Jul 13, 2020

Strategy Bulletin Vol.256

A Great High-tech Boom Will Revitalize Japan

~ The key to the US-China confrontation is semiconductors, the new ‘crude oil’

(1) China becomes even more resolute

The Hong Kong National Security Act succeeded at dividing global opinions

The demise of the one-country, two-systems era for Hong Kong has firmly established the confrontation between the United States and China. Moreover, China is becoming more aggressive in many nearby areas, including the border with India, the South China Sea, the East China Sea and the Senkaku Islands.

Enactment of the new national security act for Hong Kong sparked a joint declaration of opposition by 27 countries, including Britain, Australia, Canada, Japan, New Zealand and Switzerland. However, 53 countries led by Cuba announced their support of China’s action at the UN Human Rights Council in Geneva on the same day. These numbers demonstrate China’s success at dividing the opinions of nations worldwide.

Is Taiwan the next step of this salami-slice strategy?

Taiwan is China’s next target. From the outset, one country, two systems was created as a strategy that encompassed Taiwan. The United States has acknowledged that China has sovereignty over Taiwan (according to the Nixon Secret Meeting Minutes in China – Enlargement Final Version, The University of Nagoya Press). This US position indicates that Taiwan could become like Hong Kong at any time and that China could justify this action. China has slowly strengthened its hold on the South China Sea and Hong Kong and now controls both of these areas. Clearly, the country’s salami-slice strategy has been big success. Now, China appears to be attempting to broaden its battlefronts even more.

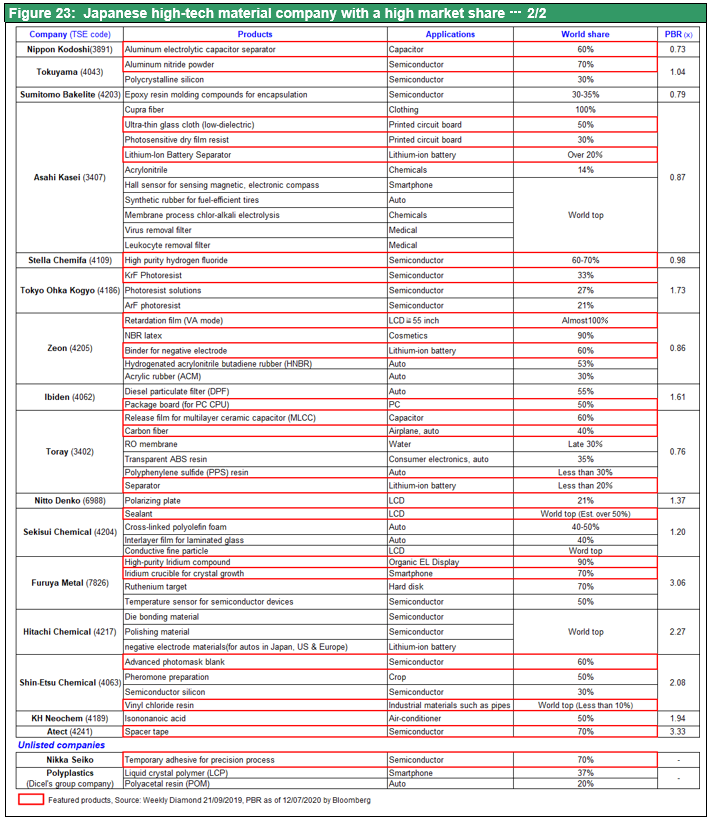

China is taking advantage of the COVID-19 pandemic

China was at the forefront of global measures to contain the COVID-19 outbreak and its economy has returned to normal after staging a V-shaped recovery. There is no doubt that the Chinese economy is becoming stronger. This crisis has given China significant geopolitical advantages. The first is rapid economic growth and the retention of the ability to supply an immense volume of goods because China was the first country to end its COVID-19 outbreak. The second is the ability to establish strong ties with countries struggling with COVID-19 by providing these countries with assistance. The third is a big delay in the impending downturn in China’s current account balance. Worries that emerged in 2018 about China’s foreign exchange reserves have disappeared. Fourth, the COVID-19 crisis has given China the opportunity to quickly take actions for achieving effective control in neighboring regions by instigating disputes. Many people expected the trade war that began in 2018 to erode China’s economic strength. In fact, China’s economic stature has instead become even greater.

