Oct 22, 2020

Strategy Bulletin Vol.263

Analysis of the Economy Affected by the Corona Pandemic

(1) Corona pandemic – an epochal development

Four events that suggest a historical turning point

The Global Financial Crisis, described as once-in-a-century crisis (former Fed Chairman Greenspan), turned out to be an overstatement in light of the subsequent smooth recovery. But we are encountering more groundbreaking events in the midst of the Corona pandemic.

Four historical changes are apparent.

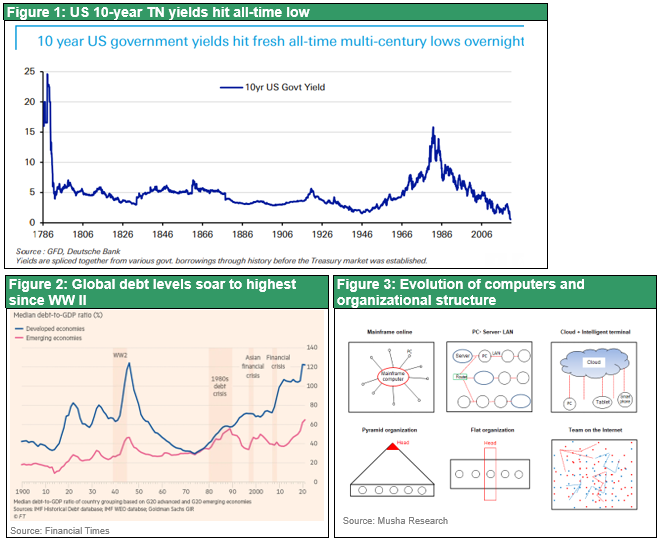

Change I. Historical decline in interest rates

Interest rates had been falling even before Corona pandemic. The pandemic drove them down further. US long-term interest rates hit a record low. (Please see Figure 1.)

Change II. Unprecedented budget deficit

The budget deficits, as a percentage of GDP, of major countries reached their post-war highs.

(Please see Figure 2.)

Change III. Now the basic economic unit is the individual, not an organization

Organizations are no longer the smallest economic unit as most human contacts are via the Internet. (Please see Figure 3).

Change IV. Change in Work Life Balance is inevitable due to drastic shifts in the organization of labor and education

The era of manual group work and group education is coming to an end. Remote work and flex work have become the new normal. Working hours have decreased dramatically, and the boundary between labor and consumption has become blurred. The prosumer that Alvin Toffler defined is now here. The 48-hours a week called for in the ILO Convention No. 1 1919, has not been achieved although a century has passed. Despite a 10-fold increase in labor productivity in 100 years, working hours have hardly changed, and the balance between production and consumption has been significantly upset. The dramatic change in working style caused by the Corona pandemic will correct the century-old work-life balance (working time vs. free time).

From an industrial society to a cyber society

The above developments are occurring simultaneously. It should be considered that a new social stage (following the primitive collection economy ⇒ agricultural economy ⇒ industrial economy) is being ushered in by the AI / net / digital revolution. It seems that society has started to fundamentally break away from the organization centered on the factory-based machinery industry. Value creation is now taking place on the Internet and in cyber space, and not on land as was in the agricultural era or in factories (offices) in the industrial era. Although the whole picture is not well defined, it is clear that this is an era in which economics and economic policies that were dominant in the past few hundred years are not workable now. can be understood that the "breaking away from bad precedents" advocated by Prime Minister Suga is becoming more persuasive. Now we are at the beginning of a new era, which is likely to be full of new dreams and opportunities. Based on the above basic consideration, this paper attempts to analyze the economy and finance affected by the Corona pandemic from a historical standpoint.

