Jul 13, 2021

Strategy Bulletin Vol.284

Why big government is inevitable

- The Implications for Investment

The Biden administration has decisively set the trend toward big government. This sharp turn was not caused by Corona, but only a trigger. This trend is irreversible, as the regime shift that had been underway at the bottom has now come to the surface. There may never be a better time for smart government than now.

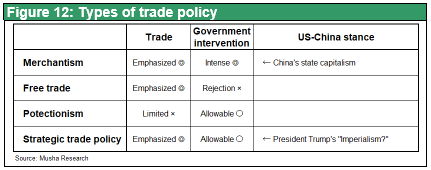

There are three factors that make big government inevitable. The first is the struggle for hegemony between the United States and China. The United States must establish a strong governmental initiative to counter China's despotism in mobilizing national resources. Second, there is a major shift in the challenges facing economics and economic policy. The reality is that the proposition that insufficient supply brings about inflation, which has justified neoclassical economic policies up to now, has receded, and the proposition that insufficient demand brings about deflation has come to the fore. The common sense of neoliberalism, the belief in small government, the avoidance of budget deficits, deregulation, and the avoidance of state intervention in industry and markets, which dominated the Reagan-Thatcher era, is being easily discarded. Instead, "New Keynesianism," with its emphasis on big government, has come to the fore. Third, government support has become crucial in the global high-tech industry and technology competition. Classical free trade has become a useless pretext, and the WTO is rapidly losing its shape. The reason for this is that high-tech industries such as semiconductors are industries of increasing returns, where initial investment and historical effects are crucial, and state industrial policy and trade management have a life-or-death importance for a country's corporate competitiveness.

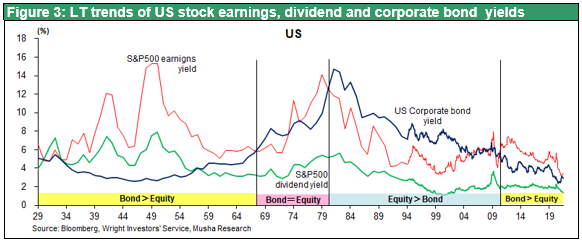

I would like to point out three investment implications for how investors should deal with the coming era of big government. The first is that although big government is a reality, the Biden administration's approach is capitalist, not socialist, and that the rationality of capital (return on capital and cost of capital) will still determine the trend. The government's support will only bring about results by positively affecting the bottom line of companies. Second, the fundamental imbalances of the modern world economy, a surplus of savings and a shortage of demand, will gradually begin to dissipate, leading to higher inflation and higher long-term interest rates, ending the era of declining interest rates and a weak dollar that began in the 1980s. Third, U.S. stock prices will continue to rise, but at a restrained annual rate of about 5-10%. The introduction of Keynesian policies and the bottoming out of long-term interest rates are similar to the environment in 1949, just after World War II. U.S. stocks rose sharply in the 1950s and 1960s. However, stock valuations are very different from those of 1949, when W. Buffett's mentor, Benjamin Graham, wrote "The Intelligent Investor" and stated that stocks were absolutely undervalued (P/E of 7x, earnings yield of 15%, long-term interest rate of 2.5%). U.S. stocks are likely to be restrained on the upside.

(1) The world's economic common sense has suddenly changed, and big government with Biden at the helm

