Dec 03, 2020

Strategy Bulletin Vol.267

Japanese stocks surge w/the prospect of COVID-19 being conquered in 2021 and a global boom in sight

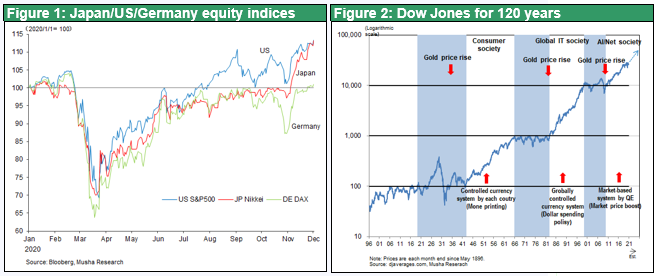

Global Stocks to Boom at the end of 2020

The US was treated with one of the greatest gifts of all with the start of the festive season from US Thanksgiving to Christmas coinciding with all three major US stock indices reaching record highs. The sharp recovery from the 40% drop in stock prices over a 6- week period caused by the COVID-19 pandemic exceeded our most optimistic expectations. A bigger surprise, however, has been the remarkable rise in Japanese stocks. Japanese stocks may not be at their all-time high, but they have been outstandingly strong performers amongst global equity markets in recent months.

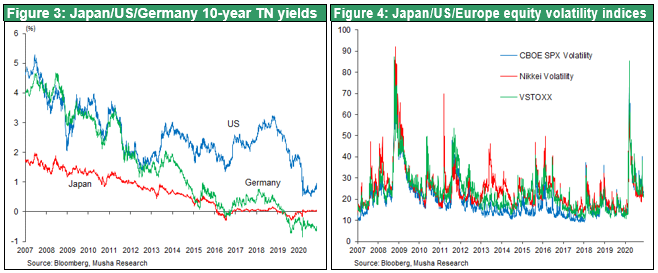

The global economy was booming just before COVID-19 appeared, the Internet information and communications revolution was underway, the US unemployment rate had fallen to an all-time low of 3.5%, and US stock prices had quadrupled in the 10 years since the GFC. Musha Research has argued that this wave of a long-term economic boom is not over, and that it will once again rise after COVID-19. This is because COVID-19 is expected to push the course of history forward. This argument appears to be validated by the rise in stock prices.

(1) Has the era of Japanese stocks begun?

Momentum of prominent Japanese stocks and Japanese financial stability

The outstanding performance of Japanese stocks is noteworthy. Japanese stocks have been notably strong when comparing the rate of increase in stock prices from August to November with the Nikkei +19.1%, the NY Dow +11.2%, the S&P 500 +9.9%, the South Korean KOSPI +15.1%, Taiwan Kaohsiung +9.7% and the German DAX +5.1%. While US stocks fluctuated wildly, especially around the time of the US presidential election, Japanese stocks remain remarkably stable, with no notable dips.