(2) Pandemic, the beginning of economic normalization

Overall picture of the Corona pandemic is emerging

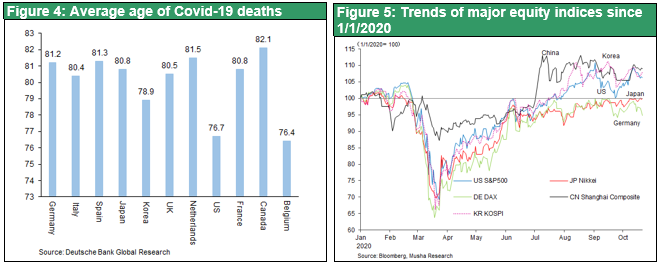

It seems that the Corona pandemic has finally peaked out. The speed of the spread of infections and the scale of infections that covered the entire world are the largest in history. However, the toxicity of the plague itself is weaker than that of the plague and cholera pandemics, which had high fatality rates (40% to 50%). Mortality rates are higher among the elderly and those with other chronic pre-existing conditions. Various causes have been identified for this. One is a cytokine storm (immunity runaway) rather than the virus itself. Based on these findings, symptomatic treatments have improved and have become more effective. As a result, the mortality rate has fallen significantly, and the progress toward normalization of economic activity under/With Corona is becoming a new normal. The Tokyo Olympics are also likely to be held. Now the focus is on how to foresee the post-Corona era. Most importantly, the Corona pandemic has brought about improvements on three fronts - innovation: technology, market (needs), and capital. The post-Corona global economy will be bright and the economic growth rate will rise.

Pessimism, stock bubble campaign was wrong

In the early stages of the spread of infections, all developed countries were locked down, economic activity came almost to a standstill globally. All economic indicators fell to their post-war record lows. The unemployment rate was the highest since the Great Depression. Stock prices plummeted at the fastest pace in history, dropping40% in the four weeks after the outbreak of the Corona pandemic. However, in the next two weeks, it achieved a half-price rebound, and in August, stocks in major countries returned to the pre-Corona level. During this time, the majority of media and experts argued that stock prices that deviated from economic reality indicated a bubble and were unsustainable. The Financial Times, has argued that this sharp recovery in stock prices is euphoric and unsustainable. The Economist warned of optimism in a special feature (in its 9th-15th May issues) entitled "A Dangerous Gap - The Markets v Real Economy”. However, stock prices in major countries are strong, despite adjustments of more than 10% in June and September.

The third global economic boom after the war is not over yet

Underlying the pessimism is the assumption that economic growth after the GFC is nothing more than a tower built on the sand, the result of the series of wrong policies and is not sustainable. Governments and central banks, including the United States, have implemented unprecedented fiscal and monetary easing measures (so-called forbidden measures) to prevent the collapse of their economies and finance. It is argued that this gives the market a sense of security, but that is nothing more than an illusion.

Until just before the Corona pandemic, the world economy was booming, and the Internet and telecommunications revolutions were underway. The US unemployment rate fell to a record low of 3.5%, and stock prices quadrupled in the 10 years after the GFC. Musha Research has argued that the wave of this long-term economic boom has not completely subsided, and that it will rise again after the Corona pandemic is contained. The reason is that the Corona pandemic is accelerate the flow of history.

Looking back at US stock market over 100-year periods, there were cycles of long-term booms which drove up stock prices of 10-fold in 20 years followed by 10-year adjustments. The Dow Jones Industrial Average in the 1950s and 1960s increased tenfold from $ 100 to $ 1,000 but remained flat at $ 1,000 for the decade in the 1970s. In the 20 years from the 1980s to the 1990s, stock prices increased tenfold from $ 1,000 to $ 10,000, but in the decade of the 2000s, there were two crashes, the IT bubble collapse and the GFC, and stock prices stayed around $ 10,000. In the 2010s, the uptrend was restored with the market seemingly ready to rise 10 times in 20 years. Has the post-war third wave peaked.

By the way, there were two factors behind the rise in stock prices 20-year cycles (1) technology / lifestyle and business model, and (2) financial regime. What supported the boom in the 1950s and 1960s was the issuance of fiat money under the Keynesian regime and the emergence of a consumer society through motorization and electrification. Behind the boom in the 1980s and 1990s was the emergence of a global IT society and the conversion of dollars into fiat money (dollar spray). The current boom (2010-2030) is being driven by the transition to a AI / NET / digital society and QE / stock market -centered monetary regime.

