Mar 06, 2013

Strategy Bulletin Vol.94

The historical significance of the DJIA’s new record high

The Dow Jones Industrial Average climbed to a new all-time high on March 5. Cynics like Bill Gross and Jim Rogers criticized the high prices as “a bubble caused by abnormal monetary easing.” But this view is no longer convincing because of the strong recoveries of the real economy and corporate earnings.

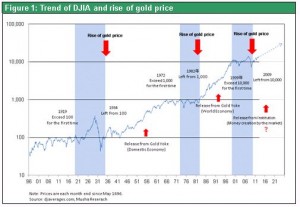

The all-time high of the DJIA can be viewed as the beginning of a new era of prosperity. On a monthly basis, this average had already reached a new high in February. Over the past 80 years, there have been four instances other than this one where the DJIA surged to a new record following a prolonged slump. Two of those record highs (in 1954 and 1982) were the precursor to the start of a new era of prosperity. The other two times (in 1972 and 2006) were merely temporary peaks that were part of volatility when stock prices were high. So what does this record high mean? We cannot deny the possibility of a temporary peak. However, this record is more likely to be the sign that we are entering an extended period of rising stock prices and prosperity.

New DJIA record /Prior peak /Significance

(1) $387 in Apr. 1954 /$388 in Aug. 1929 (25 years earlier) /Start of prolonged prosperity

(2) $1,018 in Nov. 1972 /$969 in Decc 1965 (7 years earlier) /Volatility as prices were high

(3) $1,039 in Nov. 1982 /$1,020 in Dec. 1972 (10 years earlier) /Start of prolonged prosperity

(4) $11,679 in Sep. 2006 /$11,497 in Dec. 1999 (7 years earlier) /Volatility as prices were high

(5) $14,054 in Feb. 2013 /$13,390 in Oct. 2007 (6 years earlier) / ?

Figure 1: Trend of DJIA and rise of gold price

For four years since the Lehman shock, we have consistently and forcefully stated our conviction that today’s global stock rally was coming. For an overview of this stance, please read the series of six bulletins titled Debt-based Historical View vs. Productivity-based Historical View that started on September 27, 2011.

(1) Strategy Bulletin (Vol.53), September 27, 2011

It’s time to liquidate ‘liquidationism’

(2) Strategy Bulletin (Vol.55), October 5, 2011

Productivity and credit have propelled the DJIA over the past 100 years

(3) Strategy Bulletin (Vol.56), October 12, 2011

What is the meaning of upturns in the price of gold during shifts in currency regimes?

(4) Strategy Bulletin (Vol.57), October 24, 2011

Overcome the crisis dredged up by “debt hysteria”

(5) Strategy Bulletin (Vol.60), 07 December 7, 2011

Resolving the euro trilemma and saving Europe from the debt crisis

(6) Strategy Bulletin (Vol.61), January 6, 2012

Is the triple-high a precursor of a U.S. economic rebound?

For your information, the text of Strategy Bulletin (No. 55) dated October 4, 2011, in which I outlined my scenario for an extended period of U.S. prosperity, is presented below.

For four years since the Lehman shock, we have consistently and forcefully stated our conviction that today’s global stock rally was coming. For an overview of this stance, please read the series of six bulletins titled Debt-based Historical View vs. Productivity-based Historical View that started on September 27, 2011.

(1) Strategy Bulletin (Vol.53), September 27, 2011

It’s time to liquidate ‘liquidationism’

(2) Strategy Bulletin (Vol.55), October 5, 2011

Productivity and credit have propelled the DJIA over the past 100 years

(3) Strategy Bulletin (Vol.56), October 12, 2011

What is the meaning of upturns in the price of gold during shifts in currency regimes?

