Jan 01, 2014

Strategy Bulletin Vol.111

The “falling paulownia leaf” points to a historic turning point

Happy New Year !

Precursors of the historic shift that occurred in 2013

“A falling paulownia leaf shows that autumn has come” (paulownia leaves are the first to fall) is a saying attributed to the Japanese warlord Katsumoto Katagiri, who foresaw the demise of the Toyotomi clan in 1615. One event is the sign of a major change. In English, an equivalent saying is “a straw shows which way the wind blows.” In 2013, there were two precursors of events that will undoubtedly happen in the near future.

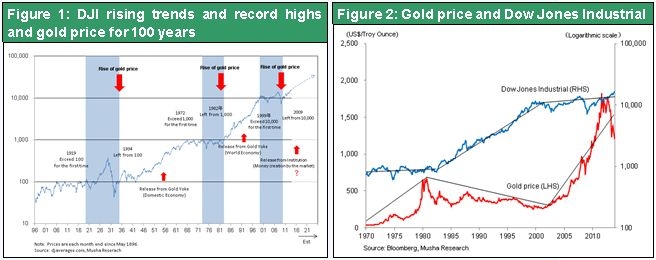

The first “falling leaf” of 2013 was the rise of U.S. stocks to a new all-time high. Record-high stock prices show that the global capitalist economy, led by the United States, is on the verge of a new era of prosperity. Stock markets are telling us that the crisis phase has ended. The world has advanced to an era in which embracing an attitude of pessimism and resignation is a big mistake.

Figure 1: DJI rising trends and record highs and gold price for 100 years

Figure 2: Gold price and Dow Jones Industrial

The second “falling leaf” is North Korea. Everyone can now clearly see how terrifying this country’s totalitarian regime is. Events in North Korea are a precursor of the beginning of the end of Marxism-Leninism (communism), which is the sole alternative to capitalism and democracy. This will bring about a major transformation in the postwar geopolitical environment. In particular, we will see a fundamental geopolitical shift in East Asia.

Collectively, these events point to a complete reversal of widely accepted thinking in 2014 with respect to the future of capitalism and the geopolitics that have determined the postwar global order. This reversal will be a favorable development regarding politics, economics and markets for Japan, which is the most powerful component of capitalism and democracy in Asia.

(1) The end of Marxism-Leninism and major shift in the postwar geopolitical environment

Is North Korea headed for a collapse?

The shocking executions of many rivals by North Korea’s inexperienced and immature hereditary dictator show that the end is approaching. The United States and other democratic countries of the world cannot stand by and do nothing about the risk of potential actions by Kim Jong Un, who controls a powerful military with nuclear weapons. Furthermore, the people of North Korea, who are unable to speak freely, are certainly aware of the cruelty of the government. Kim Jong Un cannot possibly be capable of choosing the proper policies for a sustainable economy and government. This is why North Korea will probably in 2014 start going down the road to a collapse. North Korea’s demise will most likely start with deepening economic problems and the country’s adventurism regarding other countries.

The current regime in North Korea can be viewed as nothing other than the historic consequence of Marxism-Leninism. However, the fantasy of Marxism-Leninism still has enormous influence in Asia. In China, which will soon be the world’s most powerful economy, the government is guided by Marxism-Leninism. But this ideology will have to change. In Japan as well, there are many believers of Marxism-Leninism in the media and academic circles. But these people simply state their anti-authority and anti-establishment positions while hiding behind the fig leaves of justice and ethics. They have no ideas at all for countermeasures and solutions. Since their positions are never corrected by outcomes, the formation of public opinion is distorted and intellectual degeneration of a country’s population takes place.

Signs of the impending death of Marxism-Leninism

Most people believe the Cold War ended in 1991 with the breakup of the Soviet Union. But this is not correct. In Asia, Marxism-Leninism, which is the sole alternative to capitalism and democracy, is still alive and well. For many years, Marxism-Leninism consistently attracted young people’s attention as potentially the most ideal and just ideology. But this ideology was the culprit responsible for mass killings that were perpetrated again and again by Lenin, Stalin, Mao Zedong, Pol Pot and even Japan’s Red Army. Furthermore, North Korea is an extension of this thinking. No one can deny these points today.

