Apr 01, 2021

Strategy Bulletin Vol.279

Japan-US Alliance Deepens, Eyes on 120-130 Yen to the Dollar

- Geopolitics causing a standalone depreciation of the yen

- There has been standalone depreciation of the yen since the beginning of the year on a daily basis. On a weekly basis, the trend for appreciation of the yen since 2016 seems to have come to an end. On a monthly basis, the yen seems to have hit a second ceiling in 2020 after hitting a major ceiling in 2011. This may be the start of a long-term depreciation of the yen.

- The deepening of the Japan-US alliance will lead to a weaker yen, while rebuilding the Japanese economy through a weaker yen is also in the US’s interest.

- A weaker yen will dramatically change Japan's business conditions. The competitiveness of the manufacturing industry will change drastically. The number of tourists to Japan will no doubt increase rapidly after COVID-19. Corporate profits will soar, and wages will begin to rise.

The world has entered a turbulent period

The flow of history can be slow and swift, sometimes without change for decades at a time, and at other times achieving 10-20 years’ worth of change in a single year like a torrent. I believe that we are now approaching such a turbulent period in history. In less than 100 days since the Biden administration took office, the hostility between the US and China has intensified and the conflict continues to escalate. Even under the Biden administration, the US recognizes China as a country with which it has a hostile relationship and is preparing a military encirclement network, including the establishment of the quadrilateral alliance between the US, Japan, Australia, and Indi (known as the Quad), the dispatch of the British and French fleets to Asia, the construction of a missile network to encircle China, and the modernization of US military equipment.

On the other hand, China has held a meeting with Russia's foreign ministers to strengthen ties, signed a 25-year cooperation agreement with Iran, expanded trade with North Korea, and is working with Turkey to build a network of potential non-democratic states. In addition, the Standing Committee of the National People's Congress passed an amendment to the Hong Kong electoral system, finally revoking Hong Kong's autonomy.

The biggest risk is that China will be convinced of the decline of the US

“US relations with China are a minefield of potentially explosive problems, yet the biggest risk is a subtle one: the danger that China overestimates the decline of US power and acts accordingly. If China is convinced, as its representatives and media organizations proclaim, that the US and the entire Western liberal order are in the early stages of a long-term decline, an emboldened Chinese leadership may overstep, become overly provocative and compel America to respond forcefully. The risk arises in many areas, including in the South China Sea, in commerce and, above all, in Hong Kong and Taiwan.

This risk, in fact, helps explain many of the Biden administration’s opening steps toward China. Its strategy is to counteract the Chinese narrative of a politically divided and declining America by trying to establish a picture of enduring US economic, diplomatic and military strength before fully engaging with Beijing. The message is a simple one: Don’t underestimate American power.

Countering the perception of American weakness may be most important on the crucial question of Taiwan, which China continues to consider nothing but a breakaway province. U.S. officials fear Chinese President Xi Jinping may be starting down a path toward forcing Taiwan to accept reunification with the Chinese mainland, using military force if necessary. Its efforts to quash democracy in Hong Kong may be a trial run.

If that’s the case, the best way to deter Mr. Xi may be to convince him now that if he makes such a move he would have to worry about the reaction of a strong and internationally influential America, not a weak and retreating one.” (WSJ March 30, 2021 "US Faces Potential Chinese Miscalculation – Biden’s China Challenge: Counter Its Perception of American Decline”).

Strengthening the Japan-US alliance is a must, and a weak yen is the trump card

One more thing that will ensure the US's ability to fight back is strong alliances. Of these, the Japan-US alliance is of decisive importance. Never before in history has the presence of Japan been as important to the US as it is now. This is evident by Prime Minister Suga being chosen as the first foreign head of state to meet with President Biden, Japan being the first overseas destination for US Secretary of State Antony Blinken and Secretary of Defense Lloyd Austin and the holding of Japan-US 2+2 talks. In this era of antagonism between the US and China, Japan is geographically important for both the US and China. Which side Japan takes will be one factor that determines the outcome of the struggle for US-China hegemony. Second, Japan's role is also important from an economic perspective. It will be essential that Japan has an increased presence in Asia.

The visit of Prime Minister Suga to the US in early April should declare the strong bond between the US and Japan. Suga may bring with him a Diet resolution criticizing human rights abuses in Xinjiang and other areas, which the US expects. In return, the US will probably give Japan its blessing for a weaker yen. A weaker yen is the trump card that will allow Japan to overcome deflation and bring the Japanese economy out of its long-lasting stagnation. Kurt Campbell, the Biden administration's Indo-Pacific coordinator, argued in Foreign Affairs (January 12, 2021, "How America Can Shore Up Asian Order A Strategy for Restoring Balance and Legitimacy") that there can be no alliance strengthening without providing economic benefits to allies.

