,000.

(2) Turning around yen’s excessive strength and stock market’s excessive weakness is crucial to stop deflation

Deflation is rooted in an overly strong yen and excessive drop in stock and real estate prices

Long-term deflation is the defining characteristic of the lost 20 years, a disease that infected Japan alone in the world. There were two causes of this deflation: the yen’s strength and declines in stock and real estate prices that went too far. Foreign exchange rates and asset prices are usually cyclical. But only Japan witnessed the unusual phenomenon of the same basic trends in its foreign exchange rate and asset prices lasting for 20 years. The prolonged strength of the yen and decline in asset prices made Japan the only country in the world where wages declined steadily for almost 20 years. The result was long-term economic stagnation.

Figure 1: JPY/US$ Purchasing Power Parity and market exchange rate

Figure 2: Market value of Japanese stocks and land

When Japan’s asset bubble reached the peak in 1990, the yen, stocks and real estate had all gone too far. A correction was inevitable. At the end of the 1980s, the yen weakened too much because the distinctive competitive edge of Japanese industries was becoming greater and greater. The formation of an asset bubble was the natural result of Japan’s postwar period of real estate-based financing and excessive savings. But this bubble could not be justified by any economic theory. Consequently, the upturn of the yen and downturn of asset prices in the first half of the 1990s can be justified as a correction of the distortion caused by Japan’s excessive economic success in the postwar era. Unfortunately, the correction itself went too far. The yen continued to climb too much and asset prices continued to fall too much. The combined effects of these two movements constantly exerted extremely strong downward pressure on the wages of Japanese companies.

When Japan’s asset bubble reached the peak in 1990, the yen, stocks and real estate had all gone too far. A correction was inevitable. At the end of the 1980s, the yen weakened too much because the distinctive competitive edge of Japanese industries was becoming greater and greater. The formation of an asset bubble was the natural result of Japan’s postwar period of real estate-based financing and excessive savings. But this bubble could not be justified by any economic theory. Consequently, the upturn of the yen and downturn of asset prices in the first half of the 1990s can be justified as a correction of the distortion caused by Japan’s excessive economic success in the postwar era. Unfortunately, the correction itself went too far. The yen continued to climb too much and asset prices continued to fall too much. The combined effects of these two movements constantly exerted extremely strong downward pressure on the wages of Japanese companies.

The strong yen created permanent pressure on wages

The law of one price (the same wage for the same job) is increasingly taking hold in the global labor market. Raising wages without an increase in productivity will simply spark an economic counterattack in which inflation brings wages back down. In other words, wages worldwide will always regress to the mean. The same is true of raising the value of a currency without an improvement in productivity. This will simply lower the country’s wages, once again resulting in convergence with the global standard. The persistent strength of the yen over the past 20 years produced constant downward pressure on wages in Japan. As a result, Japan was the only country in the world where deflation took hold.

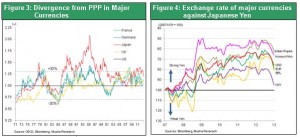

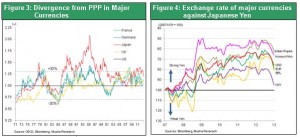

In general, a foreign exchange rate will move no more than about 30% above or below its purchasing power parity. However, the yen at one point reached the extraordinary valuation of twice its purchasing power parity. Naturally this doubled the operating expenses of Japanese companies compared with the international level. Wages doubled as well. Companies were forced to cut their workforces, hire temporary rather than permanent employees, move operations out of Japan and take other actions. Taking these steps significantly cut labor expenses. Although Japanese companies retained their competitive edge, this was accomplished at the cost of cutting the wages of Japanese workers. The resulting long-term decline in wages was what caused deflation.