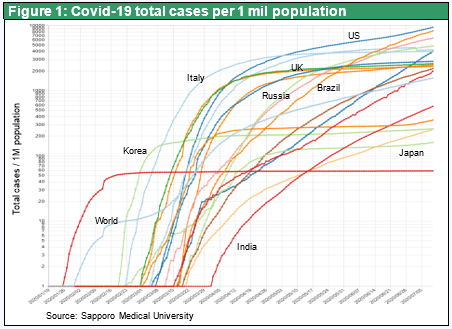

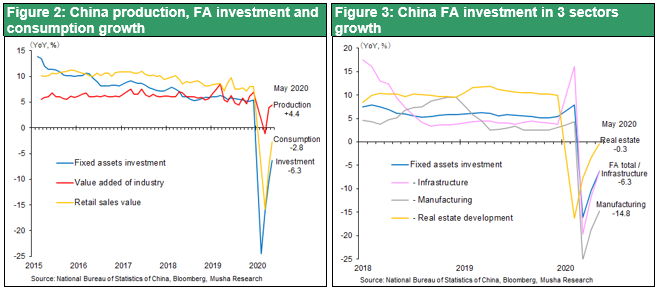

(2) China will fuel the next global economic recovery

China will probably play a central role in the next global economic recovery because it was the first country to end the COVID-19 outbreak. There are already signs of resumption of economic activity. For example, Japan’s exports to China of materials for making cardboard are up sharply, Germany’s exports to China are rebounding, and the iron ore and marine transport markets are healthy. Furthermore, real estate and infrastructure investments are generally higher than one year earlier. As a result, a V-shaped economic recovery in China is on the horizon. China’s industrial output increased 3.9% from one year earlier in April and was up 4.4% in May. In addition, fixed asset investments between January and April totaled 13.68 trillion yuan, down 10.3% from one year earlier, but these investments were down only 6.3% in the first five months of 2020. A one-month reduction of this size in the year-to-year decline means that fixed asset investments in May surged 39.4% from one year earlier to 6.24 trillion yuan. Real estate and infrastructure account for most of these expenditures.

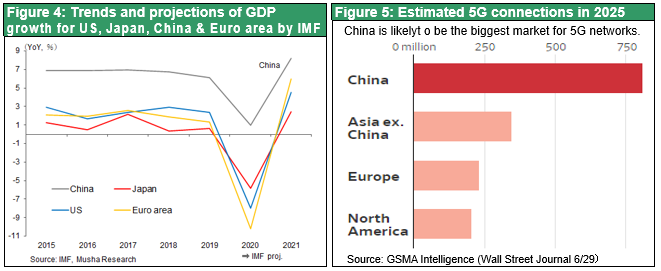

The IMF predicts economic growth of 1.0% in 2020 and 8.1% in 2021 in China, by far the highest in the world. Aggressive government spending will be the primary source of growth. According to information in Prime Minister Li Keqiang’s speech at the National People’s Congress, issuing 1 trillion yuan of national government bonds for COVID-19 crisis expenditures will raise China’s annual budget deficit from 2.8% of GDP in 2019 to more than 3.6% in 2020. Furthermore, local governments in China have raised sales of revenue bonds (issued for specific business purposes) by 1.6 trillion yuan to 3.7 trillion yuan in 2020.

Faster spending on new infrastructure; aiming for 5G leadership

In 2020, China is expected to boost infrastructure investments by 10% to 15 trillion yuan (¥230 trillion). The government says the majority of this spending growth will target new infrastructure, particularly 5G telecommunications. China had 198,000 5G base stations in March 2020 and plans to raise this to 600,000 by the end of the year. By 2025, GSMA Intelligence forecasts 5G connections of 807 million in China, 347 million in Asia (except China), 231 million in Europe and 205 million in the United States (Wall Street Journal, June 29).

Although China’s economy is vulnerable to significant risk factors, such as a Yangtze River flood caused by a Three Gorges Dam failure of major release, China will almost certainly be the main driver of global economic growth in 2020 and 2021.

