Jul 22, 2019

Strategy Bulletin Vol.229

Slump in Japan's Stocks, Caused by Time Lags and Policy, to Improve after the Election

US stocks’ record highs as Japanese stocks’ slump

Last week, all three of the US’s key stock price indices hit levels above last year's highs. This is because the market has accepted that the US-China trade war will not lead to a recession in the United States. The UK Economist's latest issue (7/13-7/19) carries a special feature entitled “America’s expansion is now the longest on record - What could bring it to an end?” and analyses that, strangely, it cannot be found any time soon.

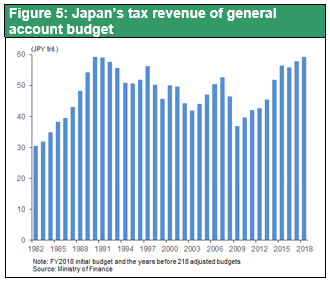

In the midst of this situation, the stagnation in Japanese stock prices is remarkable. Looking back at the rate of increase in stock prices from the bottom of the trough recorded last year to the end of last week, the Nikkei average is up just +7.3% leaving it in the losing team with Korea’s KOSPI at +2.6% against the US S&P’s +18.7%, the German DAX’s +16.2%, and the Shanghai SSE Composite Index’s +17.2%.

At times when the global economy is sluggish and risk aversion is all-pervasive, there is a certain viewpoint which holds that sluggishness in Japanese stock prices is inevitable. The end of last year is a typical example. The market was concerned about the US-China trade war and the global recession that it could trigger, and so US and world stock prices plunged by about 20%, the yen soared, and Japanese stocks were sluggish.

Three reasons why Japanese stocks move speculatively

Japanese stocks are significantly more volatile for three reasons. The first of these factors is that, among TSE-listed companies, the weighting of those manufacturing industries where the degree of impact from economic fluctuations is large, is extremely high at about 50%. This is significantly higher than the manufacturing sector ratio of less than 20% in Japan's GDP. In addition, the portion shared by Japan consists of upstream components such as materials, parts, and machinery, which means that the impact of the resulting economic fluctuations is further increased.

The second factor is that Japanese stock prices are strongly correlated with movements in foreign exchange rates and so the amplitude of fluctuation is increased as a result. As Japan is one of the largest foreign-asset-holding nations in the world, as the global economy improves, Japanese investors become bullish and increase the scale of their foreign investments, which accelerates capital outflows and leads to a weaker yen. The weak yen then acts to boost both the Japanese economy and Japan’s stock prices. On the other hand, however, when the global economy and markets enter a period of stagnation, the capital outflows stop and the yen rises, with the result that both the Japanese economy and Japan’s stock prices are driven down by the impact of the same synergies. Such currency exchange and “stock resonance.” phenomena are unique to Japan.

The third reason is that, although the foreign ownership ratio of Japanese shares is less than 30%, nearly 70% of the stock market volume is occupied by foreigners, many of whom are futures-based speculators. The Japanese stock market is subject to a very large degree of speculative activity due to its substantial liquidity and price volatility, and so is susceptible to be significantly shaken by the impact of computer-based algorithmic trading.

Speculative position close to its negative pole

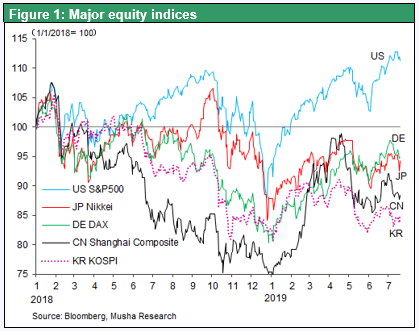

For these reasons then, it could be said that, if the global economy worsens and global risk aversion spreads, Japanese stocks are inevitably going to be the most likely be sold off. The good news, however, is that speculative amplitude is neutral to long-term trends. Since, even if Japanese stocks are sold off as a result of speculation, this does not mean that they will continue to be sold. The speculative selling positions are eventually offset by speculative buying, with the result that a large upside pressure is generated. To date, downturns in the global economy and futures-based stock sales in global risk-off situations have pushed Japanese stocks down to unreasonable levels on several occasions. The TSE’s unsettled buying balance of arbitrage trading has attracted attention as an indicator of speculative positions, but whenever this balance declines to a significant level of around ¥500 billion, this has repeatedly been seen to result in marking a major bottom for stock prices and to be reflected in the creation of a significant turning point. This was the case in 1998, 2003, 2009, and 2016, with the Nikkei average rising by 60% in the 1 to 1.5 year-periods thereafter. The balance was at the 500-billion-yen level last Christmas and fell below the 400-billion-yen level last month, which was at a low level since the time of the GFC, and this suggests the possibility of speculative buying suddenly reviving at some point in the future.

How should we view the current stagnation of Japanese stocks under these circumstances? The first of the hypotheses is the pessimistic view that the global economic downturn will progress. That is to say that what has been seen as a speculative Japanese stock decline was actually a precursor to the deterioration of the real economy. Japanese stocks are leading the global trend, and US stocks and Chinese stocks will eventually fall. The second hypothesis is that the expansion of the global economy will continue, and the global risk-taking environment will not change. There is optimism that Japanese stocks are coming late to the party but will eventually join in on the global highs. The third hypothesis is that, in the context of global economic expansion and global risk taking, for the previously mentioned reasons for the uniqueness of Japan, Japan will continue to be the only loser. The above three possibilities are considered.