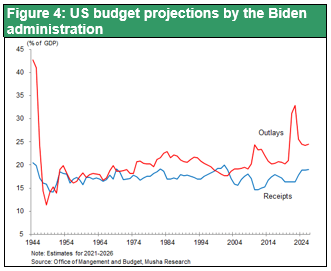

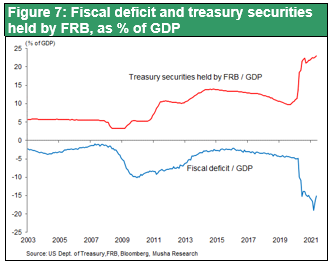

The corona pandemic has fundamentally changed the common sense of economics and economic policy in the world. The neo-liberalism that dominated the world for nearly 40 years since the Reagan-Thatcher era, i.e., the view that budget deficits should be avoided, free trade should be respected, regulations should be relaxed, and state intervention in industries and markets should be stopped, is being easily discarded. Instead, the so-called "New Keynesianism," with its emphasis on big government, has come to the fore. The Biden administration has launched a massive environmental and infrastructure investment plan (American Job Plan) of $2.25 trillion over eight years, following a $1.9 trillion plan to address corona. The plan includes $50 billion in support for domestic semiconductor production, $174 billion in EV development and charging station investment, $46 billion in support for the clean energy industry, $100 billion in high-speed broadband network construction, and $100 billion in smart grid and other power infrastructure investment. In addition, an American Families Plan of $1.8 trillion over 10 years to subsidize education, childcare, and other household needs was also announced. The Fed will respond to this demand for fiscal funds with quantitative monetary easing. The conventional wisdom that taxes and social security should be minimized because they discourage work until the Trump era has been shelved, and an increase in social security is being considered by raising taxes on the wealthy and corporations.

In Europe, the trend toward fiscal expansion has become an established fact. The Maastricht clause, which stipulates a budget deficit of no more than 3% of GDP and government debt of no more than 60% of GDP, has been effectively shelved, and the 750 billion euro European Recovery Fund has been enacted. The time has clearly shifted to the New Keynesian era, and from strengthening the supply side to strengthening the demand side. In the following, I will explain the three factors that make big government inevitable and argue that big government is an irreversible trend.

(2) Factor One that make big government inevitable, US-China confrontation

The U.S. government is getting serious about supporting industrial technology

In order to compete with China's high-tech hegemony, it is essential for the U.S. to take the initiative in fostering technological industries. In particular, in the high-tech industry, a huge initial investment is the key to victory or defeat, so it is crucial to reduce initial costs through government support. In addition, China, which has been blatantly fostering industries on a state-wide basis, is becoming impossible to compete with bare hands.

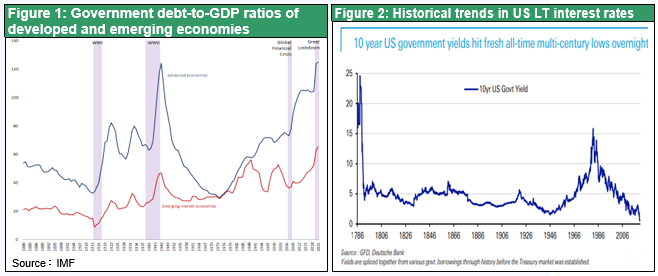

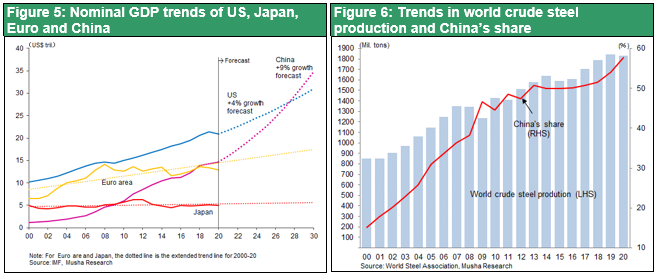

In the first decade of the 2000s, China raised its share of global steel production from the 10% range to 57% (by 2020) with unlimited state capital and subsidies. Similarly, in solar panels, China has beaten off competitors from Japan, the United States, and Europe to capture 80% of the global market share. China's share of the LCD market is now over 30%, the largest in the world. In automotive batteries, CATL, established 10 years ago, has surpassed Panasonic to become the world's largest battery manufacturer. Furthermore, in mobile communication devices, the two Chinese companies ZTE and Huawei hold a 40% share of the global market, far ahead of the US, Japan, and European companies. China is now focusing on becoming a high-tech nation, shifting light industry and heavy industry overseas, and attempting to dominate the world with cutting-edge technology.

