Jan 01, 2020

Strategy Bulletin Vol.242

Four paradigm shifts will shape global events in 2020

- Reiwa Stock Market Rally Series (5)

Happy New Year !

May this be a happy and fruitful year.

Dark clouds are going away

All of the dark clouds that shrouded 2019 are no longer in sight as the new year begins. Four developments are particularly significant: (1) the US-China trade war ceasefire; (2) stabilization of the abnormal global financial picture; (3) a clear decision regarding Brexit following the big Conservative Party victory; and (4) the start of substantial investments for 5G mobile communications. Due to these events, there is no longer talk about global economic growth ending in 2020. A closer look at these four developments shows all are changes of historic magnitude. Furthermore, all four are interconnected and will reinforce the stature of the United States in the world.

Trump is likely to win a second term

The biggest source of concern about 2020 is the US presidential election. There is a high probability of a Trump victory. In the postwar era, only two full-term presidents failed to win a second term: Jimmy Carter and George H. W. Bush. In both cases, there was a recession and falling stock prices during the first term. There is almost no doubt that President Trump can avoid both of these problems. In addition, he has fulfilled almost all of the promises made during the campaign in 2016 and earned overwhelming support within the Republican Party. The Democratic Party, however, is struggling to select a strong candidate and platform.

Massive surplus savings will move from government bonds to equities

What will happen now that the dark clouds have disappeared? The answer depends on the destination of the enormous amount of money available for new investments. Pessimists believe that surplus savings are a dangerous product of extreme monetary easing worldwide. But this is a critical error regarding the determination of an investment strategy for 2020. The technology revolution generated surplus savings by boosting corporate and household income but did not create a sufficient amount of demand. Once these savings start to fuel a positive economic cycle, there will be strong economic growth and higher stock prices.

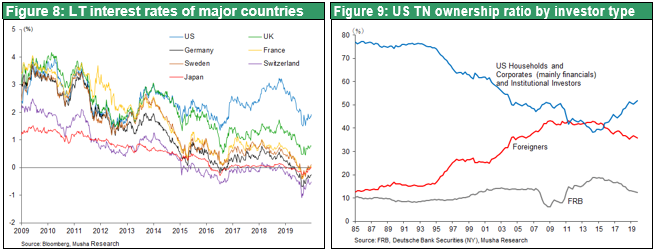

In 2019, most of the world’s surplus savings were used to buy government bonds. The result is an abnormal bond market bubble with negative interest rates for government bonds of all affluent countries except the United States and Britain. As the global economy improves, investors will have to shift their money from these bonds to equities. The result will be an excellent risk-taking environment in the first half of 2020 and a worldwide bull market that propels stock prices far higher than anyone currently expects. This unexpectedly strong bull market will be accompanied by an ongoing shift in the following four paradigms that are likely to be the core components of a new age.

(1) Will (or can) China return to its former strategy of concealing its strengths and biding its time?

The failure of President Xi’s hardline stance

China’s only course of action now is to abandon for the time being the goal of global hegemony and be passive while concealing its strengths. Supporters of democracy won the Hong Kong District Council election in a landslide and the United States is supporting human rights and democracy in Hong Kong. As a result, China no longer has the option of using military force in China. Hong Kong is a crucial source of foreign currency for China. The end of constitutional law and democracy in Hong Kong would quickly make the procurement of foreign currency more difficult for China. President Xi’s experiment of “one country, two systems” along with merely superficial self-rule for Hong Kong has failed. Now the president’s only option appears to be giving in to supporters of democracy in order to end the turmoil in Hong Kong.