(4) Strategy Bulletin (Vol.57), October 24, 2011

Overcome the crisis dredged up by “debt hysteria”

(5) Strategy Bulletin (Vol.60), 07 December 7, 2011

Resolving the euro trilemma and saving Europe from the debt crisis

(6) Strategy Bulletin (Vol.61), January 6, 2012

Is the triple-high a precursor of a U.S. economic rebound?

For your information, the text of Strategy Bulletin (No. 55) dated October 4, 2011, in which I outlined my scenario for an extended period of U.S. prosperity, is presented below.

For four years since the Lehman shock, we have consistently and forcefully stated our conviction that today’s global stock rally was coming. For an overview of this stance, please read the series of six bulletins titled Debt-based Historical View vs. Productivity-based Historical View that started on September 27, 2011.

(1) Strategy Bulletin (Vol.53), September 27, 2011

It’s time to liquidate ‘liquidationism’

(2) Strategy Bulletin (Vol.55), October 5, 2011

Productivity and credit have propelled the DJIA over the past 100 years

(3) Strategy Bulletin (Vol.56), October 12, 2011

What is the meaning of upturns in the price of gold during shifts in currency regimes?

(4) Strategy Bulletin (Vol.57), October 24, 2011

Overcome the crisis dredged up by “debt hysteria”

(5) Strategy Bulletin (Vol.60), 07 December 7, 2011

Resolving the euro trilemma and saving Europe from the debt crisis

(6) Strategy Bulletin (Vol.61), January 6, 2012

Is the triple-high a precursor of a U.S. economic rebound?

For your information, the text of Strategy Bulletin (No. 55) dated October 4, 2011, in which I outlined my scenario for an extended period of U.S. prosperity, is presented below.

For four years since the Lehman shock, we have consistently and forcefully stated our conviction that today’s global stock rally was coming. For an overview of this stance, please read the series of six bulletins titled Debt-based Historical View vs. Productivity-based Historical View that started on September 27, 2011.

(1) Strategy Bulletin (Vol.53), September 27, 2011

It’s time to liquidate ‘liquidationism’

(2) Strategy Bulletin (Vol.55), October 5, 2011

Productivity and credit have propelled the DJIA over the past 100 years

(3) Strategy Bulletin (Vol.56), October 12, 2011

What is the meaning of upturns in the price of gold during shifts in currency regimes?

(4) Strategy Bulletin (Vol.57), October 24, 2011

Overcome the crisis dredged up by “debt hysteria”

(5) Strategy Bulletin (Vol.60), 07 December 7, 2011

Resolving the euro trilemma and saving Europe from the debt crisis

(6) Strategy Bulletin (Vol.61), January 6, 2012

Is the triple-high a precursor of a U.S. economic rebound?

For your information, the text of Strategy Bulletin (No. 55) dated October 4, 2011, in which I outlined my scenario for an extended period of U.S. prosperity, is presented below.

Debt-based Historical View vs. Productivity-based Historical View (Part 2) Productivity and credit have propelled the DJIA over the past 100 years

In this second part of my series about debt-based vs. productivity-based historical views, I will analyze movements of the Dow Jones Industrial Average (DJIA) over the past 100 years to seek hints about the outlook for the stock market. In the past, stock prices have surged whenever there was a match between productivity and credit (debt). Amid today’s deepening global financial crisis, we have reached the point where falling stock prices are very likely to produce a self-fulfilling simultaneous recession. What are the causes of the current volatility in global financial markets? And what will happen next? To answer these questions, we must study what happened in the past.The link between stock prices and economic stagnation and growth

Figure 1 shows the DJIA over the past 100 years using a logarithmic scale. There is an unmistakable repetition of long periods of stagnation in stock prices followed by strong rallies. (1) Stock prices increased until 1920 and (2) were then flat between 1920 and 1934 (or even until 1942). (3) Between 1934 (or 1942) and 1972 (or 1966), there was a powerful upswing in stock prices. This was followed by (4) stagnation from 1972 (or 1966) until 1982 and then (5) another sharp upturn between 1982 and 1999. We are now (6) in the midst of a period of stagnation that started in 1999. The stock market has probably reached the end of (6) the current extended period with no direction.$100, $1000 and $10000 are major barriers