The Trump administration has called for sanctioned tariffs against China, compliance with intellectual property rights and sanctions for violations, and suspension of state aid to corporations. However, the Biden administration has gone one step further and announced a grandiose state-sponsored industrial aid program to help the U.S. surpass China in high-tech and advanced technology.

On June 8, the U.S. Senate passed a comprehensive bill (the "U.S. Innovation and Competition Act") to prepare the U.S. for technological competition with China. The bipartisan bill allocates about $200 billion over five years to strengthen U.S. technology and research. About $54 billion will be spent to strengthen production and research of semiconductors and communications equipment. Of this amount, $2 billion would be used for semiconductors for automobiles, which are in serious short supply. The Senate bill also includes other provisions related to China, such as measures to prevent the purchase of drones manufactured and sold by companies that receive support from the Chinese government. It also mandates broad sanctions against Chinese organizations involved in cyber-attacks in the US and intellectual property theft from US companies and provides for a review of export controls on products that may be used for human rights abuses.

The President, the White House, and the Senate leaders of both parties are in complete agreement, and it is expected to be approved by the House of Representatives. We are in the midst of a race to win the 21st century," The President said. We are in a race to win the 21st century, and this bill signals the start. If we do nothing, the era of the United States as a superpower will be over. We don't want to see the U.S. become a halfway house in this century," said Senate Majority Leader Chuck Schumer, the top Democrat in the Senate, and "We will not only defeat the Chinese Communist Party, but we will also use that threat to make a better America by investing in innovation," said Senator Todd Young, the Republican co-sponsor. U.S. Commerce Secretary LeMond said the funding could result in 7-10 new semiconductor plants in the U.S.

The economic boom and national power boosting by big government is also important in the confrontation of hegemonic powers. In the 1930s, Hitler's aggressive fiscal policies, such as the construction of the autobahn in the early stages of his rise to power, revitalized the economy, reduced unemployment, and boosted national power. Hitler is said to be the world's earliest adopter of Keynesian policies. This aggressive fiscal policy increased the public's attraction to Hitler and also significantly increased Germany's superiority, enabling the German military to make a rapid advance in the early stages of the war. Currently, China is implementing public sector-led demand promotion measures, and the size of China's manufacturing market has reached twice that of the United States. This huge domestic market is the source of China's competitiveness. The United States cannot afford to lose out to China in terms of domestic economic stimulus.

(3) Factor Two that make big government inevitable: Ample savings and lack of demand

Even before the corona pandemic occurred, the world economy was facing two problems: downward pressure on prices = insufficient demand, and downward pressure on interest rates = too much money. One-third of the developed economies were in an abnormal situation where long-term interest rates were negative. In addition, deflation was causing a downward spiral in economic growth. The shortage of demand was caused by an increase in productivity due to globalization and the technological revolution driven by the Internet, AI, and robotics, which boosted supply capacity. Falling interest rates were caused by the high profits of the private sector (especially corporations and the wealthy) at play. In short, deflationary pressures and abnormally low interest rates were brought about by unusual savings (i.e., the deferral of purchasing power) and a lack of demand.

Such an environment is similar to the economic conditions that Keynes faced during the Great Depression of the 1930s. The typical symptom is a "liquidity trap," in which monetary policy becomes ineffective as interest rates fall to a critical point and money preference becomes extreme. As was the case back then, this is a situation where demand creation through public finance is strongly required. Therefore, whether a coronary pandemic occurred or not, it was necessary to use the surplus funds available through both fiscal and monetary expansionary policies to stimulate demand. Freeing ourselves from the spell of fiscal moderation, which is completely unsuited to the current era, was the most necessary thing to do.