The US is clearly showing its willingness for a full-scale confrontation

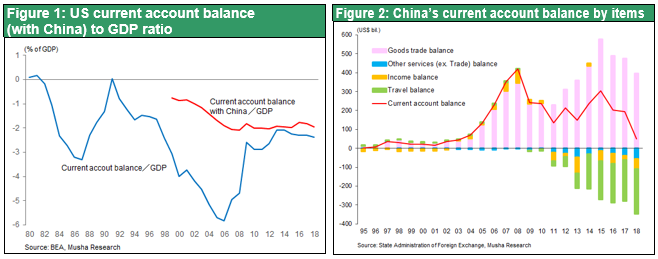

President Xi has no intention of prolonging trade negotiations with the United States. For more than the past 10 years, China has used unfair business practices to maintain an enormous current account surplus (equivalent to an income transfer) with the United States equivalent to about 2% of the US GDP. In fact, China relies largely on the United States for its current account surplus. The US surplus is about $400 billion and there is a deficit of about $350 billion with all other countries, resulting in a net surplus of about $50 billion.

The United States has started to view China as a dangerous rival. In response to human rights violations in the Uighur Autonomous Region, the United States has imposed sanctions on Hikvision, the world’s largest manufacturer of surveillance cameras, and seven other Chinese companies. In the biggest move of all, the United States placed Huawei, a global leader in 5G technology, on its Specially Designated Nationals (SDN) list. This action blocks Huawei’s access the US dollar. Freezing US assets and preventing the use of the dollar are extreme measures that were used even in 1941 against Japan and contributed to the start of the war in the Pacific theater. Implementing these measures demonstrates that the United States is starting a confrontation on all fronts, both economic and national security, with China’s human rights violations as the reason. At this point, China probably can do nothing other than concede to US demands. China’s decision to compromise on some points has produced a temporary truce in the trade war. However, China’s compromises may be a strategic rather than simply tactical move. If so, then the dark clouds over the global economy will be blown away very quickly in 2020.

The trade war ceasefire is entirely due to China’s concessions

The trade negotiation agreement reached in December was entirely the result of China’s decision agree to most US demands. The United States responded with only three concessions of its own. First, for its fourth stage of tariff hikes, covering Chinese exports of $270 billion, the United States agreed to lower the tariff from 15% to 7.5% on the $160 billion of exports for which the higher tariff had already been implemented in September. Second, the planned tariff hike to 15% for the remaining $110 billion was canceled for now. Third, the United States was threatening to raise from 25% to 30% the stage-three tariffs on Chinese exports of $250 billion but now no longer plans to take this action. Nevertheless, the third stage of US tariffs (25%) on imports from China is still in place. Consequently, the United States has only slightly lowered the high hurdle that the country established entirely on its own. China, on the other hand, agreed to measures involving the protection of intellectual property, the end of discrimination against foreign companies and other issues. China also agreed to buy an additional $200 billion of US goods over the next two years. Moreover, this agreement is only the first step. China is aware that the second step may be a trade war linked to new US demands. China’s concessions are humiliating in relation to the country’s original position regarding the negotiations and the country has, not surprisingly, restricted media reports within China about this subject. These restrictions show exactly how bitter this pill was for China to swallow.

A return to biding time by China means the trade war will end in 2020

The big question is whether China’s policy shift is temporary change in tactics for a ceasefire or a fundamental change in its global strategy. We suspect it is a fundamental change. In Strategy Bulletin Vol. 227, June 17), we stated as follows that China is about to shift to a strategy of temporary retreat. Looking back now, this analysis was on target. “When he visited the city of Ruijin, the starting point of the Long March, on May 20, President Xi Jinping told the people of China that they must embark on a new Long March. Chinese media reports interpreted this statement as the president’s resolve to resist US pressure. In fact, the statement had the opposite meaning. The Long March was a temporary retreat in response to extreme adversity followed by a switch to a war of attrition and the resumption of attacks. The president probably recalled the Long March in order to prepare for the justification of a temporary retreat. This pullback most likely applies as well to the US-China trade negotiations, which are nearing a decisive stage.”

The United States is very clearly showing its determination to prevent China from achieving global hegemony. China is not in a strong position to resist the United States. Consequently, we believe China will again accede to US demands and return to a policy of hiding its strengths while biding time in order to coexist in harmony with the United States. If this happens, the turmoil of the trade war will probably slowly dissipate during 2020.