Figure 3: Divergence from PPP in Major Currencies

Figure 4: Exchange rate of major currencies against Japanese Yen

The pointless view that “the yen did not appreciate based on the real effective exchange rate”

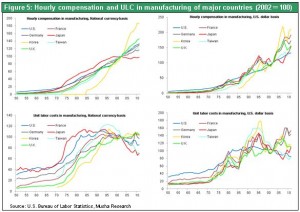

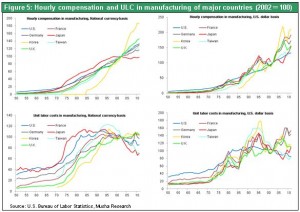

Many economists believe that there was no historic appreciation of the yen if you look at the real effective exchange rate. But this is a position that completely ignores the links between causes and effects. It is true that in terms of the real effective exchange rate the yen did not strengthen as much as in the early 1990s. But the reason is that there was a relative decline in Japan’s unit labor cost, chiefly in the manufacturing sector, as the yen appreciated in terms of its nominal exchange rate against the dollar and other major currencies. The real effective exchange rate simply moved into a balance with the nominal rate afterward. The correct view is that the yen’s appreciation significantly lowered wages in Japan even though Japan’s labor productivity continued to improve at least as much as in other countries. Figure 5shows a comparison of the hourly unit labor cost (for manufacturing) on a local-currency basis and dollar basis. As you can see, although Japan’s wages dropped sharply, there was a big upturn on a dollar basis. This was obviously detrimental to Japan’s ability to compete. The yen’s strength must be corrected; this is not an event that should be allowed to continue.

Figure 5: Hourly compensation and ULC in manufacturing of major countries (2002=100)

Hiroshi Yoshikawa, an influential professor at the University of Tokyo, stated that by 2012 the yen could no longer be viewed as too strong. He makes the point in his book Deflation (January 2013, Nikkei Publishing). “Inflation can limit economic downturns through monetary tightening. But deflation cannot be suppressed with monetary measures (because an excess reserve increase in central bank produces no effect when interest rates are zero). In other words, deflation is a result rather than a cause.” He goes on to add that, “deflation in Japan was caused by the shift in employment systems and resulting wage cuts at big companies that took place during the 1990s.” Wage reductions by companies are deflation itself rather than a cause of deflation. However, Professor Yoshikawa’s theory is frustrating because there is no attempt to determine why companies were forced to lower wages.

Hiroshi Yoshikawa, an influential professor at the University of Tokyo, stated that by 2012 the yen could no longer be viewed as too strong. He makes the point in his book Deflation (January 2013, Nikkei Publishing). “Inflation can limit economic downturns through monetary tightening. But deflation cannot be suppressed with monetary measures (because an excess reserve increase in central bank produces no effect when interest rates are zero). In other words, deflation is a result rather than a cause.” He goes on to add that, “deflation in Japan was caused by the shift in employment systems and resulting wage cuts at big companies that took place during the 1990s.” Wage reductions by companies are deflation itself rather than a cause of deflation. However, Professor Yoshikawa’s theory is frustrating because there is no attempt to determine why companies were forced to lower wages.

Deflation was caused by falling stock and real estate prices, too

Japan was also dealt a severe blow by the negative asset effect from falling asset prices. At the peak of the bubble in 1992, the combined market value of Japanese stocks and real estate was ¥3,100 trillion, which was six times higher than the country’s GDP. By 2011, this figure had dropped by half to ¥1,500 trillion and three times the GDP. This equates to an average annual decrease of ¥80 trillion, which is 16% of Japan’s nominal GDP. Falling asset prices quickly triggered a credit crunch as companies and financial institutions faced higher expenses for writing-off non-performing assets and dealing with declining values of collateral. Earnings and the animal spirit at Japanese companies evaporated as a result. These negative effects spread to financial services, real estate and other industries that rely on domestic demand. The pressure on companies to cut costs (lower wages) increased. A major reason that Japanese companies accumulated an unprecedented amount of surplus cash was the need for a financial buffer for protection against falling asset prices.