Just as the Great Depression was the starting point for the modern "cradle-to-grave" social security system, the Corona pandemic may open the way for a dramatic expansion of the social safety net, the emergence of a universal health system, and an era of universal basic income. Many concerns have been raised about dealing with budget deficits, handling the massive expansion of central bank credit, and maintaining the independence of central banks, but only after the end of the Corona crisis will we know if this is really a problem. However, we will not know if this is really a problem until after the end of the Corona crisis. In fact, there is a greater possibility that accelerated growth will naturally resolve these problems.

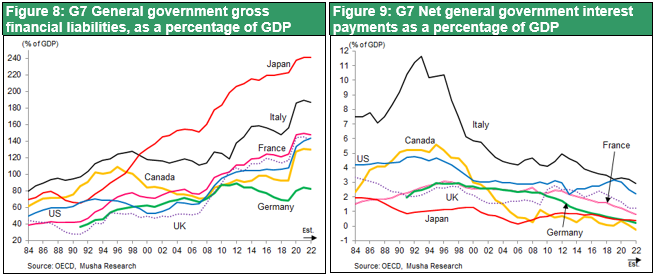

From the standpoint of economic common sense, the criticism has been that unprecedented budget deficits will cause moral hazard, leading to inflation, higher interest rates, and other problems. However, the reality is quite the opposite. In the era of neoliberalism after Reagan and Thatcher, insufficient supply and insufficient savings were considered to be the bottlenecks of the economy, and inflation was considered to be the greatest economic risk. Therefore, neoliberal economics was a supply-sider, focusing on strengthening the supply side. However, the low global interest rates over the last decade indicate that savings are abundant, and demand is chronically weak. This may mean that budget deficits are not damaging, but rather necessary. It can be said that the axis of economics and economic policy is clearly shifting to the demand side. U.S. Treasury Secretary Janet Yellen, who is also an economist, has won the support of most U.S. economists by arguing that "at this time of historically low interest rates, large-scale economic stimulus will accelerate employment and economic growth, and the benefits will far outweigh the costs. International organizations such as the IMF and the World Bank, which have been harshly critical of budget deficits due to concerns about insufficient savings, have also made a major shift in their arguments.

The concept of government debt has changed dramatically. In Europe, when the southern European countries, especially Greece, fell on hard times to repay their debts after the global financial crisis, the economic powers in the Eurozone and the International Monetary Fund (IMF) urged them to drastically curb their fiscal spending. Instead of economic recovery, Greece's economic situation worsened further, and its budget deficit widened, and in retrospect, the IMF admitted that it had made a bad decision and conducted a wide-ranging review. Olivier Blanchard, the chief economist at the time, concluded that the effectiveness of fiscal spending was remarkable, especially in the midst of the crisis when aggregate demand was weak. A few years later, modern monetary theory (MMT), which gives a major role to fiscal spending that had been considered heretical, began to attract attention, and mainstream economists began to fundamentally rethink the concept of government debt. Mr. Blanchard is one of them. He proposed that if a country's interest rate is lower than its economic growth rate - which is the case in many developed countries today - then it should not hold back on public investment. (Reuters Howard Schneider, Jan. 21) It is safe to say that incoming Treasury Secretary Janet Yellen's declaration 6 month ago invites this heretical debate on MMT and other issues to the policy center in Washington.

The monetary and fiscal regimes can be compared to the shell of an insect. When the old monetary and fiscal regimes, the shells of the past, are unable to cope with the expansion of economic realities brought about by technological and productivity improvements, a new regime emerges. The constraints imposed by the gold standard on the issuance of more money led to the Great Depression in 1929, forcing a transformation to a managed currency system. In addition, the U.S. recession around 1980 was recovered by increasing the printing of the world currency, the dollar (Reaganomics), which was made possible by the suspension of the exchange of dollars for gold, and this led to the new Bretton Woods system (the era of global managed currencies).