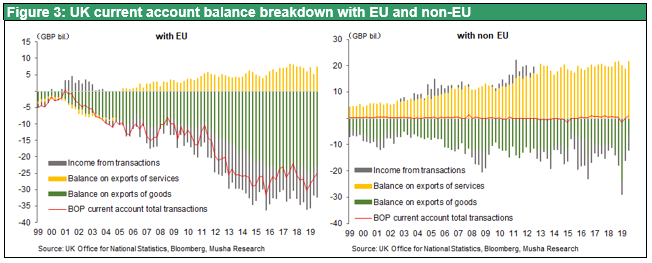

(2) Premonitions of a global order restructuring with a US-Britain focus

Unusual and similar leaders in the United States and Britain

Much as during the Reagan-Thatcher days of the early 1980s, there are now unusual and similar US and British leaders belonging to conservative political parties. In December, the Conservative Party led by Boris Johnson achieved its biggest victory since 1979 under the leadership of Margaret Thatcher. There is no longer any doubt about Brexit. President Trump is very pleased with this outcome. The personalities and policies of these two leaders are surprisingly similar. Although both are described as populists, they firmly believe in economic rationality. This sets them apart from their many left-wing supporters. There are numerous Trump-Johnson similarities: (1) The refusal on an unprecedented scale to follow common sense and accepted customs; (2) A pro-business stance with a positive attitude regarding the pursuit of earnings; (3) Liberalism and deregulation; (4) An aversion to superficial democracy and idealism; (5) A commitment to national interests and changing the global order; (6) Support of reflationary policies and rejection of the need for a balanced budget; and (7) Sympathy with vulnerable members of society, controls on immigration to foster a closer relationship with the victims of globalization, restructuring the framework for global trade with the appearance of favoring protectionism, and other similarities.

President Trump’s 2016 election victory triggered widespread criticism based on the belief that the decisions of capricious voters resulted in the selection of a man who did not measure up to historical standards for US presidents. However, voters in Britain have chosen a similar leader. As a result, it is no longer possible adopt a critical view by attributing these two outcomes merely to fickle voters or coincidence.

Prime Minister Johnson will use his stronger position to complete Brexit (either hard or soft). Other priorities are deregulation, immigration controls, using government spending to increase inflation, and establishing free trade agreements with the United States, Commonwealth countries, Japan and other countries. Furthermore, Prime Minister Johnson will probably work with President Trump to rebuild the currently hollowed-out global order.

Is this another Regan-Thatcher style conservative revolution? The answer depends on the sustainability of a stock market rally.

During the 1980s and 1990s, the Reagan-Thatcher collaboration sparked the worldwide expansion of neo-liberalism and deregulation. Now a Trump-Johnson collaboration may create a new system of values and fix the current global order based on superficial democracy that has reached a dead end. The US-China confrontation over global hegemony will probably result in uniting free and democratic nations of the world under US and British leadership. Instead of looking at Trump-Johnson differences, stock investors are likely to focus their attention on how their deregulatory and pro-business policies are precisely in step with the ongoing digital and network industry revolution. The resulting increase in stock prices will probably ensure that the global economy stages a recovery in 2020. If this does indeed happen, this economic strength would justify and firmly establish the conservative liberalism of President Trump and Prime Minister Johnson.

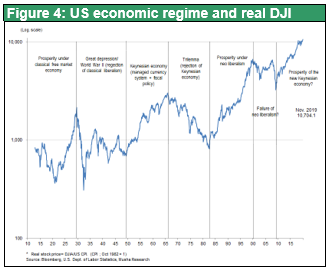

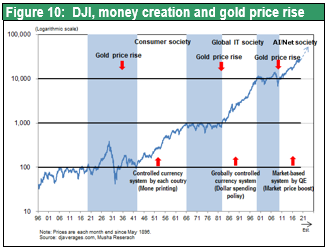

The emergence in the early 1980s of Reagan-Thatcher collaboration, which has been consistently disliked by left wing liberals, created a period of neoliberalism and ended the Cold War. However, economic prosperity during this period was the result of the prolonged upturn in stock prices that started in 1980. For example, the DJIA rose from $1,000 to $10,000 between 1980 and 1999, an average annual increase of about 12%. If conservative liberalism stemming from President Trump's collaboration with Prime Minister Johnson is greeted by rising stock prices, it may well be the beginning of a new era of prosperity for the global economy.