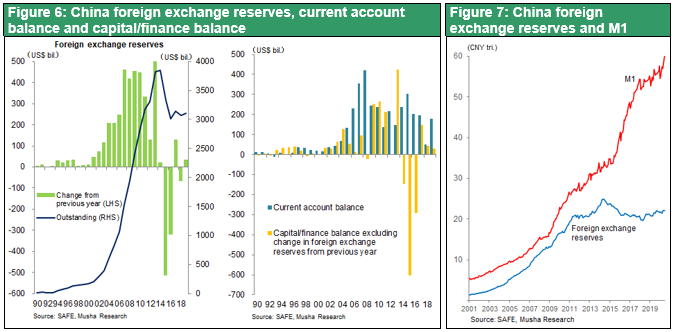

Improvements in the current account balance and foreign exchange reserves

The current account balance, often viewed as China’s Achilles’ heel, has improved significantly. In April and May, there was a big increase in the trade surplus as exports increased to about the same level as in 2019 while imports declined. At the time, the number of Chinese people traveling overseas plummeted. The result was an increase in the current account surplus. The balance of direct investments is improving too. Foreign exchange reserves have been climbing slowly and stood at $3,112.3 billion at the end of June, giving China a stronger position regarding the dollar.

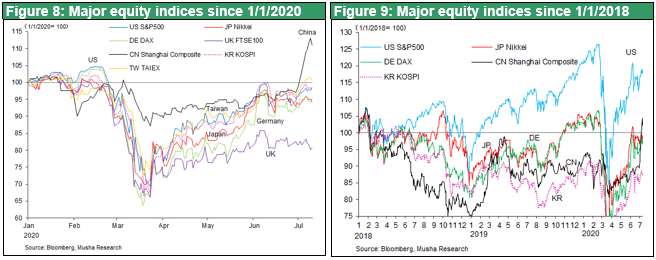

Government policies are driving stock prices higher; A semiconductor stock bubble?

China’s investment boom backed by monetary easing and the guidance of financial authorities has started pushing up stock prices artificially. At the heart of the stock market rally is the semiconductor sector. President Xi Jinping is in effect betting the country’s future on this sector by directing enormous investments to semiconductor companies. Semiconductor Manufacturing International Corp. (SMIC), a national government-affiliated contract manufacturer of semiconductors, plans to conduct an initial public offering to list its shares on the Shanghai STAR Market (Chinese equivalent of the Nasdaq stock market). SMIC originally planned to raise about 20 billion yuan ($2.8 billion). With stock prices now much higher, the SMIC IPO is expected to raise 46 billion yuan ($6.55 billion). In Hong Kong, where SMIC shares are already traded, the stock price is up 3.1 times since the beginning of 2020. SMIC’s current EV/EBITDA ratio is 22, far above Samsung’s 4.5 and TSMC’s 11 (Financial Times, July 7).

(3) The US shift to a defensive posture and long-term strategy

Hong Kong will probably remain stable for now

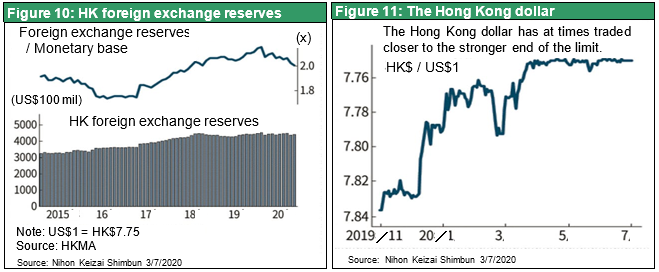

Both US houses of Congress have unanimously passed the Hong Kong Autonomy Act, which authorizes sanctions against individuals and entities that are detrimental to Hong Kong’s autonomy. President Trump has not yet signed this bill. US sanctions may not have an immediate impact because Hong Kong is currently financially stable. There are reports of an increase in overseas deposits in Singapore and other signs of an outflow of deposits from Hong Kong. Nevertheless, Hong Kong is quite able to withstand these outflows because its foreign exchange reserves of $440 billion are twice the monetary base. In a pinch, the People’s Bank of China would probably transfer dollars to Hong Kong. But there are signs that China wants to increase financial support for Hong Kong, such as by listing Alibaba in Hong Kong. Going one more step, China may announce a plan for Hong Kong’s growth as part of the Greater Bay Area Plan that results in the unification of Hong Kong with Shenzhen, a huge manufacturing center on the mainland.