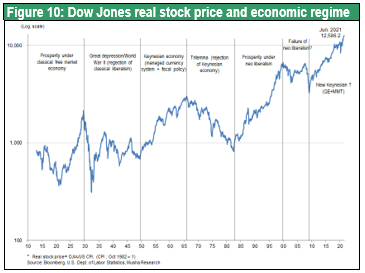

Looking back at U.S. history, it is clear that the rise and fall of the U.S. economy and the 100-year trend of the New York Dow Jones Industrial Average have been transformed by the financial regime (i.e., the mechanism for printing more paper money). Figure 10 shows the real NY Dow (NY Dow divided by the price index), which indicates the value of stocks as purchasing power. There have been three major upswings in the past 100 years, and we are now in the fourth.

What are the three waves?

1. 1910s to 1920s (rise under the classical liberal regime under the gold standard)

2. 1950s-1960s (rise under the Keynesian economic regime, which was based on a system of managed currencies and increased domestic banknote printing)

3. 1980s to 1990s (rise under the global neoliberal system under the global managed currency system → dollar spread system).

And now

4. We may be have entered new rising phase. This can be thought of as a market-based system, using a new mechanism for issuing banknotes called QE (quantitative easing) and a means of issuing currency that matches the market's tolerance of stocks and other instruments. The emergence of theories that justify fiscal stimulus, such as the Sims Theory (Fiscal Theory of Price Level) and MMT (Modern Monetary Theory), suggests that we are entering an era in which demand creation through the two engines of monetary easing and fiscal policy is essential and appropriate. Japan's early Abenomics and Trump's macroeconomic policies of total fiscal and monetary mobilization have been launched, and Biden and Fed Chairman Powell's policy of integrated monetary easing in the world can be said to be the forerunner of the "New Keynesian Policy.

(4) Factor Three that make big government inevitable, State support is essential for high-tech industry competition.

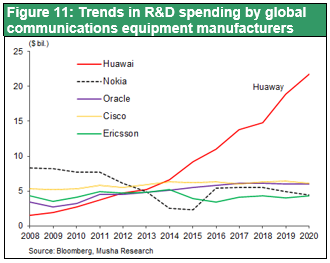

It is important to recognize that the principle of free trade does not apply to today's high-tech, semiconductor, software, and other advanced sectors. The overwhelming portion of the cost of high-tech and other advanced sectors is the accumulation of past investments (R&D investments, sales networks, business acquisitions), and the variable costs that are influenced by macroeconomic factors such as wages, inflation, and exchange rates are so small that macroeconomic policy adjustments are completely ineffective. Once a country becomes a high-tech powerhouse, no amount of currency appreciation or wage hikes can take away its competitiveness. This is called the hysteresis effect, and it is a world in which the principle of increasing returns works. In other words, the winner takes all and cannot be easily destroyed. In state-capitalist China, the power of fostering high-tech companies through national projects is immense, as seen in the rapid rise of Huawei. China's extreme heavy mercantilism was so overwhelmingly in its favor that it was inevitable that the Trump administration would cause trade friction to counter it. But that was not enough, and the Biden administration is embarking on a state-wide industrial development effort.

The rise of Huawei is a good example of China's state involvement, although Huawei's strength has now reached a point where normal market competition is completely uncontrollable. Why did this happen when we were a little careless? The reason lies in Huawei's overwhelming investment in development. As shown in Figure 11, over the past decade, Huawei's R&D investment has increased tenfold (from $1.9 billion in 2009 to $18.9 billion in 2019), while other companies have remained almost flat. This overwhelming investment in R&D by Huawei can only be attributed to government support. It is obvious that Huawei's very strong price competitiveness under government support has overwhelmed other companies with high costs based on market prices, destroying the corporate profits of the entire telecommunications equipment industry, and causing a situation where others cannot compete at all. This is a typical example of social dumping by state capitalism. The U.S. government considered the possibility of fostering domestic telecom equipment companies and called on Cisco and other related manufacturers to acquire Ericsson and Nokia, or to take a stake in them, but Cisco and other U.S. manufacturers reportedly refused, saying that these companies were too unprofitable to be acquired.