A weaker yen is good for the US as well

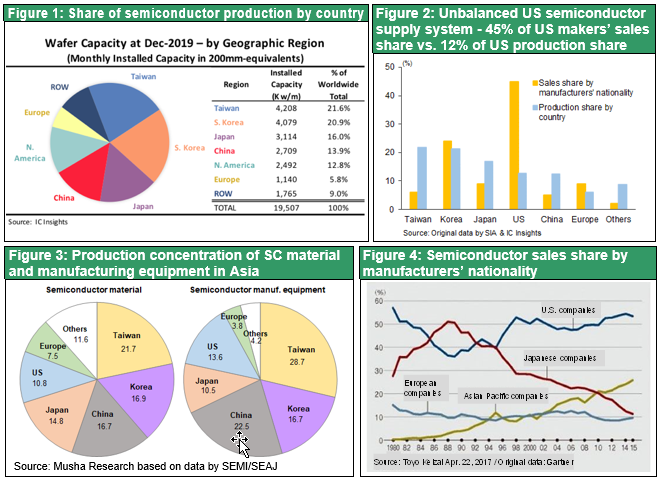

A weaker yen is also desirable for the US. It is essential to change the reality that the US is totally dependent on China, South Korea, and Taiwan for the production of semiconductors and high-tech hardware, the oil of our time. The US is 60% dependent on South Korea, Taiwan, and China for the supply of semiconductors, and almost 100% dependent on these three countries for the production of smartphones. The reason for this is that the high-tech clusters that had been concentrated in Japan have shifted to South Korea, Taiwan, and China as a result of the US Japan bashing and the extremely strong yen. China, South Korea, and Taiwan are potential battlegrounds in the era of US-China hostility, and they are in a critical situation where a single disturbance could cut off high-tech supply from these three countries. Japan bashing by the US and the excessive appreciation of the yen have made the division of labor in Asia extremely dangerous for the US. The US should be reflecting on this fact. The only way to build a safe high-tech supply chain is to invite high-tech production, such as semiconductors, to the US and to encourage the return of high-tech clusters to Japan, a safe zone in East Asia.

In addition, unlike in the 1990s and 2000s, when Japan was overwhelmingly competitive and outperformed US companies, Japan now has almost no trade surplus and no dollar surplus. In addition, US companies dominate the Japanese market in many strategic areas such as aircraft, smart phones, internet platform services, and advanced finance. Those US companies that dominate the Japanese market can easily raise their prices even with a weak yen. On the other hand, US companies that import products will see their purchase costs drop due to the weak yen. In the case of automobiles, the only area where Japanese and American companies compete in the US market, most Japanese auto companies are producing their products locally, which does not work to the disadvantage of American companies. The strong yen, which hurts Japan, is actually no longer beneficial to the US.

The yen has weakened more than the dollar against the Korean won, the Taiwan dollar, the yuan, and the euro

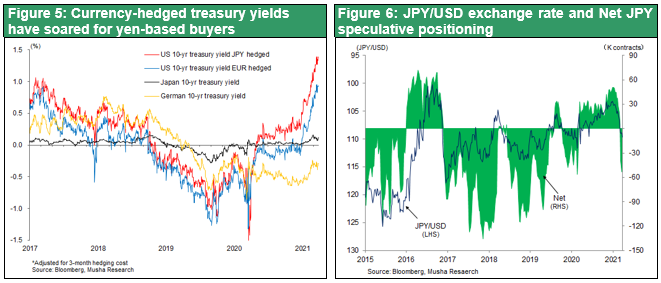

The yen has weakened since the beginning of the year. The remarkable recovery of the US economy and the rise in US long-term interest rates are ending the dollar’s depreciation since 2020 and causing a shift to a stronger dollar. The yen has weakened by 8 yen against the dollar from ¥102 at the beginning of the year to ¥110. The interest rate differential between Japan and the US is widening, and the US dollar currency hedging costs that have been restraining Japanese from investing in US Treasuries in 2019-2020 are falling sharply, improving the profitability of investing in US Treasuries. If a trend in the interest rate differential plus yen depreciation becomes evident, it could lead to a revival of dollar investments by Japanese investors.