Too soon to use the ultimate weapon: Financial sanctions

Imposing financial sanctions on China may not be the right move at this time, but the United States must act now to build a base for defending its high-tech hegemony from the Chinese threat. As the decisive step concerning Huawei sanctions, which are discussed later in this bulletin, the US government considered adding this company to its Specially Designated Nationals list (effectively a list of enemies). This would allow freezing the company’s US assets, thereby prohibiting the use of the dollar. However, the US government apparently decided that it is too soon to take this final step (Reuters, December 4, 2019).

The US has shifted to a long-term strategy – Semiconductors and other high-tech sectors will determine the outcome

China has been stepping up its short-term offensive posture. However, the country has two weaknesses: semiconductors and finances. China has been taking full advantage of the extra time the country received because of the COVID-19 crisis in order to take actions for eliminating these weak points. From a macroeconomic standpoint, China is using investments to maintain internal economic growth. In terms of finances, there has been a big improvement in the current account balance along with an artificial upturn in asset prices. These measures will probably delay the emergence of any difficulties for at least three years. Consequently, China is building momentum in the high-tech sector.

(4) Keys to the US-China high-tech confrontation – I. Huawei

Does the US have the power to contain Huawei now that has become a behemoth?

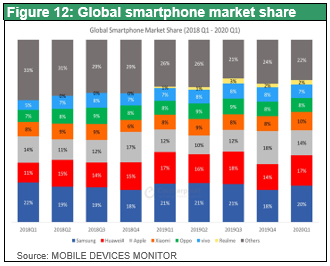

At first glance, China appears to have the advantage in the fight for high-tech supremacy. Huawei is the world’s most advanced manufacturer of 5G equipment. The company’s base stations have an enormous lead over those of competitors in terms of technologies and performance. In 2019, according to the British market survey firm Omdia, base station global market share rankings were as follows: Huawei 34.4%, Ericsson 24.1%, Nokia 19.2%, ZTE 10.2%, Samsung 8.9%, NEC 0.7% and Fujitsu 0.6%. Furthermore, based on a January 2020 survey by IPlytics, a German patent data service, Huawei owned 15.2% of the 3,147 patents required by the 5G standard, far ahead of the second-ranking company. In addition, Huawei’s share of the worldwide smartphone market was 17% in the first quarter of 2020, not far behind the 20% share of Samsung and well ahead of the 14% share of number three Apple.

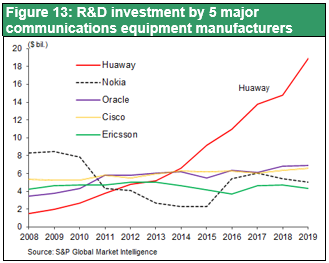

Huawei’s remarkable growth is the result of social dumping that uses state capitalism

Normal market competition alone is no longer anywhere near enough to offset Huawei’s strengths. How did this happen? The answer is the Huawei’s enormous investments for developing technologies and products. As Figure 13 shows, the company’s R&D expenditures have increased by 10 times over a period of 10 years, climbing from $1.9 billion in 2009 to ¥18.9 in 2019. Remarkably, the R&D spending of Huawei’s competitors was mostly flat during this same period.

The only explanation for these massive expenditures is the backing of the Chinese government. Huawei used this support to offer prices far below those of competitors, which had higher expenses in line with market prices. The result was the destruction of the profit structure of the entire telecommunications equipment industry and the complete inability of other companies to compete with Huawei. These events are a typical example of social dumping backed by state capitalism.

The US government studied the feasibility of providing assistance for establishing a domestic telecommunications equipment manufacturing sector. Cisco and other US companies were asked to consider acquiring Ericsson or Nokia or at least taking some shares of these companies. However, the US companies declined apparently because the low profitability of Ericsson and Nokia disqualified them as potential takeover targets.