Three obstacles to progress that Corona swept away

There were three historical trends before the Corona pandemic. (1) IT / net / digitization that covered all business, life, finance, and politics, (2) the era of big government with expansionary fiscal and monetary policies, and (3) the isolation of China and the reconstruction of international order and division of labor. However, these historical trends have been hampered by firm obstacles, which have affected the world economy for nearly a decade. These include existing customs, institutions, regulations, and forces resisting change.

These impediments stopped the flow of history and caused stagnation, major distortions in politics, institutions, economy, society and the public life. It is evident that ailments such as - deflation (= surplus supply capacity), and zero interest rate (= surplus capital) – that have been apparently affecting the world economy in recent years, were caused by obstacles that held back change. Another problem, the widening disparity, was also the result of the above-mentioned obstacles. The Corona pandemic will remove all of these hurdles and accelerate the historical trend. When the Corona pandemic subsides, the global economy will likely be more vibrant. It is significant that the Corona pandemic led to these changes, which would otherwise have taken years and finally reached after many ups and downs.

(3) Rapid expansion of the Internet - digital market

Technology breakthrough triggered by the Corona pandemic

Perhaps the most surprising thing in the post-Corona world will be how technology has evolved. In the post-Corona world business and life will be carried out with little direct human contact, made possible by working from home, teaching at home, telemedicine, etc. The technical foundation of the network required for this is already in place. However, old mechanisms, customs, rules, regulations, ignorance and other factors. have prevented its practical application, and so far no such markets or needs have surfaced.

Corona Accelerates New Internet - Digital Market

Obstacles to the use of the Internet, (old systems, customs, and forces resisting change) have been blown away by Corona. Spread of the Internet that minimizes direct contact between people has become the order of the day and its importance cannot be overstated. In particular, the spread of telework has dramatically changed the way we work and is causing drastic changes in lifestyles and business models. Net shopping will replace conventional shopping methods, dining out will be reduced, home delivery will increase, and children will not go to the cram schools, but will study at home using PCs and tablets. Everything will be replaced by the Internet. Telemedicine, which did not spread due to resistance from medical associations, is becoming common.

Digitalization of business, government, and society

The trend toward reform of external closure of companies, shortening / flexing of working hours, normalization of side jobs, elimination of the Hanko culture, an obstacle to telework, and conversion of documents from paper to data is accelerating. . Various labor organization reforms will be implemented. Outsourcing will progress further, and both cost reduction and new product development will progress.

Teleworkers do not have to worry about close supervision by their bosses. This may seem to increase the degree of freedom in working styles, but in reality, work becomes more visible, information is shared and closely monitored. In other words, the value of individual labor can be closely monitored. Employees who come to work just to have evidence of having worked or just to attend meetings are being exposed. Japan, which has a strong seniority-based employment system, was far behind in introducing the Internet, but it will catch up quickly. The shift from so-called Japan-specific membership labor to job-type labor will progress significantly.

The Corona pandemic has revealed a significant delay in the digitization of social systems in Japan. The new administration is prioritizing reforms, such as the establishment of the Digital Agency, the adoption of My Number ID cards, improving the efficiency of administration, and the public use smartphone data, among others. The government will introduce a series of initiatives such as the use of IT at all levels of society, including education, health care, finance, entertainment (music, movies, games), at all levels of society. Social changes such as a change in the leading role of the media, a review of urban settlements, smart cities, and acquisition of a second house are also expected.

Net-Digitalization pushes market efficiency to the limit

With the spread of the Internet, all economic resources will find customers on the internet and be evaluated at an appropriate price. The Internet will spread the market principle further, and the invisible hand of the market will be more effective. In other words, the market will become more efficient and productivity will increase. In addition, Internet will reduce the cost of living significantly, creating an income surplus. How will the new surplus be spent? It seems that we will enter an era where live performances, hands-on experience, and personal services will become valuable.

