Nov 17, 2020

Strategy Bulletin Vol.266

US Market becoming speculative before the 2021 economic expansion

- Japanese stocks have a big advantage

(1) US stocks hit an all-time high, but there is also risk of turbulence

Risks of the economic recovery being derailed cannot be ignored

The S&P 500 and the NY Dow both reached new all-time highs on November 16, but we should also consider the risk of turbulence for a while. Factors to be monitored include (1) the third wave of COVID-19 with an increase in the number of active cases and deaths; (2) it will take more than six months for Pfizer and Moderna's high-performance vaccine to become widely available, with a longer lag before this contributes to the economy; (3) there is a feeling that the short-term recovery trend in the US economy is sluggish, and a strong likelihood that 4Q GDP will be downwardly revised; (4) there are concerns that fiscal support for the economy will stall; (5) The Fed is increasing its easing stance, but there is only so much it can do, and the brakes will be put on monetary base growth; (6) stock markets are becoming more speculative; and (7) investors are becoming more willing to take risks.

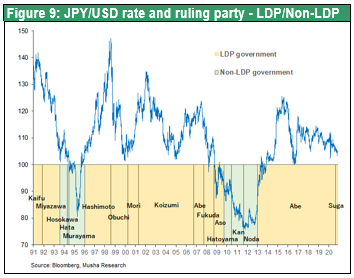

The number of active COVID-19 cases has also surged in the US, and the third wave is intensifying. The number of deaths and the number of critically ill cases, which have previously been under control, are also increasing rapidly (Figure 1). There is growing likelihood that lockdowns will be reintroduced in some areas. The fact that development of vaccines by Pfizer and Moderna is progressing well is encouraging, but it is expected to take more than six months for the vaccines to become commercially available. The sustainability of the antibodies and the side effects of the vaccine are still uncertain after only a few months of clinical trials. Moreover, there are concerns that the current surge in infections could lead to a slowdown in economic activity and a deterioration in consumer sentiment.

According to the Dallas Fed's Mobility Engagement Index (a measure of smartphone-based mobile activity), individual’s activities such as outings and long-distance travel have stopped improving since August (Figure 2). The odds are good that the momentum for economic recovery will be severely eroded if there is a third wave and worsening consumer sentiment, as well as the expiration of economic stimulus measures and a vacuum. Payroll tax cuts and enhanced unemployment benefits are inevitable, but the transition to a new government has been delayed, and there is great concern about a possible vacuum. Many of the economic measures to address COVID-19 expire in December, increasing the risk that household and business support will be lost. There is a wide gap between economic activity in areas that have almost fully recovered, such as in manufacturing, and in areas where recovery has been slow such as in aviation, food service and entertainment industries.

Now is not the time for the Fed to play a central role and a Goldilocks economy is unlikely

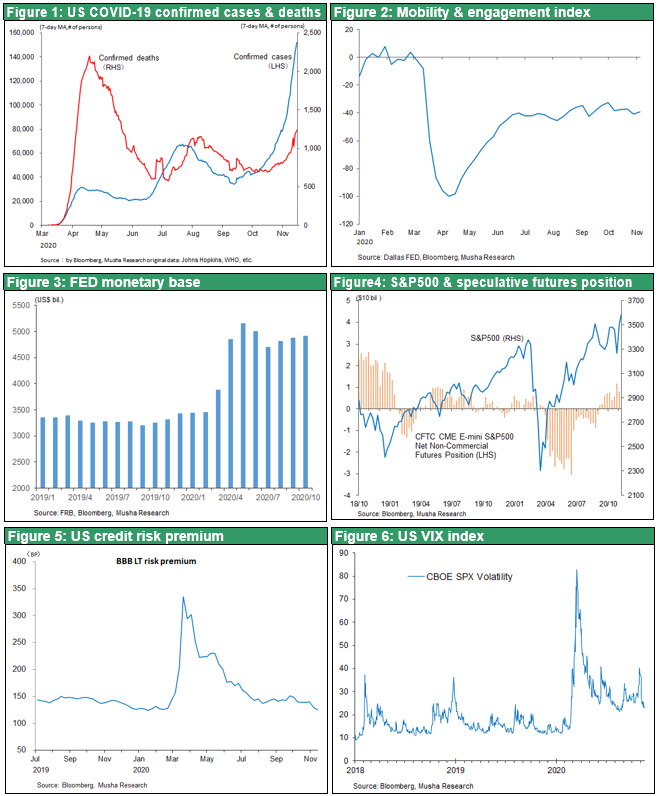

The market is counting on the Fed's support, and Chairman Powell has shown consideration by suggesting that he will allow inflation to overshoot and keep interest rates at zero until 2023. But now is not the time for the Fed to play a central role. If fiscal stimulus remains inadequate, there would be undue expectations for monetary easing and increased likelihood of the markets becoming speculative. In fact, the trend for the Fed's supply of base money to plateau has intensified since July (Chart 3). As a result, long-term interest rates have risen since August, which may suggest that the financial support channel is in limbo. What is needed is fiscal stimulus, and this is not something the Fed can fill in for. What the Fed can do is implement a special lending program (PPP for payroll protection loans and MSLP for emergency loan assistance to small and medium-sized businesses), but this has been very pervasive, and additional easing will need to concentrate on macro easing measures such as asset purchases by the Fed (=QE). This has the side effect of making markets overly speculative. There is wide disparity between industries in terms of the impact of COVID-19, and macro easing will increase the number of sectors that receive excessive (and unnecessary) liquidity supply, encouraging speculation.