Offensive actions are now the only course of action

The US government has designated Huawei as a threat to national security and imposed increasingly severe sanctions since the 2019 enactment of the National Defense Authorization Act. First is prohibiting US government agencies from purchasing Huawei products. Second is ban on sales of US products to Huawei. Third is a ban on sales to Huawei of other countries’ companies’ products containing at least 25% US-made components. This step stopped TSMC from supplying chips to Huawei. In the past, Huawei imported chips from US semiconductor companies and chips made by TSMC that were designed by Huawei’s chip design subsidiary HiSilicon. At one point, contract production for Huawei was 16% of TSMC’s sales. But this business was completely shut down in May. Furthermore, Huawei has been prohibited from using Google’s apps since 2019, a step that makes it difficult to sell smartphones outside China. There are also reports that Britain and France have agreed to US demands to reduce in stages the market shares of Huawei’s products. If Britain and France move ahead with these measures, Germany too would probably feel obligated to cut Huawei’s market share.

(5) Keys to the US-China high-tech confrontation – II. A boom in China sparked by an enormous project to establish a semiconductor industry

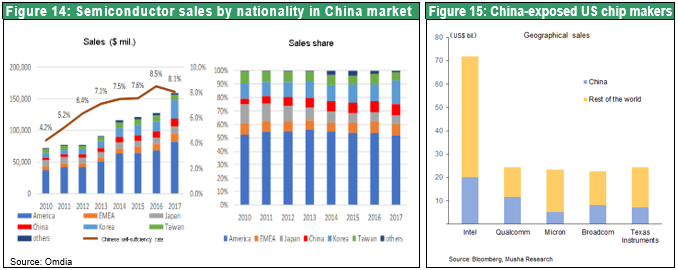

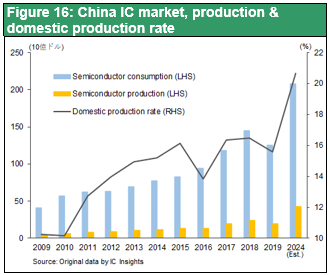

Semiconductors are the bottleneck for China’s high-tech sector. China supplies the majority of the world’s televisions, PCs, smartphones and many other electronic products. However, internally produced semiconductors meet only 15% of China’s demand for these chips. In addition, foreign-owned companies account for most of the chips fabricated in China. According to IC Insights, a US semiconductor market research company, Chinese semiconductor companies have a market share of only 4.2% within China and China buys about half of its semiconductors from US companies. The United States is stepping up its attacks by targeting China’s high reliance on imported chips. In addition to banning sales of chips and equipment to Huawei, the United States is prohibiting sales of all equipment involving China’s semiconductor investments. In 2018, the United States prohibited sales of US equipment and technologies to Chinese DRAM maker Fujian Jinhua Integrated Circuit (JHICC) due to industrial spying allegations. JHICC was forced to stop construction of a production line as a result. Huawei has been relying on TSMC for more than half of its semiconductor requirements. TSMC is at the forefront of progress in the industry, including 7 nanometer extreme ultraviolet (EUV lithography. But now that TSMC has stopped selling chips to Huawei because of US demands, China’s semiconductor crisis has become an even bigger problem.

China has started an enormous national project with the goal of raising semiconductor production from 15% of its internal demand to 70%. The country is channeling people and capital to various activities with funds coming from the government and financial markets. These expenditures are creating a boom in business activities and markets involving semiconductors.

The driving force behind China’s semiconductor project are national semiconductor funds backed by capital from the national and local governments and from the private sector. Established in 2014, the first fund had $19.6 billion (138.7 billion yuan) and ended in 2019. This fund most likely played a major role in the start of initial volume production of NAND flash memory chips at Yangtze Memory Technologies (YMTC) and DRAM chips at Changxin Memory Technologies (CXMT, formerly Innotron).

A second fund of $28.9 billion (204.1 billion yuan) was established in 2019. Investments include Semiconductor Manufacturing International Corp. (SMIC, which China hopes will become a contract manufacturer that can replace TSMC, semiconductor manufacturing equipment companies, and other companies. All of these investments are aimed at building a semiconductor supply chain that can meet China’s demand for these chips.