The tyranny and infallibility of Marxism-Leninism has been justified by using the organizational principle of “democratic centralism.” But this can lead only to bloodshed and tyranny. Democratic centralism is an organizational principle that justifies absolute obedience. A minority is ruled by a majority and lower classes are ruled by upper classes. Originally, this was a framework of control for secret military organizations that wanted a violent revolution. Democratic centralism functioned as a means of suppressing and eliminating minorities during a revolution and of establishing absolute control after a revolution. This is a framework for relationships among people based on an organizational principle that is the opposite of democracy. Democratic centralism rejects the collegiate system and feedback from debates. As a result, self-denial and policy corrections are impossible.

If North Korea cannot change from within, increasing economic difficulties will lead to either the country’s self-defeat or desperate external adventurism. Events in 2014 and afterward will bring about change in North Korea that will probably break the balance of power in Asia.

Can Xi Jinping abandon Marxism-Leninism?

Changes in North Korea will have an immediate and massive impact on China. There will probably be a struggle between two positions. Should Chinese communism follow the path of North Korean-style destruction that involves self-justification and self-purification? Or should China abandon Marxism-Leninism (communism) and democratic centralism and be reborn as a country that fully embraces capitalism and democracy? China will have to carefully examine its options because economic difficulties are about to emerge in the form of interest rate volatility caused by excessive investments in the past. Turmoil in China will probably be unavoidable. Xi Jinping has established his authority after becoming China’s president one year ago. Just as was the case for the Soviet Union under Mikhail Gorbachev, China’s future will be determined by the president’s decision about the self-denial of one-party rule. If self-denial is not possible, China will sooner or later be forced to follow the North Korean path of internal turmoil and self-destruction. In 2014, it will probably become even easier to foresee the path that China will choose.

Unrest in East Asia will strengthen solidarity among the world’s capitalistic and democratic countries, centered on the United States. This is certain to greatly enhance the geopolitical presence of Japan, the largest capitalistic and democratic country in Asia.

(2) The renewed prosperity of global capitalism is emerging

The expansion and strengthening of global capitalism

Global capitalism is about to develop even more in two ways. First is the extensional expansion of markets (increase in regions and populations ruled by markets). Second is inclusive deepening (restaurant, nursing care, child care and other market economies for household labor; Internet and other new services).

Record highs in U.S. and German stock markets are a sign that stocks are factoring in a prolonged period of prosperity. Stock markets are telling us that the crisis phase after the Lehman shock is over. The world may be entering a new age of prosperity led by the United States, Germany, Japan and other developed countries. U.S. stocks rarely climb to a new all-time high. This has happened only twice (1954 and 1982) after the extended slump following the Great Depression of the 1930’s. Each time, the record high was the precursor of a period of economic strength. This is very likely to be true for the third historic all-time high that occurred in March 2013, too.

The shockwaves of the 21st century industrial revolution

If we stop looking through colored glasses, we can see that a period of prosperity that has occurred only rarely in the history of the world has started. A 21st century industrial revolution is under way. This revolution is driven by globalization and the Internet as well as advances like cloud computing and smartphones. Companies have used this revolution to dramatically boost productivity and slash costs. Huge changes have taken place in life styles and standards of living, too. All these events raised corporate earnings significantly worldwide and stock prices have increased as a result. In other words, the current global stock market rally is not a bubble or money game. Higher prices are rooted in extremely sound corporate fundamentals.