The Trump and Johnson victories and emergence of their policies was largely unexpected by journalists, political observers and many others. One major reason is that superficial, hollowed-out democracy is hurting systems that protect the freedom of individuals and small and midsize businesses. Superficial democracy that was the pillar of the post-war era global order has become dysfunctional. There are many examples of this dysfunction: fiscal austerity, open-border policies for immigration, the inefficiencies of multinational organizations (UN, WTO, UNESCO, EU and others), environment protection measures, the me-too movement, and other events. Political correctness in the United States, opposition to Japan in Korea and the excessive level of ESG investments may also be illustrations of a dysfunctional global order.

(3) Are high US stock prices the new normal in the age of stock capitalism?

The hidden protagonist is stock capitalism in the US

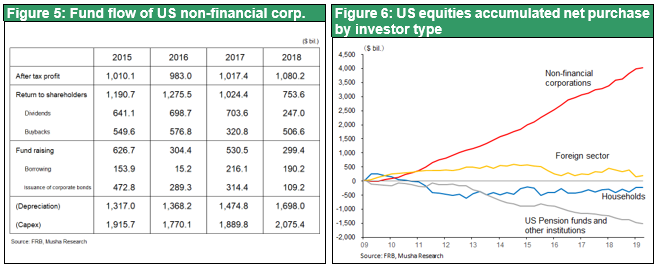

Stock capitalism has probably supported the outstanding US economic performance. In Japan and Europe, financial circulation has been paralyzed by the enormous volume of surplus capital that is locked up in government bonds. Only the United States is an exception to this phenomenon. The reason is that capital circulation is still functioning. The US long-term interest rate fell to 1.4% in August but subsequently began to climb. US companies have been returning almost all their earnings to shareholders by repurchasing stock and paying big dividends. The resulting increase in the value of assets held by households as stock prices rose has fueled consumer spending. Between 2015 and 2018, non-financial US companies recorded pretax earnings of $4.09 trillion and distributed $4.24 trillion to shareholders, a payout ratio of more than 100%. These distributions consisted of dividends of $2.29 trillion and stock repurchases of $1.95 trillion. During the decade that followed the global financial crisis, all major categories of US investors were net sellers of US stocks: households, pension funds, insurance companies and mutual funds. Prices of stocks were pushed up only by buybacks of stocks by companies, which totaled $3.9 trillion during this decade.

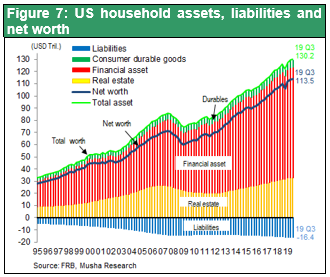

In the United States, huge payments to shareholders pushed up the financial income of households and the stock market rally raised the value of household assets. Consumer spending has been consistently strong as a result. Higher stock prices have produced a dramatic increase in the net assets of households. As you can see in Figure 7, US household net assets fell all the way to $49 trillion in the fourth quarter of 2009 during the global financial crisis. But this figure stood at $113 trillion in the second quarter of 2019, an increase of more than $64 trillion (three times the US GDP) over a period of about 10 years. This growth includes an increase in pension fund assets from $10 trillion to $27 trillion, which improved the soundness of US pension plans.

Even in the United States, government bonds are the destination of choice for almost all of the surplus funds of households, pension funds, insurance companies and mutual funds. Since the Fed started tapering in 2015, investors within the United States (households, banks, institutional investors) have bought Treasuries and remained wary of stocks as the Fed and foreigners sold Treasuries.