(4) Freedom from the spell of fiscal and financial discipline

Misrepresentation of the myth of financial and financial soundness

Traditionally, governments have made fiscal discipline their vital mission and curbing the budget deficit as the most important policy issue. For example, eurozone member countries are required to have strict fiscal discipline, with a budget deficit of 3% or less of GDP and government debt to GDP ratio of 60% or less. However, this has affected economic activity. If an event like a natural disaster prevents the Corona pandemic from being dealt effectively a Great Depression will follow inevitably. There was a shared awareness of the urgency of doing something to correct the situation, and policymakers came together to ease fiscal restraints.

The US budget deficit for fiscal year 2020 (October 2019-September 2020) tripled from the previous year to $ 3.1 trillion, the highest as a percentage of (16%) GDP (Gross Domestic Product) . Federal debt has also grown to just under $ 27 trillion, 126 percent of GDP, apparently the highest since the second world war. The International Monetary Fund (IMF) estimates that the ratio of government debt to GDP in developed countries will be 126%, which is comparable to 120% during World War II. For the first time, the EU has decided to raise € 750 billion for reconstruction assistance.

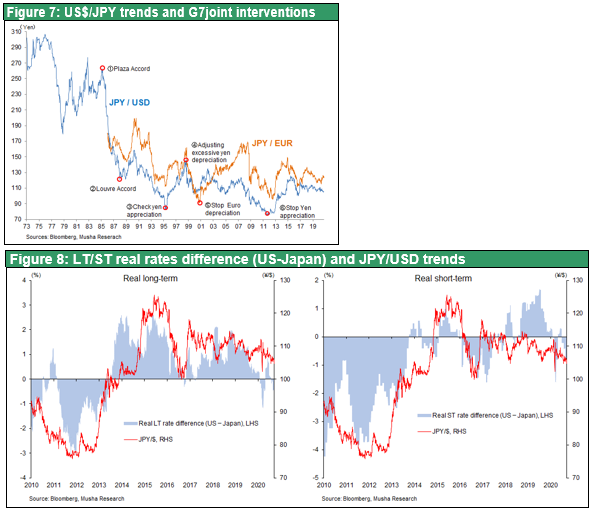

Improper advice from the academia and media caused aggregate demand to shrink

Economic theories and policies that make effective use of fiscal policy , such as MMT and The Sims Theory (FTPL), were difficult to implement due to the opposition of the majority of economists. However, strangely, the Corona pandemic made extraordinary fiscal expansion inevitably. So far, this super-aggressive and expansive approach has been rejected by majority of scholars, economists, and the media. It has been pointed out that adopting such policies will lead to (1) the government bankruptcy, (2) hyperinflation, (3) sharp rise in interest rates, and (4) the currency collapses. However, none of these problems have occurred in Japan, despite the worst budget deficit in the world. It is unlikely that BOJ will achieve its 2% inflation target. In addition, long-term interest rates have remained low (close to zero) rather than going up . Furthermore, contrary to the opinion that the budget deficit will lead to a decline in currency confidence and a sharp depreciation of the yen, the yen continues to appreciate. In other words, it can be said that the criticism of expansionary fiscal and monetary policies was a fallacy.

The theory of effective demand is being reviewed again since from the time of Keynes.

In the first place, the world economy before the outbreak of the Corona pandemic was facing two fundamental issues: downward pressure on prices = shortage of demand and downward pressure on interest rates = surplus money. The lack of demand was caused by the technological revolution (Internet, AI, and robots) which boosted productivity and increased supply capacity. The decline in interest rates was caused by the high-level profits at corporations (added value gained by increased productivity) and the excessive savings of households, which lowered purchasing power. Therefore, it was necessary to stimulate demand by utilizing the surplus funds through fiscal and financial expansion. If the capital and supply capacity that is lying idle is utilized in the wake of the Corona pandemic, the economy will be in a better shape than it was before the pandemic.

Japan's deflationary policy at the time of the Great East Japan Earthquake

If austerity is the response to an unprecedented natural disaster brought about by the Corona pandemic it will bring about a severe depression. The risk of going back to failed policies should be avoided.

