Feb 21, 2020

Strategy Bulletin Vol.245

Success and prosperity of US stock market capitalism contributes to national interest

- COVID-19 and the US stock market rally series (2)

Strengthening stock market capitalism is essential for the United States to acquire the financial power to win the high-tech investment war. In fact, this is a geopolitical requirement. US stock market capitalism is doing very well and is sustainable.

To win the war with China for hegemony, the United States will above all have to ensure that stock market capitalism is successful. This is because the key to the outcome of this struggle will be whether or not leading-edge technology development activities can be held back. Consequently, financial power will ultimately determine the winner. Will the United States or China be the leader in emerging fields of technology such as AI, quantum computing, blockchain, conductive polymers, self-driving cars and regenerative medicine.

China is using state capitalism (which is in fact a command economy) to channel investments to targeted sectors. This article reveals the shocking fact that China will soon overtake the United States in many categories of advanced technologies. In the 5G mobile communications sector, China’s Huawei has an overwhelming lead in terms of technologies and cost. Even US ally Britain was unable to comply with the US policy of shutting out Huawei. Clearly, the United States can no longer allow this situation to continue.

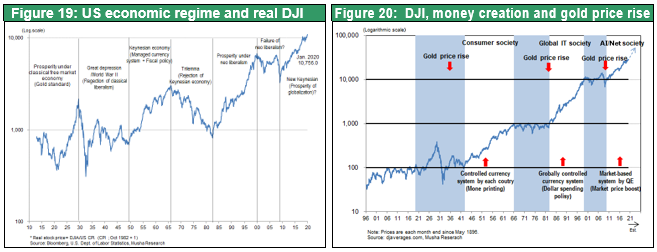

(1) MAGA-led stock market, virtuous cycle in the US economy triggered by high stock prices

Record-high US stock prices even as the COVID-19 outbreak spreads

The new year started with a procession of news with negative repercussions, notably the killing of Iranian general Qasem Soleimani and the outbreak of COVID-19. Nevertheless, US stock indices continue to climb to new all-time high territories until last week. This situation brings to mind the saying that difficulties are what reveal true strengths. In fact, we are seeing the real strength of the US stock market during this period of disruptive news. The DJIA has surged from a low of $6,547 in March 2009 all the way to $29,400 in February 2020. This equates to an increase of 4.5 times over 11 years, an annual average of about 15%. Since Donald Trump won the 2016 election, the DJIA is up 64% over a period of three years and three months, an annualized rate of about 16%. The driving force behind this growth is the high-tech revolution led by the MAGA companies: Microsoft, Apple, Google and Amazon. All four now have a market cap of more than one trillion dollars. Calling these companies MAGA is appropriate because this is also an abbreviation for President Trump’s slogan “make America great again.”

Virtuous cycle triggered by high stock prices

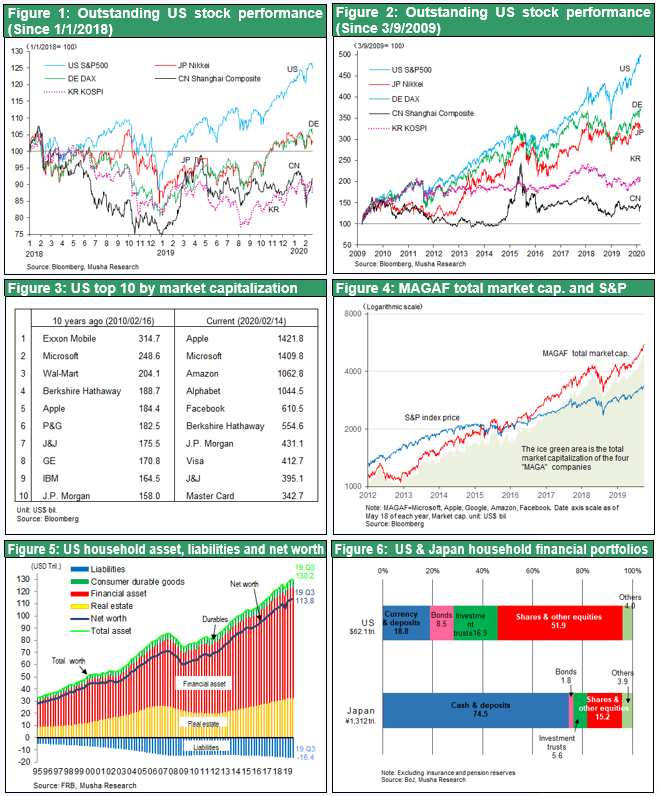

In the United States, huge payments to shareholders pushed up the financial income of households and the stock market rally raised the value of household assets. Consumer spending has been consistently strong as a result. Higher stock prices have produced a dramatic increase in the net assets of households. As you can see in Figure 6, US household net assets fell all the way to $49 trillion in the fourth quarter of 2009 during the global financial crisis. But this figure stood at $113 trillion in the second quarter of 2019, an increase of more than $64 trillion (three times the US GDP) over a period of about 10 years. This growth includes an increase in pension fund assets from $10 trillion to $27 trillion, which improved the soundness of US pension plans.