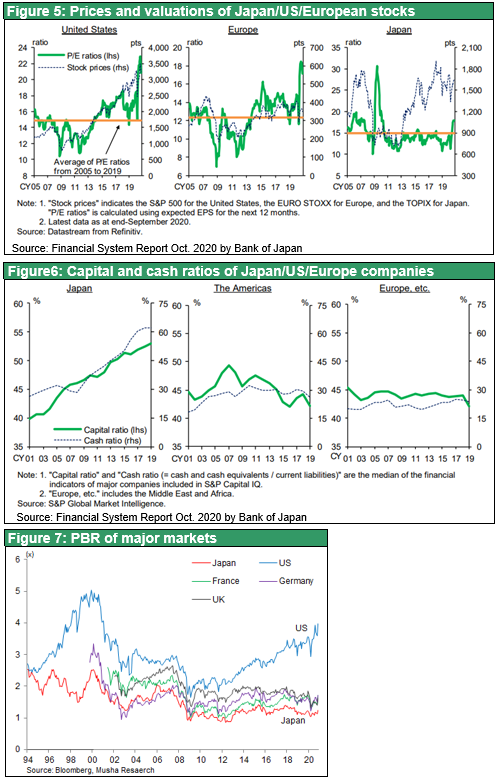

In the world of interest rates, Japan has also relinquished its status as a failed player. Deflation and zero interest rates were Japan’s exclusive domain for a long time, but now Japan's long-term interest rate is +0.02%, well above Europe's negative rates. The long/short term interest rate spread (yield curve) is steepening, though insufficient, and the profit base of financial institutions in Japan is stronger than in European countries such as Germany and France. The BOJ's innovative yield curve control policy has been effective. Also, as we will discuss later, fiscal stimulus has softened the heavy burden on the BOJ. This is a sign that the world's most advanced (?) fiscal and monetary policy coordination is beginning to work.

This stability is also evident in the currency markets. Although the dollar has depreciated as a result of the US ultra-easy monetary policy, the dollar’s depreciation against the yen has been very limited. The yen's strength is milder than that of South Korea and Taiwan, and the volatility that used to make Japanese stocks a flashpoint has fallen relatively significantly. Given that Japanese stocks are undervalued and Japanese companies have strong balance sheets, it would not be strange for Japanese stocks to be bought back at any time. The revolution in stock valuations could be triggered by the global economic boom that is anticipated to follow the COVID-19 pandemic.

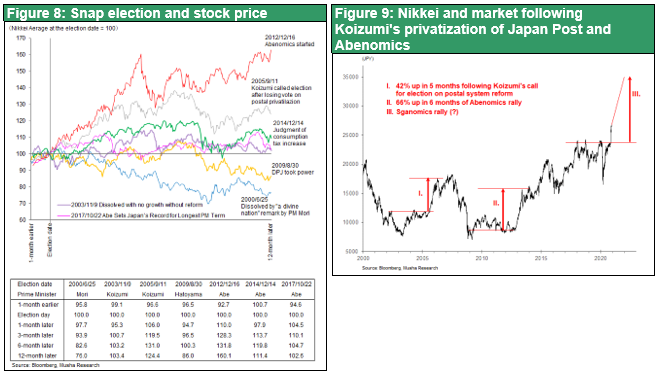

Possibility of historic boom

The eye-popping strength and stability of Japanese stocks since November suggests that they have entered a new accelerated upward stage. This could be the third rally since the 2000s. Both of the preceding two market rallies were long-lasting, but the initial short-term surges were very strong. The rally on the back of Koizumi’s privatization of Japan Post, which began in August 2005, resulted in a 42% increase in the first five months (through January 2006). The rally on the back of Abenomics, which began in November 2012, resulted in a 66% increase in the first six months (through May 2013). If this is the third major rally since 2000, based on a starting point of 23,000 yen when the Suga administration was inaugurated in September 2020, a 30% rise in the market would equate to a Nikkei of 30,000 yen, a 40% rise would be 32,200 yen, and a 50% rise would be 34,500 yen.

(2) Five conditions for the three rallies since 2000

If we analyze the earlier two rallies i.e., the rally following Koizumi’s privatization of Japan Post and rally following the introduction of Abenomics, we can see that there are five common factors. These five conditions are currently being met. The first condition is that stock prices had been in a slump for several years prior to the rally, which created a springboard. This time too, there has been continued turmoil in the market and stagnation with several sharp drops in the Nikkei 225 that was capped at the 24,000 yen level from 2018. The market finally broke through 24,000 yen in November. Although the surge of 3,450 yen in the month of November is extraordinary with a rise of 14.5%, it is not excessive as an entry point compared to the previous two rallies. This suggests there are no dips and no buying opportunities for bearish traders who want to buy.