China will probably be unable to catch up because of US sanctions

China’s current project will probably be unable to accomplish its goal. One reason is the inability of China to utilize the latest technological advances because of US sanctions targeting Huawei. ARM, a subsidiary of Softbank, is the world’s only supplier of architecture for smartphone CPUs with high performance and low power consumption. Now, ARM has cut off all services for China in response to the US embargo. ASLM of the Netherlands is the world’s only supplier of EUV lithography equipment, which is essential to fabricate 7 nanometer chips. But ASLM as well has stopped selling equipment to SMIC and other Chinese companies. Consequently, China is unable to acquire semiconductor devices using state-of-the-art 10 and 7 nanometer technology.

Another reason is the possibility of even more embargos on exports to China because of the resolute stance of the United States. Furthermore, the 25% limit on US-made components (parts, materials, devices, software) means that even companies in other countries are unable to sell many of their products to Huawei. And the US can probably reduce the US content of their products to the 10% or 5% range. The 5G products made by Huawei are a large market from the standpoint of Japanese companies. According to Huawei chairman Liang Hua, the company will buy $10 billion of parts from Japanese companies during 2020 (Wall Street Journal, June 30). Examples include the multilayer ceramic capacitors of Murata Manufacturing and the measuring instruments of Anritsu. Japan can sell these products to Huawei because of the low US content ratio. However, now that Huawei has been designated a US security threat, even products that can be sold to China today may be banned in the future.

As Figure 15 shows, China accounts for approximately half of the sales of US manufacturers of semiconductor devices. Consequently, the United States is very unlikely to block all of these sales immediately. These manufacturers will probably continue to export products that do not use advanced technologies and sell their products to Chinese companies that, unlike Huawei, Hikvision and others, are not designated as US national security threats.

With the United States now using any way impede China, the project to achieve high-tech supremacy is almost certain to fail with respect to Huawei as well as the semiconductor industry. IC Insights forecasts that China will increase its semiconductor self-sufficiency rate to only 21% by 2024.

(6) Keys to the US-China high-tech confrontation – III. The start of a US semiconductor strengthening project led by the Department of Defense

The excessive concentration of global semiconductor production in Asia (Korea, Taiwan)

If the US-China confrontation becomes even more heated, access to semiconductors will become the biggest risk for the United States too. The reason is that semiconductors, which are now as vital to the economy as crude oil was in the past, are manufactured primarily in countries with the potential for conflicts.

A new “Sputnik shock” for the US Department of Defense

The United States is obviously very worried from the standpoint of defense about losing its global high-tech supremacy. An article titled “The Geopolitics of Semiconductors” in the June 27 issue of Diamond magazine stated that the United States is experiencing a 21st century “Sputnik shock” that will trigger massive expenditures for national defense. The Soviet Union’s success at placing the first artificial satellite in orbit created a US defense sector crisis that resulted in the rapid advances of the US space program. The article goes on to say that the United States is extremely concerned about China’s capabilities involving AI and 5G and has started to take actions for making enormous investments in technology. The US Department of Defense is spending $10 billion for the creation of an integrated cloud system called the Joint Enterprise Defense Infrastructure. However, there is a sense of crisis about the supply of semiconductors needed to build the foundation of this infrastructure. As the United States and China continue to face off, semiconductors will play a role similar to that of crude oil in the past.

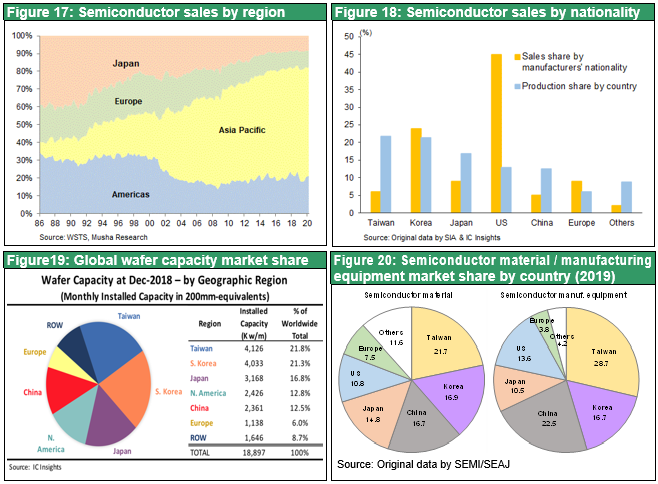

The risk associated with global shares of 45% for sales and 12% for manufacturing