(3) Deflation blocked structural change

Deflation (paralysis of the price mechanism) blocks structural change and eventually kills an economy

Deflation causes many problems. One is the paralysis of the price mechanism in the goods and service markets. Another is the loss of risk capital by creating a preference for cash in financial markets. These two problems create an obstacle to shifts in the allocation of resources (structural change). The key to resolving this problem is to direct as many resources as possible to growing sectors of the Japanese economy (areas with prospects for growth in demand and jobs). In other words, capital that can generate earnings must be collected. Deflation became the greatest obstacle of all to achieving the optimum allocation of resources. Inflation plays a critical role in the reallocation of income. Obviously, the price mechanism is the “invisible hand of God” in all markets. But deflation (service price deflation in simpler terms, as is explained later) prevented this mechanism from functioning.

Service price inflation, which fills in gaps in productivity improvements, disappeared from Japan

For proof of the role of service price inflation, we need only look back to the days of Japan’s rapid economic growth. Living standards in Japan improved rapidly during this period because of technological progress and rising productivity. Income gaps between cities and agricultural areas and between the manufacturing and service sectors narrowed. But the reason was a shift in income from manufacturing and other highly productive sectors to the service and agricultural sectors in the form of higher prices for services and agricultural products. This is so-called “productivity improvement rate gap inflation.”

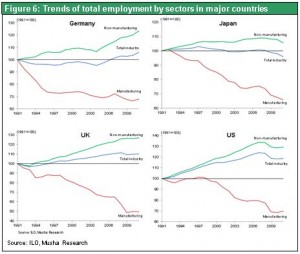

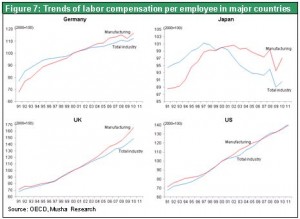

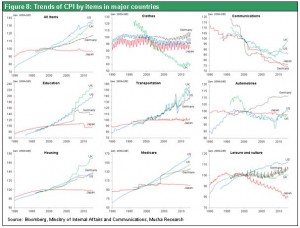

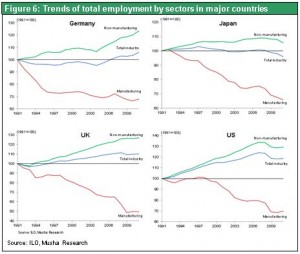

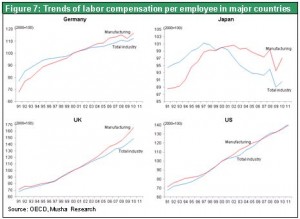

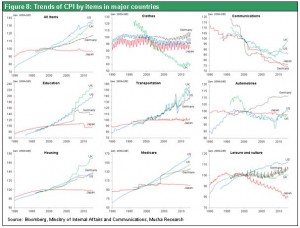

The end of service price inflation also brought to an end the redistribution of income in Japan. The growth of the service sector and service jobs stopped. Figure 6shows how employment changed in the manufacturing and non-manufacturing sectors in Japan, the US, Germany and the UK. Only in Japan has there been no growth in non-manufacturing jobs. The cause is service price deflation. Figure 8 compares prices in different sectors. Prices of manufactured goods have declined in all countries. But prices for services are down only in Japan, clearly setting Japan apart from the rising service prices of other countries. Furthermore, Figure 7 shows that wages fell only in Japan and that the decline was particularly large in the non-manufacturing sector. The facts are clear. Japan was the only country in the world that suffered from the negative cycle of service price deflation, falling service-sector earnings, lower wages and a loss of jobs.