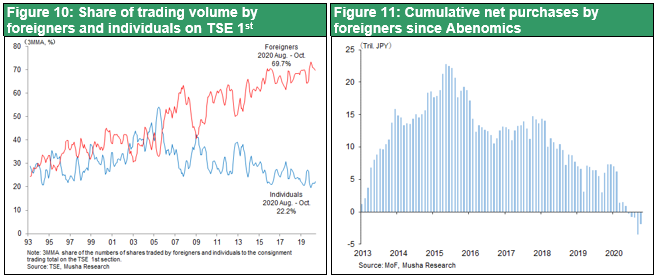

Conditions for foreigners to buy Japanese stocks are set

The second condition is the surge in foreign buying. The sharp rise in stock prices since 2000 has been led by foreigners in each case. The percentage of shares held by foreigners jumped from 23.3% at the end of 2004, when Koizumi privatized Japan Post, to 27.8% at the end of 2006, and from 28.0% at the end of 2012 when Abenomics was introduced to 31.7% at the end of 2014. This time, foreigners have sold all of the accumulated 23 trillion yen worth of stocks they acquired during Abenomics, bringing the percentage of foreign ownership down to 29.6% at the end of 2019. Foreigners are now substantially underweight Japanese stocks and started to pick up pace in their purchases in November.

Possibility of a global economic boom after COVID-19 is contained

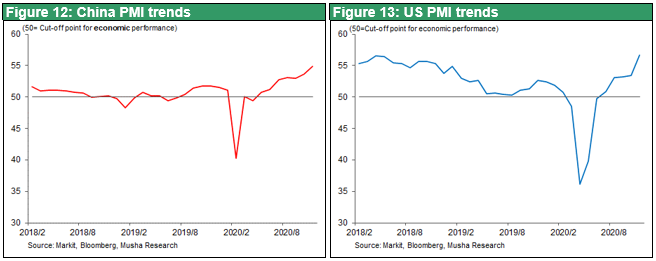

The third and most important condition for a large rally is a simultaneous global boom. If a COVID-19 vaccine becomes commercially available, the synergistic effects of (1) accelerated innovation, (2) unprecedented fiscal and monetary support, and (3) pent-up demand and ample savings, discussed below, will lead to a major economic boom. There are signs that the economic recovery is picking up pace. Market prices for commodities such as copper, iron ore and shipping are at multi-year highs; in the US equity markets, economy-sensitive value stocks have begun to outperform; investments in economy-sensitive emerging markets are surging; US-China confrontation will become rule based under new President Biden and uncertainty is likely to disappear. Musha Research argued that there would be an increase in the growth rate for the global economy following COVID-19 since the pandemic is expected to push the course of history forward carrying away obstacles and there are signs that this is happening.

The IMF forecasts that the global economy will not return to pre-COVID-19 levels until 2021 (-4.4% in 2020 and +5.2% in 2021), but if there is rapid distribution of the vaccine and COVID-19 is successfully contained, we may see a global economic recovery as early as the second half of 2021 and by 2022 at the latest.

The fourth condition is the popularity element, especially in promoting a reform agenda that is loved by foreigners. It is well-known that Prime Minister Suga is the most enthusiastic towards reforms of successive prime ministers, and foreigners will no doubt be favorably inclined if he can achieve results. Warren Buffett's investment in the shares of Japan's five largest trading houses could be the catalyst for a Japan boom.