With 45% of global semiconductor sales, the US companies still control the semiconductor industry. The United States is well ahead of South Korea (24%), Europe and Japan (9% each), Taiwan (6%) and China (5%). However, US companies outsource more than 70% of their chip production to companies in Taiwan and South Korea. Production within the United States is only 12% of global semiconductor output (Figure 18). Market share data for semiconductor materials and manufacturing equipment (Figure 20) also clearly demonstrate US reliance on Asia for manufacturing and the high degree of concentration of semiconductor production in East Asia.

This reliance on Asia makes the United States vulnerable to the effects of any sort of future incident with China. The US semiconductor depends on Taiwan most of all. But depending on the outcome of the next election, Taiwan may become part of China just like Hong Kong. An armed conflict between North and South Korea is another possibility. A decision by South Korea to appease China is also possible. There are many potential sources of instability. TSMC has stopped selling chips to Huawei, but some people think Samsung could step in to replace TSMC. The United States is therefore moving quickly with plans to increase internal semiconductor production in order to reduce its vulnerability to these risk factors.

To return the production of high-tech hardware, particularly semiconductors, to the United States, many activities are under way to rebuild the global supply chain under the leadership of the Department of Defense. These activities are centered on the following three plans:

i. Chips for America Act (introduced on June 10)

This act has a budget of almost $23 billion, consisting of $10 billion for state and local incentives for attracting new semiconductor plants, $12 billion for R&D subsidies and a $750 million trust fund for supporting policy consistency in the semiconductor industry. Another major provision is a 40% refundable income tax credit for semiconductor investment expenditures through 2024.

ii. America Foundries Act of 2020 (introduced on June 25)

This act has a budget of $25 billion. The largest component is $15 billion for grants distributed by the Department of Commerce for supporting capital expenditures for semiconductor production equipment in the United States. The remainder is $5 billion for supporting plants and R&D for specialty semiconductor production for national security and intelligence activities and $5 billion for semiconductor R&D expenses of government agencies.

iii. Economic Prosperity Network

This network is the US concept for a global supply network that does not rely on China. Operations of the EPN will be based on values rooted in democracy. The United States is talking about this idea with South Korea, Japan, India, Australia and other countries with friendly US relations.

A world that ignores traditional economic rational

The US-China conflict over high-tech hegemony has started to produce in both countries an investment competition that is not limited by rational economic guidelines. As investments grow, accepted theories involving free trade, market competition and other themes will no longer influence economic activities. Ignoring these theories may trigger an abnormal semiconductor investment boom centered on government policies.

(7) Japan will be the biggest beneficiary of the US-China high-tech fight for hegemony

The geopolitics that destroyed Japan’s high-tech cluster are now favorable

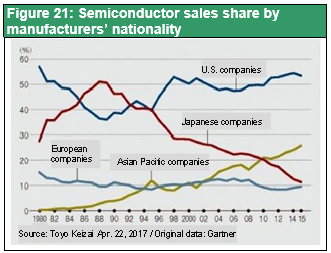

The US-China fight for high-tech supremacy is good news for Japan. In March 2011, I published a book titled “The end of Japan’s lost 20 years – The Japanese economy from a geopolitical perspective.” from Toyo Keizai magazine. The book explains that Japan bashing by the United States and the yen’s appreciation destroyed Japan’s high-tech cluster. Japan’s lost 20 years started as the country could no longer compete in the television, PC, smartphone, semiconductor and other markets. But the US-China confrontation has shifted the geopolitical environment for Japan from a headwind to a tailwind. The advanced technologies that Japan has always retained are now creating a new industrial cluster. The book concludes by proclaiming that Japan is about to stage a big rebound following the prolonged downturn of its industries.