Figure 6: Trends of total employment by sectors in major countries

Figure 7: Trends of labor compensation per employee in major countries

Figure 8: Trends of CPI by items in major countries

The United States is the opposite of Japan

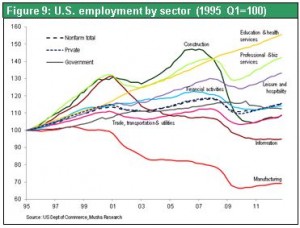

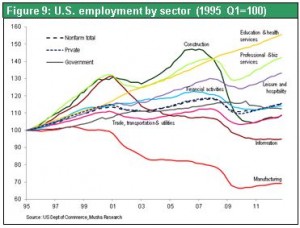

Employment in different sectors of the US economy since 1995 is shown in Figure 9 Over the past 15 years, there was a big improvement in US labor productivity (physical productivity) in manufacturing and IT sectors. However there were sharp downturns in jobs in the manufacturing and IT sectors, which had driven income creation (economic growth). At the same time, though, the number of jobs rose significantly in industries where there were only small labor productivity (physical productivity) improvements. Examples include education, health care, entertainment and services. The cause was a shift in income from the manufacturing and IT sectors to the service sector through price mechanism. Companies in the service sector were able to continue to maintain income levels that could support job growth. Service price inflation was the primary channel for this income shift.

*The United States benefited from deflation due to imports of low-cost goods from China and other countries and from technological progress deflation for high-tech products and communication fees, but so did all other countries in the world.

Deflation destroyed the appetite for risk

Deflation produced an extreme preference for cash. Financial markets could no longer fulfill their function as a means of supplying funds from investors willing to accept risk. After 20 years of deflation as prices of stocks, land and other assets fell, investors embraced the cash-is-king mentality. People shunned any exposure to risk. No funds at all flowed to assets with risk. The income return on stocks(earnings yield) rose to 7- 8% while the return on corporate bonds dropped to 1%. Even this difference of 7 to 8 times was not enough to entice investors to buy stocks. Capital was stored as dead money in the form of cash and there was absolutely no interest rate arbitrage.

These events mirrored the position of Friedrich Hayek that deflation (the distortion of relative prices) brings the redistribution of assets among sectors to a complete halt, thereby blocking economic growth. Some people try to make this situation look good such as by calling it “stability in a deflationary environment” (The Japanese Economy Will Be Destroyed by Investors Selling Off Japan, by Tadashi Nakamae, Shukan Economist, February 19, 2013). But these views fail to recognize the severity of the situation. Paralysis of market functions by deflation is a disease that can kill an economy. On the surface, the economy appears to be stable. However, this is merely due to extra demand created by global economic growth and government spending, which are nothing more than a special type of nutritional supplement for the economy.

Figure 9: U.S. employment by sector (1995 Q1=100)

(4) A shift in the monetary policy regime is the key

The Bank of Japan consistently allowed strong-yen deflation to persist

Monetary measures had a decisive effect on excessive strength of the yen and downturn in asset prices. The Bank of Japan made no change in its stance of doing nothing because currency is the responsibility of the Ministry of Finance and asset prices are determined by markets. But this was a mistake. As the asset bubble grew and finally burst in the early 1990s, the monetary measures of the Bank of Japan played a pivotal role. Yasushi Mieno, who was the Bank of Japan governor at that time, was widely hailed by journalists as a hero. Subsequently, though, the Bank of Japan dropped the ball during the second half of Japan’s lost 20 years by doing nothing to halt the abnormal drop in asset prices. The bank allowed the negative bubble to continue while terminating the positive bubble. It was thus no surprise that investors remained extremely averse to accepting any risk exposure.

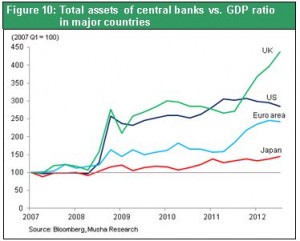

The new financial regime is in step with today’s age of shadow banking

Central banks around the world adopted a new regime in the wake of the Lehman shock. Non-traditional monetary initiatives and quantitative easing that began with US and UK central banks have become normal operating procedures. There are three key elements of this new normal. First, central banks have become the buyer of last resort rather than the lender of last resort during a financial crisis. Second, central banks no longer use loans to supply liquidity. Instead, they create buying power by boosting market prices that is, lowering the risk premium. Third, central banks justify these new actions by establishing new financial targets for economic growth, unemployment and other policy goals.

