Jul 05, 2021

Strategy Bulletin Vol.283

Triple High in the US, Double Low in Japan

-Dollar rises, US stocks tumble as tapering begins, JP stocks regain relative advantage as yen falls

International financial markets have lost their sense of direction

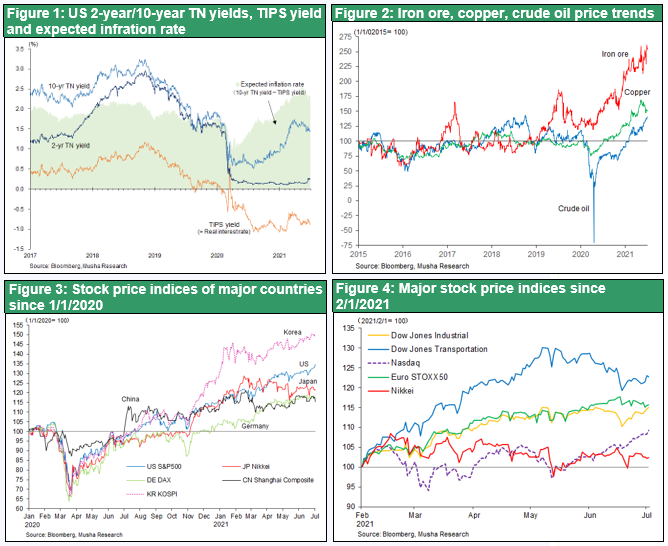

From the start of the Corona disaster until February of this year, the trends in the global financial markets were clear. In anticipation of a post-Corona economic recovery, led by the U.S., interest rates and stock prices rose simultaneously in the world. However, the yield on 10-year U.S. government bonds, which had bottomed out at 0.5% in August of last year, became volatile in March when it rose sharply to 1.74%, and a sense of direction was lost. The logic behind this has also become difficult to understand.

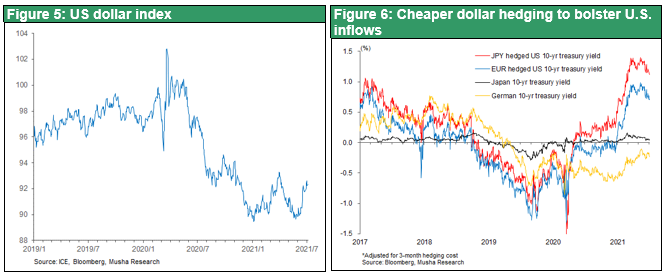

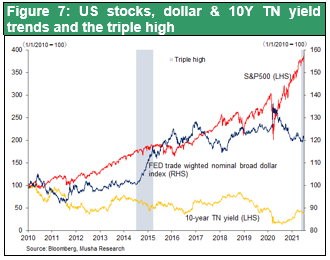

In the past few months, the trend of rising interest rates in the U.S., which was taken for granted because of the economic recovery, has been reversed. Commodity markets continue to rise, but the upward trend varies from commodity to commodity; crude oil and shipping are strong, while copper and lumber are adjusting at high levels. In addition, the U.S. dollar (U.S. dollar trading partner weighted average index) has been on an upward trend since the end of May, after it is continued fall under the unprecedented monetary easing in the U.S. due to the Corona disaster. At first glance, it is puzzling that the dollar has strengthened while U.S. long-term interest rates have declined. Stock prices have also been moving in different directions around the world. The U.S. stock market is extremely strong, with the Dow S&P 500 and NASDAQ all reaching new record highs, and NASDAC, which had been adjusting since March, has been recovering rapidly since mid-May. However, European stocks, which had been growing rapidly since February, have been stagnant in the high range since mid-June, and Japanese stocks have fallen 10% from their February highs, highlighting their slump.

The Mystery of Declining U.S. Long-Term Interest Rates: Foreigners Buying U.S. Treasuries?

The biggest question is why the yield on 10-year U.S. government bonds has fallen sharply to the 1.4% level after the FOMC meeting on June 16, which suggested tapering (reduction of asset purchases) and accelerated interest rate hikes. The central bank's purchases of assets (U.S. government bonds) have tightened the supply and demand for government bonds and kept interest rates from rising. A reduction in the amount of such purchases is a factor pushing up interest rates. How do we explain the mystery of the decline in interest rates despite this? Two hypotheses can be considered.

The first is the pessimistic view of the U.S. economic outlook, that the economy will stall if the support for the Corona measures is removed. However, the outlook for the U.S. economy is positive and a slowdown is unlikely. It is true that there are some downsides, such as the fact that household benefits from the Corona measures are expected to run their course, but the pent-up demand should be quite large, as the huge amount of savings (= purchasing power) that has been accumulated by the accumulation of desire and nest eggs waiting for the end of Corona will explode at once.