Tighter US monetary policy and appreciation of the dollar post-COVID-19

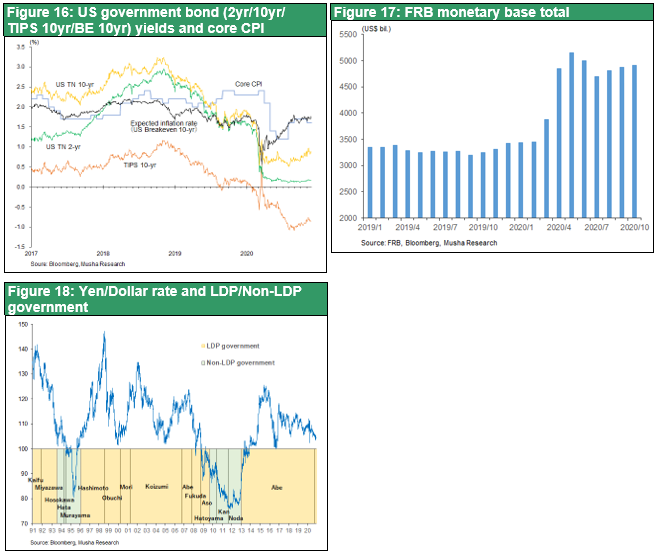

The fifth condition is the depreciation of the yen. This may be the most difficult and important condition, but it is also conceivable. If COVID-19 is contained and Biden introduces fiscal stimulus, there would be the prospect of a shift in the US Fed's ultra-easy monetary policy.

(3) When will the US tighten monetary policy and the dollar appreciate post-COVID-19?

Falling US real interest rates do not lower inflation expectations, so it is a potential strong dollar factor

The consensus in the international financial markets is that the dollar is now weakening. This is due to the fact that the US has launched one of the world's most aggressive monetary and fiscal easing programs, which has resulted in an ample supply of dollars. In addition, the world’s lowest real interest rate of -1.2% under the US zero-interest rate policy has been a major driver of the dollar's weakness. Real interest rate differentials are considered the most important trend determinant in currency markets, and this decline in real US interest rates has been a major factor in the widely shared belief that the dollar is weakening.

However, this aggressive fiscal easing foreshadows the strongest recovery of the US economy among advanced economies over the period 2021-22. If we see a shift in monetary policy under that scenario, the dollar will no doubt strengthen significantly. In the first place, the zero interest rate is not the main reason for the sharp decline in US real interest rates. Short-term policy rates are near zero not only in the US, but also in Japan and Europe. The fact that US inflation expectations did not decline at all even during the COVID-19 pandemic is the reason why US real interest rates are remarkably low. There was virtually no decline in the US long-term expected inflation rate, reverse calculated from TIPS (10-year Treasury yield - TIPS), which sits at 1.6 to 1.7%, indicating that the underlying strength of inflation in the US is quite strong. This implies that the US enjoys the highest confidence in economic growth amongst developed countries and therefore the highest inflation expectations of any developed country, which further depresses real interest rates in the US.

This confidence in the economy and relatively high inflationary expectations will require a change in monetary policy sooner rather than later, which will lead to a stronger dollar in the long run. The US long-term interest rate has already bottomed out at 0.5% in August, and real interest rates have begun to rise. The Fed is gearing up for more monetary easing to fight COVID-19, but it has also been holding back QE and halting the monetary base increase since May and June. This may be a sign of caution about the risk of excessive liquidity supply leading to overheated speculation.

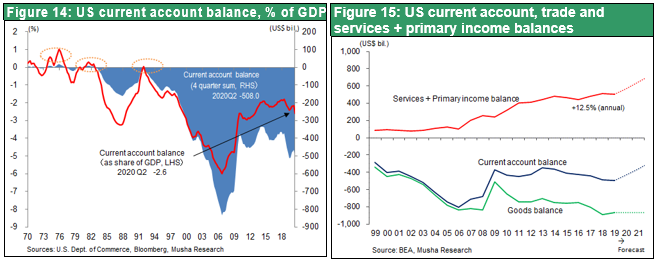

The debate about continued US ultra-easy monetary and fiscal policy and a weaker dollar should be dismissed as a limited story as long as COVID-19 lasts. US economist Stephen Roach argues that the twin US deficits will cause the dollar to plummet, but that argument is only valid for the 1980s and 1990s, when US industrial competitiveness collapsed, and the trade deficit soared. The US current account deficit worsened to 3.4 percent of GDP in 1985 and 5.7 percent in 2006, but it is now significantly lower than it was in the second quarter of 2020, at -2.6 percent. In addition, services exports and the primary income (the culmination of outward investment by US companies and individuals), in which the US boasts an overwhelmingly competitive position, have expanded rapidly from $90 billion two decade ago to $507 billion in 2019, a major source of foreign currency.