Why are these changes needed? The reason is the enormous structural changes taking place in the financial sector. In the past, indirect financing mainly in the form of bank loans was the main source of funds. But now the primary channel for obtaining capital is direct financing via financial markets. Shadow banking has become the mainstream of finance. Along with this shift, the mechanism for credit creation is moving from loans to higher asset prices. Credit (purchasing power) is transferred by changes in market prices, not contracts. This is why credit creation now means rising market prices. Due to these changes, central banks, which oversee the financial sector, must also oversee market prices. Central banks have been forced to extend their wings beyond managing bank loans to the management of asset prices as well. As Fed chairman Ben Bernanke has said many times, this is accomplished through the management of the risk premium. Mario Draghi, president of the European Central Bank, declared that “eliminating the euro collapse premium” was the reason for starting outright monetary transactions. The objective was raising the prices of the oversold government bonds of southern European countries. When a central bank attempts to influence the risk premium, the most important factor is stock prices, which are the key indicator of investors’ willingness to accept risk. Alan Greenspan, the previous Fed chairman, and current chairman Ben Bernanke both viewed stock prices as an unspoken policy target. The Bank of Japan must alter its stance of ignoring stock prices.

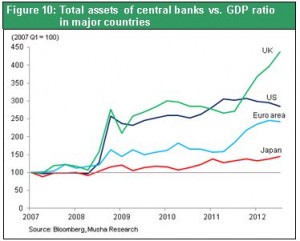

These new initiatives by central banks create two sources of concern. First is the rapid growth in central bank balance sheets. Second is the growth in financial assets at central banks with exposure to price volatility risk, which could create additional costs. Should we view this as a precursor to the collapse and demise of central banks along with the rise of the moral hazard? Or is this merely evolution? Opinions are divided. Pessimists expect a collapse. They expect the failure of non-traditional central bank measures to lead to an even greater economic downturn. But my position as an optimist is that we are seeing the evolution of the role of central banks. I believe that current measures are very likely to succeed (see my Strategy Bulletin No. 78 dated September 10, 2012). The debate must use a pragmatic viewpoint. Is restoring jobs and returning to economic growth following the burst of the asset bubble possible or impossible? If this is possible, what measures are needed through what channels? For this process, the old textbooks as well as the old sentiments, theories and sense of justice of economists, which are the basis for the beliefs of all pessimists including Bank of Japan governor Masaaki Shirakawa, will be of no absolutely use.

Figure 10: Total assets of central banks vs. GDP ratio in major countries

The current problem is the inability to direct ample capital to the proper users. Correcting this problem will enable the creation of new demand and jobs. Financial authorities of major countries worldwide need to take the necessary actions. In the United States, the Fed is working on encouraging risk-taking so that surplus capital will flow to both financial markets and the real economy. For financial markets, the aim is to increase the desire to make investments in stocks and other assets with risk. For the real economy, the aim is to stimulate near-term spending as well as long-term investments .

The current problem is the inability to direct ample capital to the proper users. Correcting this problem will enable the creation of new demand and jobs. Financial authorities of major countries worldwide need to take the necessary actions. In the United States, the Fed is working on encouraging risk-taking so that surplus capital will flow to both financial markets and the real economy. For financial markets, the aim is to increase the desire to make investments in stocks and other assets with risk. For the real economy, the aim is to stimulate near-term spending as well as long-term investments .

The evolution of central banks

A change is taking place in the role of central banks. We are also seeing a change in what stands behind the currency central banks issue. Under the gold standard, a central bank’s balance sheet consists of currency and gold. Under the managed currency system, these banks maintained the proper balance between currency and government bonds. However, the debt crisis in Greece and other events are casting doubts on the wisdom of holding government bonds. At the Fed, government bonds accounted for almost all balance sheet assets prior to the collapse of Lehman Brothers. But after the collapse, the Fed added massive amounts of mortgage-backed securities and other marketable securities to its balance sheet. Moreover, central banks are raising long-term bonds, which tend to be more volatile, as a percentage of government bond holdings (the Fed’s Operation Twist, for instance). This is a change of historic proportions for central banks.

