Feb 21, 2013

Strategy Bulletin Vol.92

Why is strong stock market with low interest rate good news?

- Naming the next BOJ governor will begin the second phase of Japan’s stock market rally

With Japan near the appointment of the next BOJ governor, as well as the start of new initiatives by this bank, Japan’s stock market rally is likely to advance to its second stage. Expectations fueled by Abenomics were behind the rally that started in November. From now on, stock prices will reflect specific measures. This process will probably propel the Nikkei Average to more than ¥12,500 by the end of March.

Figure 1: Nikkei, JPY/USD and 10-year JGB yield

Figure 2: S&P500 and 10-year TN yield

Figure 3: FRB total assets and QE

Haruhiko Kuroda is the leading candidate – Appointment will spark the second stage of the rally

Yesterday (Feb 20, 2013)’s Yomiuri Shimbun reported that Toshiro Muto, the previous front-runner to be the next BOJ governor, is apparently no longer under consideration. Mr. Muto is the ultimate bureaucrat. This raises concerns about his ability to implement reflationary initiatives with all his energy. Consequently, he was not a candidate that would have been welcomed by financial markets. The Yomiuri Shimbun went on to report that there are now four candidates: Kazumasa Iwata, Kikuo Iwata, Haruhiko Kuroda and Takatoshi Ito. But Mr. Kuroda is the leading candidate by far. Kikuo Iwata is committed to reflationary policies. However, he is unlikely to be selected because his academic background means that his skill involving government policies is unknown. Another issue is his distance from the front lines of international finance. Takatoshi Ito is a believer in establishing an inflation target. But there are doubts about the consistency of his logic and beliefs. For example, with regard to Mr. Ito, Your Party has stated that “a person who says the yen is not overvalued even at ¥75 to the dollar is not making any sense at all.” That leaves Kazumasa Iwata. He believes that Japan should purchase ¥50 trillion of foreign bonds as a quantitative easing measure. But there are doubts about whether or not this can be achieved. Making these purchases would subject Japan to enormous international criticism about manipulating foreign exchange rates. I believe that Mr. Kuroda will be chosen. First, he fulfills Prime Minister Abe’s demand for someone who “has the commitment and skill to end deflation as well as the ability to state his positions on a global stage.” Furthermore, his practical skills have been proven by his performance as a Vice Minister of Finance for International Affairs of the Ministry of Finance and as the president of the Asia Development Bank. For many years, Mr. Kuroda has had a strong desire to eliminate deflation and been critical of the BOJ. The following paragraph is an excerpt from a Strategy Bulletin of more than six months ago. Haruhiko Kuroda, president of the Asian Development Bank (former Vice Minister of Finance for International Affairs of the Ministry of Finance), has an enormous influence on financial policy. Here are a few of his statements from an Asahi Shimbun article on June 4. “Consumption and investments in Japan will not increase as long as long-term deflation continues.” “Like other countries, what Japan needs to do is to clearly define targets and bolster policies to achieve those objectives.” “1% (inflation goal) is far from enough to end deflation.” “The target must be more clearly defined. For example, if the goal is to end deflation in one to one and a half years, we should enact thorough monetary easing measures to achieve the goal.” An individual who played a central role in creating policies pointing out a specific error in a policy is itself abnormal. This indicates that the net encircling the BOJ is becoming tighter. As this net closes in on the BOJ, the bank will probably no longer be able to retain its stubborn stance of the past. (Strategy Bulletin No. 72, June 6, 2012) Naming Mr. Kuroda the next BOJ governor will probably generate a huge positive response in financial markets. Stock prices in Japan, which have recently been flat, are likely to start moving up again due to expectations about the innovative financial policies that Mr. Kuroda will announce.Buying Japanese government bonds to encourage risk-taking

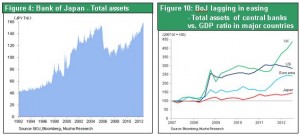

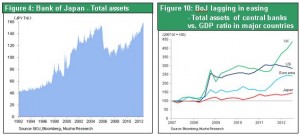

The new BOJ governor will probably announce an unprecedented quantitative easing program that will produce a massive expansion of the bank’s balance sheet (by tens of trillions of yen). Purchases will most likely consist mainly of (1) foreign bonds, (2) assets with risk (ETFs, REITs, etc.), and (3) Japanese government bonds. Buying any of these assets will be effective. However, purchasing foreign bonds will be viewed as exchange rate intervention and spark criticism from other countries. Purchasing assets with risk will have an excessive impact on these markets because of the small size of ETF or REIT markets. As a result, the only realistic option is to buy Japanese government bonds. The BOJ has until now restricted these purchases to Japanese government bonds with no more than three years remaining to redemption. But now the bank will probably extend the maximum number of remaining years for these purchases in order to raise these purchases dramatically. This is precisely the QE2 program implemented by Fed Chairman Ben Bernanke. QE2 was $600 billion of additional purchases of Treasury securities (see Figure 3) over the 8-month period starting in November 2010 in response to instability in financial markets following the outbreak of the financial crisis in Greece. The goals were to push down long-term interest rates, encourage risk taking and reduce the risk premium. Initially, there was criticism because of fears that QE2 would lead to inflation in the future or cause increasing strength for emerging country currencies along with speculation. In fact, QE2 allowed the U.S. to achieve sustained economic growth by producing a powerful U.S. stock market rally and stimulating the animal spirit in the economy and financial markets. After the emergence of Abenomics, Japanese stocks are up 30% and the yen is down 20% over the three-month period since last November. Despite these big movements, the Japanese government bond yield is still a very low 0.7%. Many people regard the lack of a change in the bond market as proof of the ineffectiveness of Abenomics. They think that expectations for inflation have not increased at all among bond investors and that the hopes of stock investors regarding Abenomics have no substance. But this is a mistake. Reflationary measures will not trigger a rush from assets with risk as expectations for rising inflation create panic among investors. By confirming the possibility of rising asset prices, these measures will instead increase investors’ appetite for risk. As a result, prices will rise (interest rates will fall) more for government bonds with more years remaining to redemption, which have greater risk than for the same bonds that mature sooner. Investors who take on more risk must earn higher returns than investors who shun risk (by purchasing government bonds with less time remaining to redemption). The key point of credit easing resulting from QE is that this process creates a firm foundation for expectations for higher price increases of assets that have greater risk. Due to the objectives of QE, an immediate increase in expectations for inflation (because of the upturn in long-term interest rates) would be impossible. Short-term government bonds, which have less risk, could not become more attractive relative to long-term government bonds, which have more risk. During the QE2 program in the United States, the yield of long-term Treasury securities declined as policies were implemented. This immediately produced an upturn in prices of stocks and other assets. The same is true for the QE process envisioned in Japan. First, long-term interest rates will fall. Then investors should expect to see a broad upswing in the prices of stocks and real estate. These events will probably undermine the position of people who view the reasons for this stock market rally from the pessimistic stance of impending inflation, a plunge in Japanese government bond prices and a general sell-off of Japanese assets. We can expect to see a slow increase in interest rates as Japan’s economy recovers and deflation comes to an end. But this will be a positive rather than negative upturn in interest rates. The BOJ must observe the principle of “practice what you preach.” That means the BOJ needs to increase its own risk-taking and make a commitment to holding assets with risk. Abenomics (QE) does not seek to produce the fear of inflation expectations. The aim is to have people take on the challenge of creating expectations for economic growth and higher earnings. This is why Abenomics will probably destroy every type of pessimistic viewpoint. Figure 4: Bank of Japan - Total assets Figure 5: BoJ lagging in easing - Total assets of central banks vs. GDP ratio in major countries