A means of avoiding a strong yen, easy fiscal policy increases the freedom of monetary policy

On the other hand, there is a factor on the Japanese side that makes us expect the yen to weaken. That is Suganomics. Prime Minister Suga is a leader with a strong interest in stocks and the currency. In addition, he has appointed aggressive fiscal advocate Yoichi Takahashi as his cabinet counselor, which suggests that he understands the need for fiscal stimulus to help the economy recover and end deflation. In 2012, before Abenomics started, Japan's budget deficit (as a percentage of GDP) was -8.2%. By 2018, after the consumption tax hike, it had shrunk sharply to -2.3%. For the first six years of Abenomics, fiscal austerity continued to put downward pressure on growth by 1% per year, a path that was responsible for Japan's low growth compared to other major countries in the 2010s. However, under COVID-19, Japan has shifted from a long-term path of fiscal austerity to a path of expansion. The budget deficit (as a percentage of GDP) is, according to the IMF's forecast, -14.8% in 2020, not quite as high as the US deficit of -18.0%, but much higher than the Eurozone deficit of -10.0%. In addition, a third supplementary budget is planned for pump priming, which is expected to exceed 15 trillion yen.

During his tenure as Chief Cabinet Secretary, Mr. Suga hosted a tripartite meeting of the Ministry of Finance (Vice Minister), the Financial Services Agency, and the Bank of Japan to strengthen fiscal and monetary coordination. Although the BOJ condones a rise in long-term interest rates through yield curve control, it has introduced measures that effectively provide subsidies such as applying interest to the current account deposits of regional banks and is prepared to avoid a strong yen by widening negative interest rates. If it is known that there is commitment for the yen not to rise above 100 yen to the dollar, speculators could eventually challenge the significantly weak yen.

Although the precise timing is unknown, we believe the basic trend for 2021 will be a simultaneous global economic boom and a rise in Japanese stocks. The global economy and the markets will take a roller coaster ride as they transition from pre-COVID-19, to the COVID-19 crisis, living with COVID-19, the post-COVID-19. The slow economic recovery at the beginning of the COVID-19 pandemic, with low interest rates due to ultra-easy monetary policy, weak dollar/strong gold price and the higher stock prices driven by growth stock will eventually enter a transition period in anticipation of a post-COVID-19 world. This will likely take the form of a shift in monetary policy, higher interest rates, a stronger dollar and lower gold price, and higher stock prices with a preference for value stocks/emerging country stocks/Japanese stocks.

(4) COVID-19 accelerates the cogs of history

Even before COVID-19, two historical trends had occurred: (1) the IT/internet/digitalization of business, life, finance and politics, and (2) the era of big government due to fiscal and monetary expansion. These historical trends, however, have been hampered by heavy obstacles, which have held back the global economy for nearly a decade. The obstacles have been existing customs, institutions, and resistance against shifting to the Internet, and the belief in sound finances and austerity measures against big government.

These obstacles were holding back the flow of history, creating stagnation and major distortions in politics, institutions, economics, society and life. The COVID-19 pandemic is expected to break every one of these obstacles and accelerate the historical trend.

When the COVID-19 pandemic has been contained, the global economy should be more dynamic. It is significant that the COVID-19 pandemic has allowed us to reach these conclusions, which would normally have taken many years to reach after so many failures, in a fraction of a second.