The shift in central bank holdings from gold to government bonds and then government bonds to marketable securities (with significant price volatility risk) is very significant. Right now, this change may appear to be nothing more than a stopgap measure to deal with a crisis. But the new balance sheet composition may become permanent. Ending the gold standard was also viewed as a stopgap measure simply to achieve near-term stability. At that time, no one thought that a central banking system of issuing currency backed by government bonds, which are underpinned by nothing, instead of gold could last very long. Almost everyone expected the world to return to the gold standard. Furthermore, the Nixon shock that created the paper dollar system was regarded as a stopgap measure to overcome a short-term problem. Now, we can see that both of these events signaled the birth of a new currency system. The changes currently taking place may be the start of yet another currency system.

Currency systems have never been developed based on a plan that follows a clear concept. These systems have changed over the years to meet the requirements of markets. The gold standard was founded on the widely held fantasy that gold has value. Backing government bonds is the belief that bonds will always be repaid because governments can collect taxes. But this belief is beginning to weaken. So what is underpinning marketable securities? These securities are the first instruments with economic value that central banks have purchased. Marketable securities have a value equal to the current value of future cash flows, which are very predictable. In fact, we may even be able to state that these securities have a more solid backing than gold or government bonds do.

Today, we are apparently seeing the emergence of a mechanism for issuing currency that is backed by marketable securities. Is this the start of a new system? Or is this nothing but a temporary event? No one knows. Nevertheless, no one can deny that there is a need for a new currency mechanism in order to create new demand. Growth in demand must keep up with the rapid increases in productivity and the global capacity to supply of goods. Otherwise there will be an increasing likelihood of a severe economic downturn caused by a surplus on the supply side. Consequently, the United States may be starting to implement economic measures that look ahead to the next generation. Due to Abenomics, the Bank of Japan also has no alternative other than to follow this global trend.

(5) One more point – The Ballasa-Samuelson effect worked in reverse in Japan

According to the law of one price, more advanced countries should have higher inflation, resulting in wider internal-external price gaps

Deflation caused by the strong yen has probably demonstrated the validity of an international economic theory called the Ballasa-Samuelson effect. This effect confirms the principle that the law of one price applies to economies on a global scale. The law of one price is applicable only for traded goods (manufacturing). For these goods, the cost of labor at the same productivity (unit labor cost) will end up at the same level. That means (a) wages will increase significantly in countries with a high rate of productivity growth and (b) wage growth will be slow in countries with low productivity growth. In this case, the growth rate of wages in the non-traded sector (services), where there is no international competition, will be subject to arbitrage within the domestic labor market. Therefore, the rate of service-sector wage growth will be high in countries in the above category (a) and low in category (b) countries. The problem is that there are big differences in the rate of each country’s productivity growth for traded goods because they come from capital-intensive industries. But since non-traded goods (services) are labor-intensive, the differences in productivity growth rates in this sector are small among all countries. For instance, the productivity of a barber shop will be roughly the same in industrialized and emerging countries. Despite the small differences, service-sector wages are high in category (a) countries and low in category (b) countries. In other words, there is high inflation (decrease in purchasing power parity) in category (a) countries as prices of services rise (to absorb the cost of high wages). In category (b) countries, there is no service sector inflation so overall inflation is low (increase in purchasing power parity). The conclusion is that high inflation in industrialized countries is inevitable.

Cause and effect: Strong yen=Deflation, Weak yen=Inflation

At this point, we should recall that the Ballasa-Samuelson effect produced precisely the opposite result in Japan during the yen’s period of unusual strength. The rising yen eroded Japan’s ability to compete, leading to the following progression of events: a decline in wages in Japan’s tradable goods sector that in turn lowered wages in Japan’s non-traded goods sector that caused the entire Japanese economy to become mired in deflation. Subsequently, deflationary pressure became even greater because the yen remained strong due to the lack of exchange rate flexibility.

The reverse is also true. If a decline in wages in Japan’s tradable goods sector to far below the global level by the yen’s depreciation, there would be upward pressure on wages in Japan. Increasing wages in the tradable goods sector would then push up wages in the non-tradable goods sector, resulting in inflation. On February 12, Prime Minister Abe asked the executives of Japanese companies to distribute part of the additional earnings from the weaker yen and other sources to workers in the form of higher wages. This is precisely the aim based upon the Ballasa-Samuelson effect.