At last, the U.S. government is not only shutting down Huawei, which has leapt to become the world's most powerful 5G-related equipment company but is also promoting the exclusion of China in many other high-tech fields and trying to build a new global supply chain that excludes China.

In order to level the playing field, the U.S. will have to provide corporate support, and government involvement will be critical in the global decarbonization movement that has gained momentum in the 2020s. Supporting specific industries and companies with economic penalties and advantages in terms of carbon emissions is truly a public intervention in the private sector.

In the first place, the pastoral free trade theory and the comparative advantage theory were not viable in the 21st century. The following issues can be pointed out.

- The overwhelming portion of costs are fixed costs (i.e., accumulated past investment in R&D, accumulated capital investment, sales franchise investment, etc.) → Hysteresis effect, world of increasing returns, not easily destroyed, policy is decisive for fixed costs

- Generalization of international division of labor between processes within a company → For example, Musha Research is also developing international division of labor within a company, even though it is a small company, such as using a database in the U.S. as a material, completing it as a product in Singapore, and selling it in Europe under a Japanese brand and franchise. In this kind of division of labor, the allocation of value-added among countries changes due to the partitioning among countries, and the overwhelming allocation is to HQ (the country where the headquarters is located), which does not fit the law of comparative advantage and factor cost equalization.

- All direct labor processes will eventually become unmanned → Mother factories will play a decisive role as the key to know-how in manufacturing process organization.

I would like to confirm the significance of state intervention through trade and industrial policy by introducing the new trade theory of Paul Krugman, who won the Novel Prize in Economics. In response to the limitations of the classical free trade theory, the new trade theory proposed by Krugman in the 1980s sought the cause of the international division of labor and the emergence of trade in the form of lower costs resulting from the advantages of scale brought about by the regional concentration of industries. It also believed that what brings about the concentration of industry in a particular region is not a God-given innate, but an acquired second innate. Second nature is a trait that is acquired by chance or policy, but like a gene, it may be small at first, but it is destined to develop in the future. Silicon Valley has the presence of Stanford University and the wonderful weather and nature that attracts talented engineers. In the case of Bangalore, India, policy was decisive. In the case of Detroit, the coincidence of being the hometown of Henry Ford, the founder of the automobile industry, led to the regional concentration of the automobile industry. In each case, the first drop was crucial.

It is very similar to the formation of icicles. In winter, large icicles hang down from rain gutters in cold regions such as Hokkaido. The only reason I can think of is that the first drop fell from there. Perhaps there was some small debris on the rain gutters that caused the drops to fall. The paint may have been applied unevenly, creating uneven surfaces. If for some reason the first drop of water is determined to form a tiny icicle, the second drop will always fall from the same spot, and the third and fourth drops continue to grow. Eventually, a large icicle is formed, but this is entirely determined by where the first tiny drop fell from. The hysteresis effect of accumulation further increases efficiency and strengthens competitiveness. Krugman calls the Silicon Valley of high technology and the Seattle of airplanes the places where roulette just happened to stop, but the first drop significantly increases the so-called externality, making it more advantageous for companies, workers, and engineers to be located in close proximity to each other.

When such ex post facto forces bring about the first drop and determine the future fate of the country, government intervention in the form of managed trade, trade policy, and industry development measures, rather than free trade, is sometimes necessary. This means that it is very important for the government to intervene to give the second nature. The effect of this first drop has been maximized in the high-tech industry.

This series of arguments shows that there are limits to the market mechanism, or the optimal allocation of resources by the market.

As we have discussed above, this trend is irreversible as long as there are decisive circumstances that make big government inevitable. In the past, the success of the Ministry of International Trade and Industry (MITI)-led Super LSI Technology Research Association (1976-1980) was highly criticized during the Japan-U.S. trade friction, and since then the Japanese government has been reluctant to support industrial technology, partly because of the increasing budget deficit.

However now is the time to change such stance.