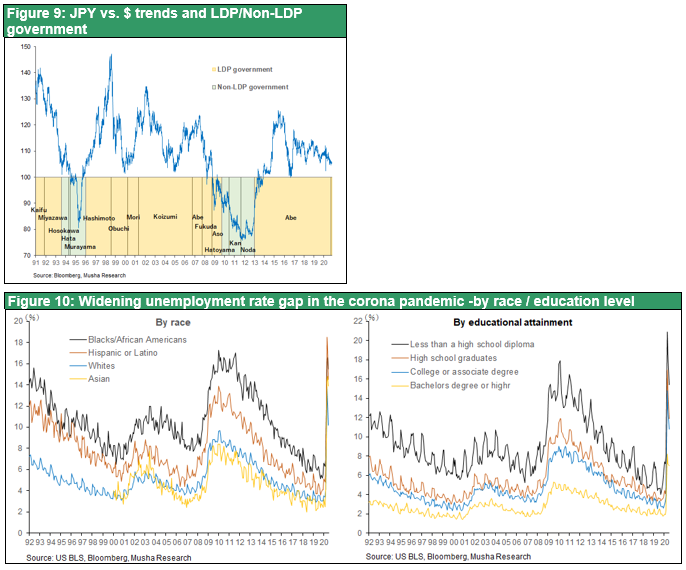

A bad precedent was set in Japan by the administration led by the Democratic Party of Japan and Bank of Japan (then the Governor was Mr. Shirakawa) after the Great East Japan Earthquake. In April 2011, the Science Council of Japan released "Urgent Recommendations for the Great East Japan Earthquake" a paper denying the BOJ's underwriting of reconstruction costs, and instead recommending a tax increase. In fact, this recommendation was adopted by the Democratic Party of Japan, and taxes were raised. In addition, the Bank of Japan's negative stance toward earthquake related bills and reluctance to ease monetary policy led to higher interest rates, raised Japan's real interest rate significantly (Figure 8), and brought about a remarkable appreciation of the yen pushing it up to the 70-80 yen range from 2011 to 2012. In addition to the blow, the weakening of competitiveness due to the strong yen hit Japanese companies and the economy. It had a fatal impact on the agglomeration of high-tech industries such as semiconductors, liquid crystals, and smartphones. Figure 7 shows the dollar-yen rate and the G7 exchange rate coordinated intervention. All four of the past five coordinated interventions have been major turning points in exchange rate trends. However, only the G7 cooperative intervention to support the Great East Japan Earthquake on March 18, 2011 failed to change the trend toward appreciation of the yen. It can be said that the BOJ's missteps are extremely painful. It should also be noted that (Figure 9 ) the yen appreciated above the \100/$ rate only under an administration (which had unfriendly economic policies) not led by the LDP.

The harmful effects of the spread of this false idea that unites academia and the media should be deeply regretted. Basically, it was necessary to dumpy policies advocating fiscal and financial discipline.

Facing increased inequality and income redistribution, expanding the social safety net is indispensable

The Corona pandemic has brought to light a widening disparity in the digital world (see Figure 10). The confrontation between the two extremes came to light in the US presidential election - the poor white on the right and the black and colored people who gather under the "Black Lives Matter" on the left . It can be viewed as the downfall of the middle class, which was the bearer of US democracy. To end the disparities, it is necessary to quickly to build a social safety net using public funds. This can be realized by taking advantage of low interest rates and excess savings. Professor Stephanie Kelton, the advocate of MMT, is an economic advisor to former Vice President Biden.

Just as the Great Depression became the starting point for the modern cradle to grave social security system, the Corona pandemic may possibly open an era of universal basic income which be a dramatic expansion of social safety nets and the establishment of universal health insurance systems.