Strangely, each period of extended stagnation started after the DJIA reached the significant milestones of $100, $1000 and $10000. The average does not move well above these levels for 10 to 20 years. But we have seen a repetitive pattern in which a rally begins once the DJIA does move well above a milestone that boosts the average by 10 times. We should focus our attention entirely on answering the following two questions. First, what were the factors behind the two long-term bull markets over the past century that raised the DJIA by 10 times and will this happen again? Second, what type of phase is the stock market in right now?Correlation with the Price of Gold

I will have to entrust a thorough examination of economic history to the specialists. However, I believe that I can come up with an overall perspective of past events for the time being. The DJIA ended a long period of stagnation and started a powerful rally in the late 1930s and early 1940s and in the early 1980s. An event that happened at both times was an upturn in the price of gold. In fact, upward movement in the gold market was a precursor of a bull market that continued for many yearsThe three requirements for prosperity: (1) A geopolitical regime

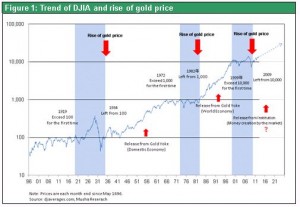

Let’s take a look to see what factors came together when a long-term bull market started in the United States. Looking back at past stock market upturns indicates that at least three events occurred at the same time. A summary is presented in Figure 2. First is a geopolitical regime. Second is an improvement in productivity (that is, an increase in supply capacity) fueled by a technology revolution. Third is a currency system that functions as a mechanism for creating demand. Let’s take a closer look at the first requirement. A political foundation that supports unrestricted commerce and provides a financial guarantee is vital to economic prosperity. Since the 1940s, the U.S. leadership of the Western world (Pax Americana) was the primary element of this foundation. Furthermore, prosperity in the 1980s and 1990s was backed by the extension of U.S. power to a global scale due to the collapse of communist countries. The American standard became the global standard as the United States established an overwhelming presence as the world’s only superpower.The three requirements for prosperity: (2) Productivity revolution

No one can deny technological advances dramatically raises productivity that triggers economic growth. Energy from petroleum was the foundation for the advanced U.S. consumer society that flourished between the 1940s and 1960s. Electricity and automobiles are the symbols of this period. Starting in the 1980s, business models were rewritten as progress in semiconductor technology fueled the information revolution. Naturally, advances in technology and productivity inevitably create growth in the ability to supply goods. If demand did not grow as well, the larger supply resulting from higher productivity would result in excess output capacity and an upturn in unemployment. In fact, an improvement in productivity is a double-edged sword. Higher productivity alone is not enough to support economic prosperity.The three requirements for prosperity: (3) Demand creation mechanism and currency system

Finally, the establishment of a mechanism for creating demand is vital to prosperity. The widening gap between output capacity and insufficient demand was the cause of the Great Depression of the 1930s. The invention of the currency system and growth in credit were most likely the driving forces behind demand creation through economic measures (the only political / imperialistic response to the shortage of demand was to wage wars and control colonies). Emergence of the managed currency system played a key role in the prosperity that lasted from the 1940s to the 1960s. Under the gold standard, money supplies had been restricted by the need to store gold. With this limitation gone, the money supply could grow to the optimum level demanded by the economy. The expansion of credit thus functioned as the mechanism for creating demand. Since the 1980s, there has been a flood of so-called “paper dollars.” The cause was the Nixon shock, which ended limitations on the global money supply that had been imposed by U.S. gold holdings. Excessive speculation and the formation of an asset bubble were by-products of this money supply growth. On the other hand, the expanding money supply led to the industrialization of Japan and other Asian countries and rapid economic growth worldwide. Figure 2: A Century of Modern World History – Viewed from the Perspective of the Stock Market