Figure 4 shows the changes in the S&P index and speculative futures positions. Pessimism has increased with concerns about a second bottom and the unprecedented level of short futures positions up until June and July and a large increase in long positions in September to October. In addition, the expansion of the Fed's asset purchases to include corporate bonds has caused substantial decline in credit risk premia (Figure 5), supporting corporate risk-taking. This may have increased the speculative nature of the US stock market. The US VIX index, shown in Chart 6, has remained significantly higher than it was before the COVID-19 crisis, even when stock prices are reaching all-time highs.

Again, the Fed's additional easing may appear at first glance to be a revival of the Goldilocks market, but it may increase the volatility of stock prices and significantly reduce the speed of long-term stock price increases. Volatility will inevitably be larger the higher the excess returns on stocks due to monetary easing. This is a repeat of the Japanese stock market up to the 2010s.

If anything, the certainty of an Asian-led global economic recovery, with the region successfully containing COVID-19, will greatly enhance international investors' expectations for Japanese stocks.

(2) Three things are certain in 2021 and the economy is sure to recover, but...

Economic recovery is certain, but there is great uncertainty

There is much and varied speculation about the outlook for 2021 making it difficult to formulate a definitive scenario, but at least three things are almost certain.

The first thing we can be sure of is that 2021 will be a year of global economic recovery. We note four factors: (1) the containment of the COVID-19 pandemic, (2) pent-up demand and savings, (3) global fiscal and monetary support, and (4) accelerated innovation (net digital, new energy, and decoupling from China’s supply chain).

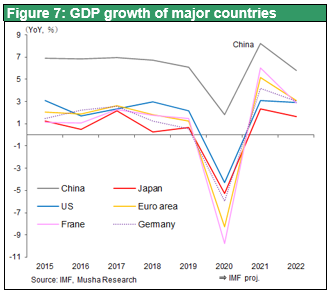

China's dominant driving force

China clearly has an overwhelming lead, even when it comes to containment of COVID-19. According to the IMF's World Economic Outlook for 2021, compared to pre-COVID levels in 2019, China will lead the global economic recovery by a long way with growth of +10.3%, while the forecast for the US is -1.3%, Europe -3.5% (Germany -2.0%, France -4.3%), and Japan -3.1%.

Although China's GDP is two-thirds that of the US, the ratio of manufacturing to national income is 29%, three times the 11% recorded in the US, so China’s manufacturing market is twice the size of the US. China is the dominant player in movement of goods such as the commodity markets and international trade. China's sharp recovery (+1.9% in 2020 and 8.2% in 2021) is the engine of the global economy, and the benefits of this recovery have spread to the Japanese economy.

An unprecedented amount of investment capital

The second thing that is certain is the unprecedented amount of investment capital that exists under the ultra-easy monetary conditions. There is an unprecedented $4.6 trillion of funds on standby in US MMFs. However, lucrative investment opportunities are disappearing. The credit risk premium has fallen significantly and is nearing its limit. Long-term interest rates in many countries, including the US, are at historic lows, making bond investment a risk.

US policy, US-China relations and energy policy are all impossible to foresee

The third thing that is certain is the great uncertainty. First, the transition of power from Trump to Biden in the US will change the rules of the growth game in the US, but Biden's policies are not yet clear. Much of the Democratic Party’s left-led policy agenda is not known, although there are indications that much of it will not be implemented, including higher corporate taxes, higher capital gain taxes, tighter Wall Street regulations, and Green New Deal infrastructure investment. A shift in the policy mix, where the stock market was the driving force under the Trump administration, to a large government with fiscal traction would be desirable in the long run, but the shock to the market would temporarily increase if implemented.

Next, we also do not know what will happen to US-China relations. Will Biden follow all of Trump's policies toward China? Nevertheless, it is worth noting that the Trump administration's policy toward China was fraught with major contradictions. It continued to maintain US-China collaboration in key industrial sectors while treating China as an enemy. A symbol of this is the Apple model. The rise in China's high-tech is due to the fact that Apple produces nearly all of its smartphones in China and built a huge high-tech industrial cluster as a starting point. Apple's China-dependent supply chain has been largely untouched. In addition, Tesla has built a 200,000-unit-per-year Gigafactory in Shanghai and has begun exporting cars from China to the rest of the world. In an effort to seize global dominance in EVs, China is allowing Tesla to establish a wholly-owned subsidiary to quickly expand its EV industrial base. China is trying to pull ahead of the car-producing nations of Japan, the US, and Germany, all of which have a negative legacy of internal combustion engines, in one fell swoop. If this Apple-Tesla business model of US-China collaboration continues, the Trump administration's one-sided adversarial line against China will be unsustainable. Europe and Japan, which cannot ignore China's huge market, may find themselves in a conflict with the US over the competition for the Chinese market.