(5) Full-scale stock capitalism

Stock market is at the core financer

The Corona pandemic may open a new era of equity capitalism. In the United States, monetary policy is now stock-price oriented. QE made a decisive contribution to raising asset prices such as that of stocks and this trend became even more pronounced in the Corona pandemic. The Fed launched large-scale monetary easing, including the zero-interest rate policy in March. Chairman Powell eased the monetary policy further in September suggesting that the super-monetary easing policy will continue till 2023. The September FOMC statement said, "For the time being, we are aiming for a rate of price increase that is somewhat higher than 2%, and we expect to continue accommodative monetary policy until price targets and employment improvements are achieved."

Many scholars, economists and BIS are critical of the side effects and harmful effects of unprecedented monetary easing. However, central banks, which are responsible for the consequences, must avoid a severe depression by dumping failed economic policies . Central bankers must be pragmatic.

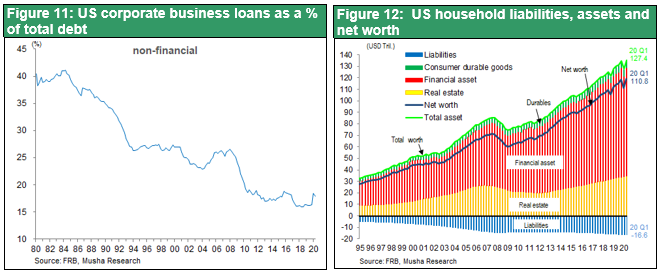

Perhaps the most serious criticism of ultra-easy monetary policy is that it gives the market an excessive sense of security and is causing a stock bubble. Sure, the Fed (which never officially admits) seems to be helping to keep stock prices high for good reason. In the past, monetary easing has facilitated bank lending and increased aggregate demand. But now banks have no borrowers and can no longer stimulate demand by increasing bank lending (see Exhibit 11). Therefore, the only way for central banks to boost aggregate demand is to control the prices of assets such as stocks. Monetary policy is being directed at keeping stock prices high.

The legitimacy of monetary policy targeting stock prices

In fact, high stock prices have become the starting point of a virtuous economic cycle in the United States. Rising asset prices, driven by high stock prices, have significantly increased household net worth. US household net assets, which had fallen to $ 59 trillion at the bottom in 4Q 2009, increased to $ 119 trillion in 2Q 2020, an increase of $ 60 trillion (three times the US GDP) in 10 years. Pension assets have increased significantly from $ 10 trillion to $ 27 trillion, providing significant support for pension finance. It is argued that rising stock prices and dividends benefit only the wealthy. However, 70% of household savings in the United States are stocks and investment trusts (70% in Japan are cash and deposits), and it can be said that shareholder returns benefit most savers. The cash income of US households is 70% of wages and 30% of asset income, and it is no exaggeration to say that the vigorous consumption by US households is supported by the rise in asset prices centered on high stock prices.

Critics claim that the stock market is experiencing a bubble. The stock dividend yield is as high as 2%, and the total shareholder return rate, including share buybacks, is as high as 5%, exceeding that of bonds and deposits which carry interest rates of less than 1%.

Again, why is it necessary to create credit as alchemy? For an answer, we must look at the history of the development of technology and the division of labor. As technology develops and productivity increases, a sense of surplus of people and products, that is, labor and capital, surfaces. It can be rephrased as increasing supply capacity. If so, the demand will be relatively insufficient. Therefore, a policy to increase demand, that is, credit creation, is indispensable. The reason why there is no inflation and the risk of deflation is predominant worldwide is that the increase in supply capacity due to technological innovation exceeds demand (= relative shortage of demand). Now is the time for Keynes's theory of effective demand to reappear.

Bank lending portfolios defined the future ,Now it is stock market capitalization

Shunpeter states that bankers' discerning lending drives innovation and lays the foundation of a future society. However, the role of bank lending has diminished significantly. Now, the stock market will draw blueprint of the future through changes in market capitalization. Even start-ups will be able to raise capital through higher stock prices and promote innovation and creative destruction. The high GAFAM stock prices or highest market capitalization of Tesla among the world's automobile companies will stimulate metabolism and improvement in the industry. Optimism will drive the Post-Corona world.