There are assertions to the effect that the rising stock prices and dividends are only benefiting the wealthy. However, 70% of household savings in the United States are held in equity and investment trusts (70% in Japan are cash and deposits), indicating that shareholder returns benefit most savers (Chart 7). It is no exaggeration to say that the surge in consumption by US households is supported by rising asset prices, driven by stock prices, with the sources of US household cash income consisting of 70% from wages and 30% from asset income.

(2) Stock-based corporate financial strategy and monetary policy

The sole buyer, repurchasing their own shares

US companies have been returning almost all their earnings to shareholders by repurchasing stock and paying big dividends. The resulting increase in the value of assets held by households as stock prices rose has fueled consumer spending. Between 2015 and 2018, non-financial US companies recorded pretax earnings of $4.09 trillion and distributed $4.24 trillion to shareholders, a payout ratio of more than 100%. These distributions consisted of dividends of $2.29 trillion and stock repurchases of $1.95 trillion. During the decade that followed the global financial crisis, all major categories of US investors were net sellers of US stocks: households, pension funds, insurance companies and mutual funds.

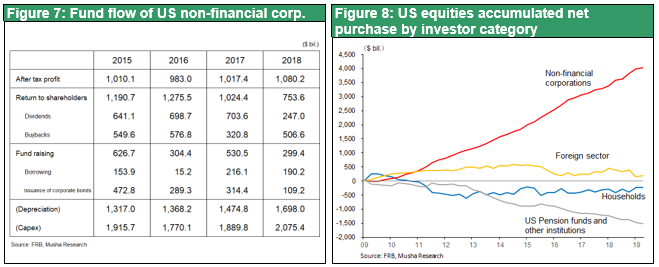

The benefit of corporate financial strategies that prioritize stock prices

The importance that the financial strategies of companies place on stock prices is a major cause of high US stock valuations. Many US companies are willing to reduce retained earnings in order to buy back stocks. The objective is to boost stock prices by improving the balance between supply and demand and raising the ROE. However, the resulting highly leveraged balance sheets will make US companies less resilient to rising interest rates and falling earnings during the next recession. But from a macroeconomic standpoint, distributing surplus corporate capital to households is beneficial because these distributions help maintain the sound circulation of capital.

Monetary policy that targets stock prices (quantitative easing)

In the United States, monetary policy as well is now targeting stock prices. In the past, interest rates were raised and lowered in order to control the creation of credit through bank loans. But interest rate measures are no longer effective because of zero and even negative interest rates along with the lack of demand for loans at companies. This is why central banks have started to use quantitative easing instead. According to Ben Bernanke, the purpose of QE is to lower the risk premium, which basically means raising prices of stocks and real estate. Accomplishing this requires enormous expenditures and, as a result, central bank balance sheets have ballooned.

If the purpose of finance is to increase purchasing power by creating credit, then it is clear that bank loans are no longer a way to accomplish this goal. Today, the only conceivable method to create purchasing power is to raise asset prices, chiefly stocks. Demand creation fueled by rising stock prices was a major reason for the ability of the US economy to grow much faster than the economies of other industrialized countries in the wake of the global financial crisis.

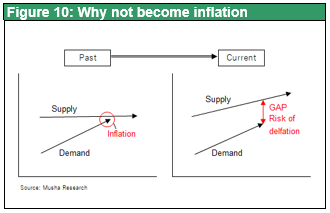

The policy of artificially raising stock and real estate prices is certainly a money-spinner. But it cannot be declared to be a bubble without sustainability. So, to determine why we need credit creation as a money-spinner strategy, we must look at the history of the development of technology and social division of labour. As technology develops and productivity increases, people and products, that is to say labour and capital, all become increasingly redundant. In other words, we can say that supply capacity increases. If this is the case, there will be a relative shortage of demand, and therefore a policy to increase demand, that is to say a credit creation policy, is essential. As you can see in Figure 10, there is no other alternative but to think that inflation is not occurring now, and the risk of deflation is becoming prevalent worldwide, because the increase in supply capacity due to technological innovation exceeds demand (= relative demand shortage).