スマートフォンサイト

When Japan’s asset bubble reached the peak in 1990, the yen, stocks and real estate had all gone too far. A correction was inevitable. At the end of the 1980s, the yen weakened too much because the distinctive competitive edge of Japanese industries was becoming greater and greater. The formation of an asset bubble was the natural result of Japan’s postwar period of real estate-based financing and excessive savings. But this bubble could not be justified by any economic theory. Consequently, the upturn of the yen and downturn of asset prices in the first half of the 1990s can be justified as a correction of the distortion caused by Japan’s excessive economic success in the postwar era. Unfortunately, the correction itself went too far. The yen continued to climb too much and asset prices continued to fall too much. The combined effects of these two movements constantly exerted extremely strong downward pressure on the wages of Japanese companies.

When Japan’s asset bubble reached the peak in 1990, the yen, stocks and real estate had all gone too far. A correction was inevitable. At the end of the 1980s, the yen weakened too much because the distinctive competitive edge of Japanese industries was becoming greater and greater. The formation of an asset bubble was the natural result of Japan’s postwar period of real estate-based financing and excessive savings. But this bubble could not be justified by any economic theory. Consequently, the upturn of the yen and downturn of asset prices in the first half of the 1990s can be justified as a correction of the distortion caused by Japan’s excessive economic success in the postwar era. Unfortunately, the correction itself went too far. The yen continued to climb too much and asset prices continued to fall too much. The combined effects of these two movements constantly exerted extremely strong downward pressure on the wages of Japanese companies.

Hiroshi Yoshikawa, an influential professor at the University of Tokyo, stated that by 2012 the yen could no longer be viewed as too strong. He makes the point in his book Deflation (January 2013, Nikkei Publishing). “Inflation can limit economic downturns through monetary tightening. But deflation cannot be suppressed with monetary measures (because an excess reserve increase in central bank produces no effect when interest rates are zero). In other words, deflation is a result rather than a cause.” He goes on to add that, “deflation in Japan was caused by the shift in employment systems and resulting wage cuts at big companies that took place during the 1990s.” Wage reductions by companies are deflation itself rather than a cause of deflation. However, Professor Yoshikawa’s theory is frustrating because there is no attempt to determine why companies were forced to lower wages.

Hiroshi Yoshikawa, an influential professor at the University of Tokyo, stated that by 2012 the yen could no longer be viewed as too strong. He makes the point in his book Deflation (January 2013, Nikkei Publishing). “Inflation can limit economic downturns through monetary tightening. But deflation cannot be suppressed with monetary measures (because an excess reserve increase in central bank produces no effect when interest rates are zero). In other words, deflation is a result rather than a cause.” He goes on to add that, “deflation in Japan was caused by the shift in employment systems and resulting wage cuts at big companies that took place during the 1990s.” Wage reductions by companies are deflation itself rather than a cause of deflation. However, Professor Yoshikawa’s theory is frustrating because there is no attempt to determine why companies were forced to lower wages.

The current problem is the inability to direct ample capital to the proper users. Correcting this problem will enable the creation of new demand and jobs. Financial authorities of major countries worldwide need to take the necessary actions. In the United States, the Fed is working on encouraging risk-taking so that surplus capital will flow to both financial markets and the real economy. For financial markets, the aim is to increase the desire to make investments in stocks and other assets with risk. For the real economy, the aim is to stimulate near-term spending as well as long-term investments .

The current problem is the inability to direct ample capital to the proper users. Correcting this problem will enable the creation of new demand and jobs. Financial authorities of major countries worldwide need to take the necessary actions. In the United States, the Fed is working on encouraging risk-taking so that surplus capital will flow to both financial markets and the real economy. For financial markets, the aim is to increase the desire to make investments in stocks and other assets with risk. For the real economy, the aim is to stimulate near-term spending as well as long-term investments .