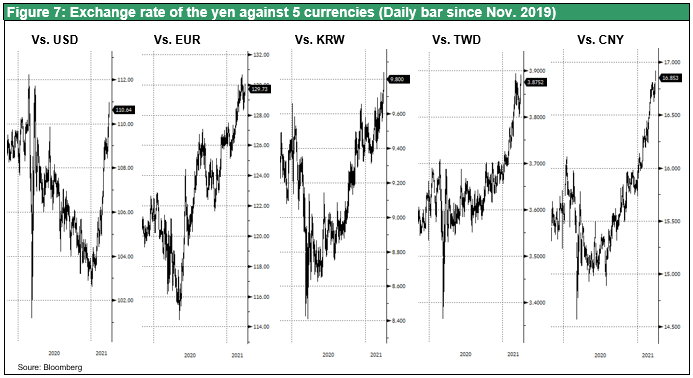

More important, however, is that the yen is depreciating rather than the dollar appreciating. The important exchange rates for the Japanese economy are not the Australian dollar, Brazilian real, Turkish lira, and other speculative currencies, but the Korean won, Taiwanese dollar, US dollar, euro, and Chinese yuan, which compete in trade markets. Three trends can be seen in the changes in these currencies. First, on a daily basis, the yen has continued to depreciate on its own since 2020. The yen is down around 15% against the euro, Korean won, Taiwan dollar, and Chinese yuan compared to its 2020 high. This is much more than the 8% decline against the US dollar.

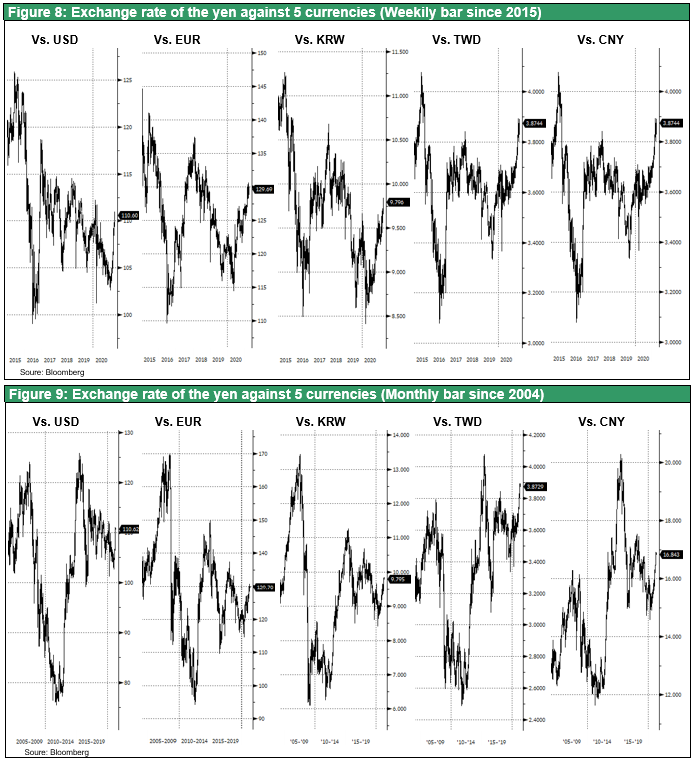

On a weekly basis, the five-year trend for appreciation of the yen appreciation that began in 2016 appears to have come to an end. On a monthly basis, the yen hit a major ceiling in 2011, and although Abenomics and the Bank of Japan's (BOJ) unconventional monetary easing weakened the yen, it ran out of steam and the yen appreciated again, hitting a second ceiling in 2020. If a major ceiling and a second ceiling have been reached, this may be the starting point for a long-term depreciation of the yen.

A weaker yen will be final blow to Japan's deflation and long-term stagnation

If the yen reaches 120 to the dollar, the Japanese economic landscape will change dramatically. Japan, the cheapest country in advanced world, will become even cheaper. Tourists will flood into Japan. The competitiveness of Japanese products will increase. Corporate profitability will jump due to the yen conversion of overseas profits of Japanese companies into yen and the increase in the value of dividends and technical guidance fees from overseas subsidiaries.

The rate of wage growth will increase in Japan due to the tight supply-demand situation and the further undervaluation of Japanese wages caused by the weak yen. The weakening of the yen will make Japanese products more competitive, which will encourage companies to raise selling prices toward international levels according to the law of one price.

Prime Minister Suga should bring home the gift of a weaker yen

If the yen depreciates Japan's prolonged stagnation caused by the strong yen and deflation will be completely over. Prime Minister Suga is expected to reap the gift of a weaker yen during his visit to the US.