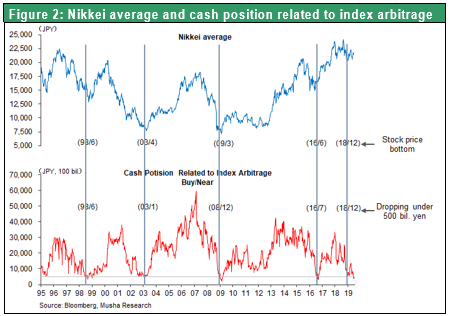

Global Economic Mini-cycle Turning Upward

The first of these hypotheses, that the global economy will deteriorate, is wide of the mark. Although the US and China are involved in a trade war, this is currently not very harsh, and their domestic economies are both firm thanks to the economic measures taken and monetary easing, which has led to a rise in both US and China stocks. It can be assumed that the US and China economies, which can make full use of the two policy measures of monetary easing and fiscal movement, will remain solid even if there are any other further negatives. The US economy has now recorded the longest economic expansion ever in the 10 years since 2009, and this currently shows few sign of stopping. However, there is also a mini-cycle in the long-term economic expansion, which is appearing in trade and investment as shown in Charts 3 and 4. Recently, we have seen a spring peak in 2015, a spring bottom in 2016, a spring peak in 2018, a spring bottom in 2019. The mini-setback from the middle of 2018 was caused by the emergence of the US-China trade war and the shelving of many investment projects due to uncertainty as the feeling that the replacement cycles for smartphones and cars were peaking became stronger. But now, with these replacement cycles going to be completed, the trade-war uncertainty has also been eliminated (the trade war continues but a full-scale confrontation has been avoided, and the outlook for other issues such as the prospect of production bases leaving from China to ASEAN nations is now broadly visible). The mini cycle is therefore very likely to start to turn upwards from the second half of 2019 onwards.

Perhaps the mixture of the second and third hypotheses may result in a proper interpretation. The delay in the emergence of Japanese stocks is that the upturn in the global economic mini-cycle has not yet been reflected in Japanese business prospects and so there is a time lag as a result of this.

Japan's Inherent Negative Factors, Tax Increases and Lack of Scope for Monetary Easing

Then we come to asking what is the unique stock price loss factor in Japan? Well, that would be policy. Leaving aside whether they are good or bad, countries around the world are now becoming ever more dependent upon policy measures. Productivity has risen as a direct result of the AI revolution, and supply capacity is increasing worldwide, with the result that there is constant deflationary pressure (supply capacity surplus = demand shortage). Therefore, demand-creation policies that absorb the surplus funds and surplus-supply capacity are essential, and a policy mix of monetary easing and expansion in fiscal spending is also required. Policy methods such as the currently fashionable MMT (Modern Monetary Theory), Professor Sims’ FTPL theory (Fiscal Theory of the Price Level), and QE (quantitative monetary easing) are emerging in response to the demands of such times. In reacting in turn to this situation, the Trump administration has delivered a very full response, and the US stock market has recorded new highs. In Japan, on the other hand, in addition to the anticipation ahead of the hike to the consumption tax rate in October, the BOJ's scope for additional easing is expected to remain limited. Expectations for policy measures are at their lowest, and so it’s fair to say that if this is disliked by global money then that’s just too bad.

Focus on Post-election Reflationary Policy Agenda

However, Prime Minister Abe is saying that the consumption tax hike in October will be the last within coming decade. The House of Councillors election is over, and the focus of politics is now on the next general election. At that time, the issue of the agenda set by Abe administration's will of course be highlighted. To begin with, the consumption tax hike from 8% to 10% is not something that the Abe administration launched but is just the implementation of the “homework” requirements set by the three-party (Democratic Party, Liberal Democratic Party, and Komeito) agreement under the Democratic Party government in 2012. It is very likely that Abe's main intention of implementing a reflationary policy, will be the key theme after the House of Councillors election.

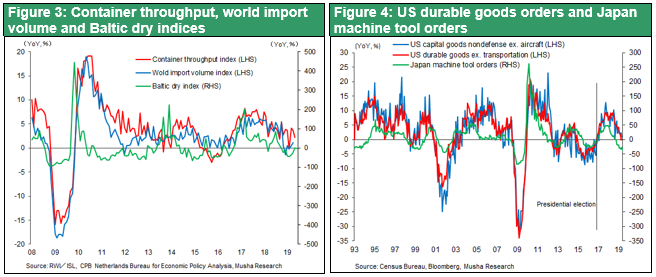

Backed by increasing in tax revenues, it may be possible to launch a fiscal stimulus plan consisting of tax reductions and national resilience measures before the next general election. The Bank of Japan may also launch some new approaches to its methodology, such as a further promotion of the zero-interest-rate policy, an increase in ETF purchases, and delivering a boost to its portfolio-rebalancing aims by means of the implementation of bank asset purchases. Thereafter, it may well be that we will see the emergence of a synergy between the upturn in the global economic mini-cycle and a boost to policy expectations, resulting in a spectacular turnaround in Japanese stocks that have been sold off emerging into next year.