(3) Examining the US stock bubble theory

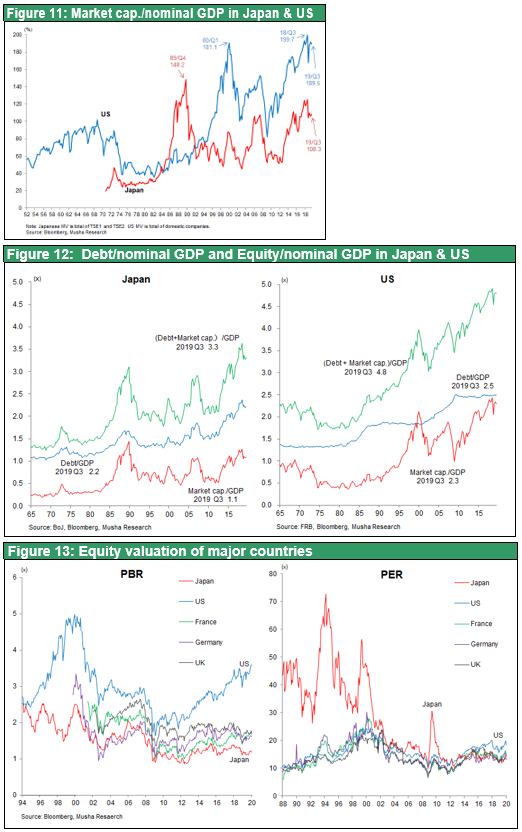

Valuation looking high in relation to GDP

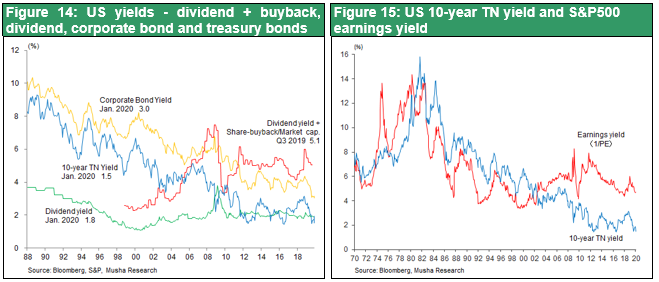

US stock prices are at a historically high level in relation to the GDP (Figures 11, 12). Also, it is equally clear that valuations of US stocks are currently high in relation to the stocks of other countries as well as valuations in the past. US stocks have much higher valuations than stocks of other countries in terms of both their PER and especially their PBR. The PBR of US stocks(3.6) is three times higher than the PBR of Japanese stocks(1.2) and about twice as high as the PBR of European stocks(1.7).

Looking undervalued in relation to bond yields

Despite these fears, it is still possible to say that stocks are clearly undervalued in relation to other categories of financial assets. This is because the return on stocks is far higher than the returns on US treasuries and corporate bonds. The return on treasuries and stocks (S&P 500) moved largely in tandem between 1970 and 2007, just before the global financial crisis started. Since 2009, though, the earnings yield of stocks did not decline along with interest rates, resulting in a large and steadily widening gap between the two returns. Arbitrage-like investments involving bonds and stocks were no longer possible and stocks became chronically undervalued.

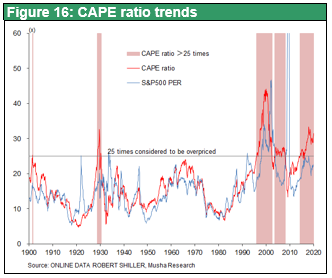

PER rise in reaction to falling interest rates is natural

Perhaps the strongest foundation for the bubble theory is Professor Shiller's CAPE ratio (stock price multiple of 10-year moving average earnings adjusted for inflation), as shown in Figure 16. A level that exceeds 25 times is not sustainable and will always fall, says Hiroshi Yoshikawa (former professor of the University of Tokyo, President of Rissho University) and Hirohide Yamaguchi (former Deputy Governor of the Bank of Japan, now Chairman of Advisory Board of Nikko Research Center). (‘Rising US Financial Risks ...’ Weekly Diamond, September 21, 2019). However, of the 291 months between December 1995 and February 2020, when the CAPE ratio increased 25 times for the first time since the Great Depression, 200 months (69% of the total) were, at over 25 times, in bubble territory. If stocks are financial assets and the measure of the value of the financial assets is a long-term interest rate (10-year government bond yield), it goes without saying that a decline in interest rates raises the PER to a reasonable level. Since 1995, when long-term interest rates have declined significantly, the PER should rise, of course, and so this high PER should be considered the new normal.