Japan is still the nucleus of the Asia high-tech industrial cluster

Four countries in the Far East still account for more than 70% of the world’s semiconductor output: South Korea, Taiwan, Japan and China. The reason is the sharp decline in semiconductor production in Japan caused by US-Japan trade friction in the 1980s and 1990s. Japanese semiconductor engineers and companies that supplied materials, machines and components for the semiconductor industry suddenly had nowhere to go. These resources ended up contributing to the creation of industrial clusters in South Korea, Taiwan and China. There was also a need for these industries in these countries. In other words, the high-tech cluster that existed solely in Japan 30 years ago has grown to encompass all of East Asia.

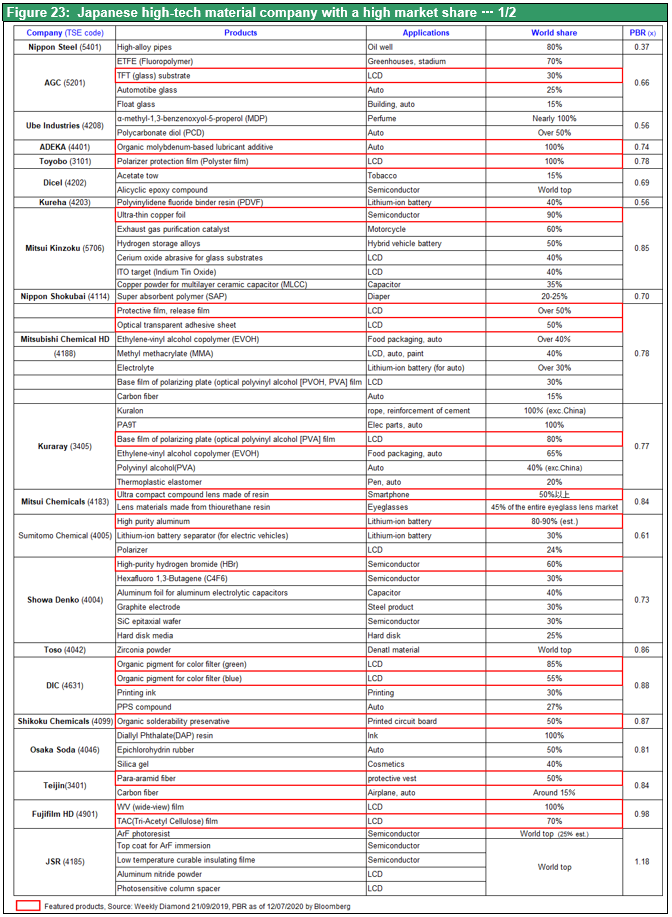

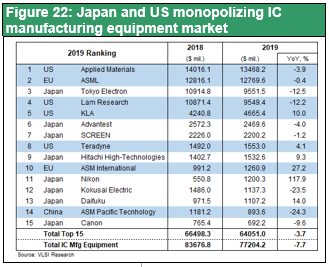

Japan is still a vital supplier of high-tech materials and products required by South Korea, Taiwan and China. As a result, Japan plays the crucial role of the foundation of the East Asia high-tech cluster. As Figure 22 shows, Japan and the United States dominate the global market for semiconductor manufacturing equipment . Eight of the top 15 companies are based in Japan. Figure 23 lists Japanese suppliers of high-tech materials that have large shares of their respective markets. With these strengths, Japan may be the only country in the world with the capabilities and technologies for domestic production extending from upstream to downstream processes of the semiconductor industry.

Risk associated with the US-China struggle for East Asia countries other than Japan (China, Taiwan, South Korea) may increase. If this happens, companies are certain to once again start establishing high-tech clusters to Japan. Currently, about half of Japan’s semiconductor plants are operated by US companies. Two examples are Hiroshima Plant that Micron Technology purchased from Elpida Memory and the NAND flash Yokkaichi Plant that is owned jointly by Toshiba (now Kioxia) and Western Digital. TSMC recently decided to build a semiconductor plant in the US state of Arizona due to US national security considerations. Semiconductor companies are likely to start realizing that raising production in US ally Japan can also produce benefits.

Japan lost its position (mainly with respect to high-tech clusters) in the international division of labor because of geopolitics. The key point to keep in mind today is that geopolitical forces have shifted and are now positioning Japan for a comeback.