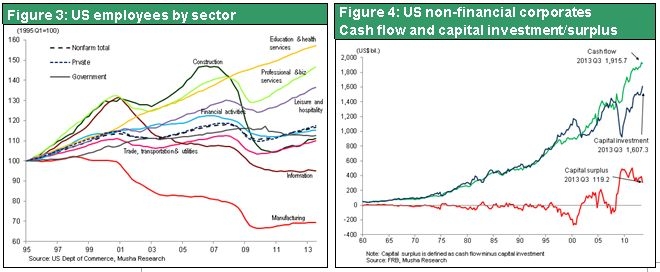

Rising earnings are the result of a big drop in labor’s share of income caused by the ability to use less labor because of higher productivity. However, this raises unemployment. As a result, the economy remains lackluster until new demand (job creation) emerges. On the other hand, higher productivity allows companies to use less capital. The resulting sharp drop in the cost of equipment has produced an unprecedented volume of surplus capital. This is the cause of the historic downturn in long-term interest rates. Consequently, the United States has been ruled since 2000, both before and after the Lehman shock, by the following basic process: rising productivity = surplus labor = surplus capital.

QE and higher stock prices are vital to creating demand

As Figure 3 shows, the 21st century industrial revolution was responsible for significant declines in jobs in the U.S. information and manufacturing sectors. Despite these declines (and despite the significant surplus capital that was created, as shown in Figure 4), surplus labor and capital did not come to the surface until the Lehman shock. The reason is that these surpluses were absorbed by the housing sector, which resulted in a bubble. Once the housing bubble burst, the explosive release of surplus labor and capital created the deepest economic downturn in the postwar era. The economy would have collapsed if nothing was done about these two surpluses (both of which were the result of higher productivity). But the economy would grow if the surpluses could be used to create demand (which means creating new value). The direction of history depended on the policies chosen immediately after the Lehman shock. It was a critical moment. Fortunately, U.S. policies overseen by Fed Chairman Ben Bernanke were consistently aimed at stimulating the demand creation process. Financial markets quickly returned to stability as a result. Quantitative easing was the central component of these policies.

Figure 3: US employees by sector

Figure 4: US non-financial corporates - Cash flow and capital investment/surplus

Record-high stock prices in the United States can thus be viewed as the result of the ongoing 21st century industrial revolution and on-target government policies associated with this revolution. Simply put, the rally is the result of the use of quantitative easing as a means of creating demand.

Gold’s rise and fall are a precursor to prosperity

As stocks set new highs, an event that appears to be a “falling leaf” is happening. The price of gold has surged and then plunged. Over the past century, the price of gold has increased only three times: in 1933, 1980 and 2011. Gold’s price movements support the following three hypotheses (cause and effect = regularity). (1) The price of gold has climbed when the money supply grows (or expectations for growth increase) because of a new currency regime in response to a financial and economic crisis. This time as well, the continuing surge in the price of gold was accompanied by quantitative easing (growth of the money supply). (2) The price of gold has climbed when investors are extremely averse to risk during a severe crisis because gold was used for the temporary storage of purchasing power. But once people gain confidence in a new currency regime and the future looks brighter, purchasing power stored in gold initially shifts to high-risk financial assets. Next, money moves on to investments and spending, resulting in a sharp drop in the price of gold. Therefore, a drop in the price of gold is proof that the economy is about to advance to a stage of sustained growth. (3) Stock prices are usually weak (sharp drops and sluggishness) until a financial crisis becomes severe and a new financial regime is established. This means that stock prices stay low as long as gold prices continue to climb. But once a new financial regime begins to function, purchasing power shifts from gold to stocks and a long-term stock market rally starts.

With respect to these three points, there are similarities between 1982 and 2013. As you can see in Figure 2, (1) after reaching a peak two years ago, the price of gold has started to decline sharply; (2) stock markets are setting new records after an extended period of weakness. The year 1982 was the starting point for the rise of the Dow Jones Industrial Average from $1,000 to ¥10,000. Although not certain, it is quite possible we are at a similar starting point now.

Two key themes for 2014

Global events in 2014 will probably be shaped primarily by two themes. First is more prosperity for global capitalism, led by the United States. Rising U.S. stock prices and the falling price of gold show that this is likely to happen. Second is the impact of two geopolitical changes: the decline in Asia of Marxism-Leninism, a remnant of the Cold War, and a transition in the United Nations framework.