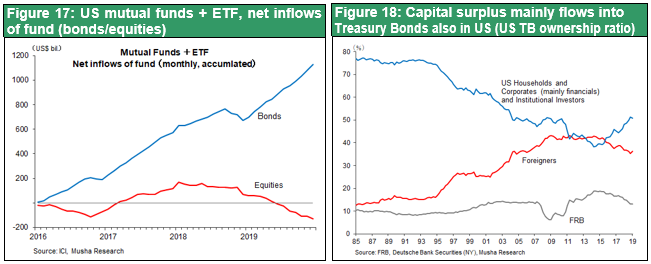

Stock prices are rising even though stocks are unpopular

Is there really a bubble in the stock market? The primary way to determine the sustainability of this rally is by gauging the level of optimism and enthusiasm among investors. But even in the United States, where optimism about stock prices is highest, people are still cautious about buying stocks. During the decade that followed the global financial crisis, all major categories of US investors were net sellers of US stocks: households, pension funds, insurance companies and mutual funds. The only buyer was companies buying back their own stock. These repurchases totaled about $3.9 trillion during the past decade. In 2019, U.S. money market funds recorded record-high inflows of $547.5 billion. At the end of 2019, these money market funds held $3.6trillion, about the same as the all-time high in 2009 ($3.8trillion) during the financial crisis . This clearly demonstrates the very high level of negative sentiment about stocks, as well as the magnitude of money that is parked on the sidelines.

Of course, even if stock price highs can be expected for the time being, this will eventually cease and, in some cases, the possibility of a sharp fall cannot be ruled out. Leaving aside political and geopolitical shocks, the possible sudden triggers are: (1) economic slowdown and a decline in corporate profits; and (2) monetary tightening due to inflation, but neither has small. At present, cyclical economic deterioration is looking unlikely to occur.

(4) A new era of stock capitalism may be emerging

If this is not a bubble, then these high prices may be a sign of the beginning of the age of stock capitalism. In other words, maybe we should even regard this socio-economic focus on higher stock prices in the United States as the beginning of a new financial regime.

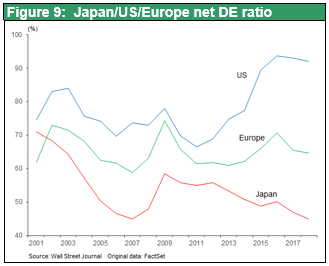

The financial regime is an insect shell

The financial regime can be compared to the shell of an insect. The old financial regime, being an old shell, cannot cope with the expansion of the economic situation driven by improvements in technology and productivity, and so a new regime appears. Restrictive constraints on the issuance of currencies tied to the gold standard caused the Great Depression that started in 1929, forcing a transition to a managed currency system. There was a recovery from the US recession from 1980s onwards as in response to increased issuance of the world’s currency, the US dollar, (Reaganomics) made possible by the suspension of the exchange of dollars, which resulted in the new Bretton Woods regime (the globally managed monetary era).

Changes in the paper-money issuance mechanism

The reason why we can say that QE is a new financial regime, because it is a completely new mechanism for reprinting banknotes. Looking back at the history of the United States, as shown in Figures 19 and 20, it is clear that the ups and downs of the US economy and the 100-year trend of the Dow Jones Industrial Average have been changed by the financial regime (= the paper-money reprint mechanism). Figure 19 shows the real NY Dow (the NY Dow divided by the price index) and also shows the stock value as purchasing power. There have been three major uplift waves in the last 100 years, and we are now in the middle of the fourth. These three waves were:

(1) 1910-1920s (rise under the classic liberal regime under the gold standard)

(2)1950s-1960s (rise under the Keynesian economic system under each country's managed currency system ➞ domestic bank reprint system)

(3) The 1980s and 1990s (the world managed currency system ➞ the dollar scatter system rise under the global neo-liberal monetary system).

And now:

(4) A new rise began in 2010. It can be thought of as a market-oriented system that uses a QE (quantitative monetary easing) mechanism for issuing new banknotes and a means of issuing currency that is compatible with the market tolerance of stocks and other products. It looks as if this might turn out to be a new global Keynes system with the demand created by the government sector as a driving force. The emergence of theories that justify fiscal stimulus, such as FTPL (Fiscal Theory of Price Levels = Sims Theory) and MMT (Modern Monetary Theory), would appear to indicate that the creation of demand by two engines, monetary easing and fiscal policy, is indispensable and appropriate. One could say that this is an era in which the adoption of a macro policy calling for the mobilization of fiscal and monetary policies such as those of Japan’s early-stage Abenomics and of Mr. Trump is required and justified.