COVID-19 made us realize the great advances in technology

Perhaps the most surprising thing to people in the post-COVID-19 world is how much technology has evolved. Telecommuting, online classes, and home consultations allowed most businesses and lives to be conducted without direct human contact. The technological foundations of the network were already in place. But old structures, customs, rules and regulations, and ignorance prevented their practical application, and until now, no such market or need had been created. With COVID-19, the obstacles to the use of the Internet, old systems, habits, and resistance to change, were blown away. The use of the Internet as a trump card to avoid direct contact between people has become an absolute imperative. The reform of the closed-door nature of companies, shortening and flexing of working hours, the normalization of dual and side jobs, the elimination of the stamp culture that was an obstacle to telework, and the conversion of documents from paper to data are all progressing at once. Labor organizational reforms are being carried out in various directions.

Full-scale easing of fiscal and monetary policies to accelerate the global economy

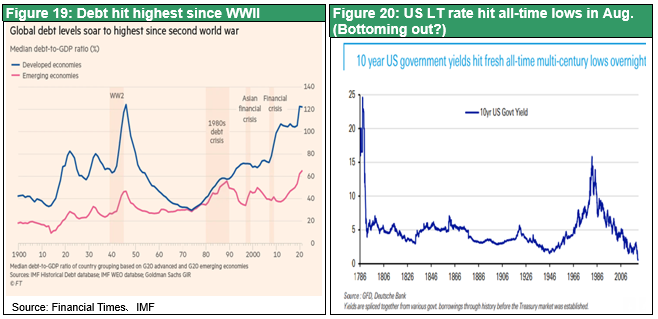

One more obstacle that COVID-19 has swept away is the myth of fiscal and monetary health. In the past, governments have made fiscal soundness their "flagship" and curbing budget deficits their top policy priority. For example, Eurozone member countries have been required to impose strict fiscal discipline, with budget deficits of 3% or less of GDP and government debt to GDP ratio of 60% or less. However, the shock has led to a shared sense of urgency to do whatever can be done, and policymakers have come together to lift the ban on fiscal policy. The US budget deficit for fiscal year 2020 (October 2019-September 2020) tripled from the previous year to $3.1 trillion, and as a percentage of GDP ballooned to 16%, the largest in the post-war era. US federal government debt has also expanded to just under $27 trillion, or 126% of GDP, and appears to have been the largest ever, surpassing that of the immediate post-World War II era. The International Monetary Fund (IMF) predicts that the ratio of government debt to GDP for developed countries will be 126%, comparable to 120% in World War II. For the first time, the EU has also decided to devote 750 billion euros of public funds to reconstruction efforts.

Retreat of the Economic Sentiment of Fiscal Austerity

Economic theories and policies to better use public finances, such as MMT and the Sims Fiscal Theory of the Price Level (FTPL), were difficult to implement because of opposition from the majority of economists. However, oddly enough, the COVID-19 pandemic made an expansion of the fiscal cliff inevitable. The idea that this ultra-aggressive and expansionary fiscal policy is forbidden has dominated academics, economists and the media for some time

now, but the evidence is scant. On the contrary, we are in an era where the effective demand theory of Keynesian times is in even greater demand. Gita Gopinath, Chief Economist at the IMF and patron saint of the financial system, wrote in her Financial Times article that the "Global liquidity trap requires a big fiscal response" (2-Nov), which indicates a major change in the global economic climate.

Prior to the COVID-19 outbreak, the global economy was facing two fundamental difficulties: downward pressure on prices (lack of demand) and downward pressure on interest rates (money glut). The lack of demand was caused by the technological revolution of the Internet, AI and robotics, which drove up productivity and increased supply capacity. Lower interest rates were caused by high corporate profits (the added value gained by companies through increased productivity) and excessive household savings that postponed purchasing power. Therefore, it was necessary to stimulate demand by utilizing surplus funds from both expansionary fiscal and monetary policies. If the COVID-19 pandemic can be used to leverage the capital and supply capacity that had been at play, the economy should be better than it was before the COVID-19 pandemic.