The benefit of corporate financial strategies that prioritize stock prices

The importance that the financial strategies of companies place on stock prices is a major cause of high US stock valuations. Many US companies are willing to reduce retained earnings in order to buy back stocks. The objective is to boost stock prices by improving the balance between supply and demand and raising the ROE. However, the resulting highly leveraged balance sheets will make US companies less resilient to rising interest rates and falling earnings during the next recession. But from a macroeconomic standpoint, distributing surplus corporate capital to households is beneficial because these distributions help maintain the sound circulation of capital.

Monetary policy that targets stock prices (quantitative easing)

In the United States, monetary policy as well is now targeting stock prices. In the past, interest rates were raised and lowered in order to control the creation of credit through bank loans. But interest rate measures are no longer effective because of zero and even negative interest rates along with the lack of demand for loans at companies. This is why central banks have started to use quantitative easing instead. According to Ben Bernanke, the purpose of QE is to lower the risk premium, which basically means raising prices of stocks and real estate. Accomplishing this requires enormous expenditures and, as a result, central bank balance sheets have ballooned.

If the purpose of finance is to increase purchasing power by creating credit, then it is clear that bank loans are no longer a way to accomplish this goal. Today, the only conceivable method to create purchasing power is to raise asset prices, chiefly stocks. Demand creation fueled by rising stock prices was a major reason for the ability of the US economy to grow much faster than the economies of other industrialized countries in the wake of the global financial crisis. Maybe we should even regard this socio-economic focus on higher stock prices in the United States as the beginning of a new financial regime, an era of stock capitalism in which stocks are the primary component of monetary policy.

Political decisions determine if asset prices or fiscal measures are used to create demand

The capacity to supply goods increased steadily during the era of the industrial revolution. During supply-side growth, the ability to create demand to keep pace with supply is imperative. One way is to produce more purchasing power by pushing up stock prices. More government spending is another way to increase demand. Governments make these decisions. For example, if the radical Elizabeth Warren becomes the next US president, there would probably be a big shift in policies that is centered on stocks. This could have a big negative impact on stock prices for a short time. We believe the possibility of this policy shift occurring is currently the greatest risk factor for stock investments.

(4) 5G investments have started and there is no going back

An irreversible investment competition has begun

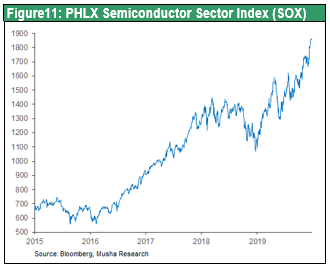

Investments are starting in the field of 5G mobile communications and other new technologies. Companies are beginning to boost investments in leading-edge semiconductor technologies and other fields in order to stay ahead of competitors. China plans to make substantial investments to be the world leader in 5G. High-tech sector investments are increasing rapidly in China and other countries have started competing with each other to make investments needed to keep up with China. One illustration is semiconductor manufacturing equipment orders by TSMC. These orders totaled $7.7 billion in the third quarter of 2019, far above $1 billion to $2 billion in the past quarter. Data center investments, which had been sluggish until 2019, are rising as well because of the emergence of 5G. In China, many semiconductor companies have suspended new investments since 2018 because of the trade war. Now, there may be an unexpected improvement in supply-demand dynamics in the semiconductor industry because these investments were pushed back. In fact, US semiconductor company stock prices, which are highly sensitive to changes in the manufacturing activity, are currently posting new all-time highs.

Global cyberspace, sometimes called the seventh continent, is becoming bigger and bigger. Furthermore, the borderless 5G revolution has started. Carefully and prudently designed systems will be crucial to achieving more progress. Many issues must be resolved. For example, how much can we control digital technologies and associated activities? Another issue is how to deal with censorship by countries. Nevertheless, there is no doubt that investment competition has started for 5G, the IoT and other high-tech sectors.