The second hypothesis is that there is a favorable supply-demand balance, i.e., demand for U.S. government bonds is rising due to increased investment in U.S. bonds from abroad. The cost of currency hedging, which has prevented foreigners from investing in U.S. government bonds for the past several years, has fallen sharply, and investors in Japan and Europe can still earn interest rates of 1% or higher even with currency hedging. As shown in Chart 6, the yield on 10-year Japanese government bonds is 0.04$ and that on 10-year German government bonds is -0.24%, so the excess return from investing in US government bonds is greater than ever. There is a possibility that investments targeting this interest rate differential are becoming more active.

Buying in the U.S. and triple high in the U.S. pervades the global financial markets

If you think about it this way, you can conclude that the trend running through the world's financial markets right now is to buy the US. U.S. stocks are rising, U.S. bonds are rising, and the dollar is rising simultaneously. This is a sign of growing confidence in the U.S. economy, which is driving the global digital internet revolution and has the strongest economic outlook among developed countries.

The 2014-2015 experience, the US triple high, did not last long.

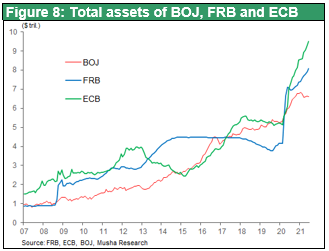

However, in the past, the US triple high was not very sustainable, and the stock market tended to be more volatile. As shown in Chart 7, the triple high after the Lehman shock was most pronounced from the second half of 2014 to 2015, when tapering began, but stock prices later became volatile due to the China shock.

Figure 8 shows the total assets of Fed, ECB, and Japan. The tapering that began in January 2014 caused the Fed's total assets to level off, resulting in a stronger dollar. This time, too, an early tapering in the U.S. will result in a stronger dollar. This time, too, the U.S. will be the first to taper, which will result in a stronger dollar. The pace of the Fed's asset growth has already been slower than that of the ECB. In 2014, domestic investors (institutional investors, financial institutions, and households) increased their purchases of U.S. government bonds, and we can assume that domestic investors suffering from difficulties to find attractive investment objectives will also enter the market this time. If this is the case, demand for U.S. government bonds will rise, and bonds may continue to appreciate.

However, the sustainability of the stock market rally will require caution. We should keep in mind that U.S. equities are vulnerable to external risks such as the China shock in 2015.

The double depreciation in Japan is temporary

In contrast to the U.S., the Japanese market has been marked by weakness not only in stocks but also in the Japanese yen. This is a double depreciation of stocks and the yen. Pessimistic theories are circulating that this is a sell-off of Japan. It is true that Japan's economic outlook is the weakest among developed countries, partly due to the delay in vaccination. However, vaccination in Japan has been accelerated since May and 70% of people will be fully vaccinated at the end of October. It means that Japan will enter hard immunity sage shortly. The IMF and the World Bank will be forced to revise their economic forecasts for Japan significantly upward.

A weaker yen is critical for Japan's business climate and stock prices

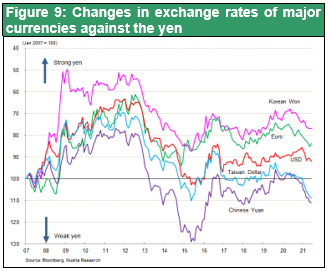

More than that, a weaker yen will be a major boost to the Japanese economy and corporate earnings. The yen is 10% weaker against the dollar than it was at the beginning of this year, but it is significantly weaker by more than 15% against the euro, the Korean won, the Taiwan dollar, and other countries with which it competes in trade. Since the Bank of Japan's Tankan survey for June assumes a rate of 106 yen to the dollar and 122 yen to the euro, there is a lot of room for upward revision. It will also boost the price competitiveness of Japanese companies. High-tech companies active in the international market, top global niche companies, and the tourism industry will greatly increase their competitiveness.

A weaker yen will be the trump card for Japan to overcome deflation and for companies to recover their business performance. As shown in Chart 9, the Japanese economy and stocks have been strongly linked to the relative exchange rate of the Japanese yen, with the yen appreciating against Japanese stocks from 2009 to 2012, weakening against the yen and dominating Japanese stocks from 2013 to 2016, and appreciating against the yen and dominating Japanese stocks from 2016 to 2019. However, since the end of 2019, the Japanese yen has been on a downward trend with almost all currencies.

A weaker yen is a factor for higher stock prices, and the current double-dip should be considered a temporary phenomenon.