Furthermore, a shift in energy policy is also unlikely. Even if a return to the Paris Agreement is a certainty, as the world's largest oil producer, it is unlikely that the US will be able to easily achieve a policy shift. It will have to coordinate with the Midwest oil-producing region, which is home to many jobs.

(3) Forecast Financial Market Trends in 2021

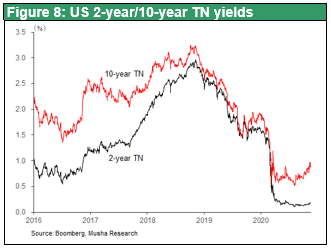

The Fed's ultra-easy monetary policy may be in its final stages

Key US long-term interest rates appear to be rising after bottoming out at 0.5% in August. US monetary easing has been both elastic and pragmatic. While it depends on the economy and the vaccines as well as the economic support measures from fiscal policies, there may not be any further easing. If this is the case, the weak dollar could come to an end, and there could be a return to the long-term strong trend that began in 2011 by the second half of 2021. Under the expected full-scale recovery of the US economy and changes in the trend of long-term interest rates in the second half of the year, there is likely to be a shift in stock speculation toward so-called value stocks that are sensitive to economic conditions. We can expect to see some correction in growth stocks.

2021 will be a year of speculation in the US with Japan seen as a safe zone

The most significant feature of the financial markets in 2021 will be increased speculation and high levels of volatility. Volatility, or the strength of speculation, is essentially considered to be determined by the magnitude of excess returns on stocks. If interest rates are low and excess returns on stocks are high, investors will increase their leverage to pursue greater investment outcomes. The high returns of such highly leveraged portfolios are lost by the occasional market swings. A mechanism exist whereby the excess returns on stocks are redistributed to various market participants, financial institutions, and investors through this volatility cost.

The wild price movements of Japanese stocks throughout the 2010s can be attributed to the excess returns of stocks, which were significantly higher under extremely low interest rates. The efficiency of speculative positions was very significant in Japan. But after the COVID-19 crisis, US long-term interest rates fell sharply, and the excess return on stock investments was even greater in the US than in Japan. These large excess returns appear to be attracting global speculative players to the US stock market.

The financial environment with the economic recovery, abundant investment capital and speculative nature makes it difficult to find suitable investments

Risk-free assets such as government bonds and cash may become more dangerous with the economic recovery, rising inflation and higher long-term interest rates. Stocks, on the other hand, will become more volatile, speculative (not to say bubbly) and difficult to handle as an investment target. Asian stocks, which are less affected by COVID-19 and shown remarkable economic recovery, are in the spotlight. But as we have seen in the setback at Ant Financial, there are risks in investing in China as well.

Japanese stocks will become a promising option, by a process of elimination

In this context, the stability of Japanese stocks has attracted attention. In contrast to US stocks, the relatively large decline in Japanese stock volatility has made Japan a low-risk market: only 3% for Japanese stocks in September-October 2020, compared to a 10% change in US stocks. Throughout the 2010s, the Japanese stock market was remarkably speculative and highly volatile, making it difficult for investors such as individuals to approach. Foreign investors, who account for 70% of Japanese stock turnover, were mainly speculative (trading) players. However, a sense of calm appears to have been restored to the Japanese market as these speculative players migrated to the New York markets.

1) Small number of COVID-19 cases and the expectations that normalization of the economy will be accelerated

2) Shift into Japanese stocks, dominated by economically sensitive sectors, amidst the global economic expansion

⇒ the expectations that the recovery in China will benefit the results of global companies

3) Assessment of the impact of the Suga reform minded administration

4) Inspiration provided by Warren Buffett's investment in trading company stocks

5) Supply and demand for Japanese stocks are extremely favorable, and foreign investors are underweight Japanese stocks

6) Valuations are the lowest in the developed world, and if you look hard enough, there are many factors that will greatly encourage investment in Japanese stocks.

The Bank of Japan's clever new monetary policy

The Bank of Japan's new operations are in the spotlight. The BOJ will rein in QE and allow long-term interest rates to rise, while at the same time providing a de facto subsidy to regional banks that propose management reforms by attaching 0.1% interest to current account deposits. In addition, the steepening of the yield curve will improve earnings at financial institutions. If the yen continues to appreciate under these conditions, it will be possible to immediately widen the negative interest rates. It would be a clever move to promote reform and curb speculation about the yen's strength, so it is safe to say that there are no longer concerns about the yen appreciating to more than ¥100 to the dollar. This new policy may be the one that foreigners appreciate the most.