Sep 27, 2021

Strategy Bulletin Vol.290

Evergrande crisis signals the end of the growth story with Investment=Debt expansion

~The financial crisis will be averted for the time being, but a marked slowdown is inevitable

(1) How the Evergrande crisis unfolded and what will happen next

The Evergrande Group's business crisis has effectively broken down

As of the end of June, Evergrande Group, China's largest real estate company, was in financial crisis, with interest-bearing debt of RMB 570 billion, or more than 9.7 trillion Japanese yen ($89 billion in loans and bonds issued). If we add to this the accounts payable owed to suppliers and the down payments and prepayments made by homebuyers, the total debt is estimated to be RMB 1.96 trillion, or about 33 trillion yen.

The tightening of real estate regulations by the Chinese government over the past few years has triggered confusion in the real estate business, including worsening profitability, cash flow difficulties, construction stoppages of properties under construction, stagnant payments to clients, and the inability to move into purchased condominiums due to lack of prospects for completion. If Evergrande Group goes bankrupt, it will have a major impact on its employees and business partners. In addition, if Evergrande Group were to sell off its properties in a hurry to raise funds, other companies would also be affected through falling real estate prices. In addition, losses incurred by financial institutions and investors could trigger a chain reaction of financial difficulties.

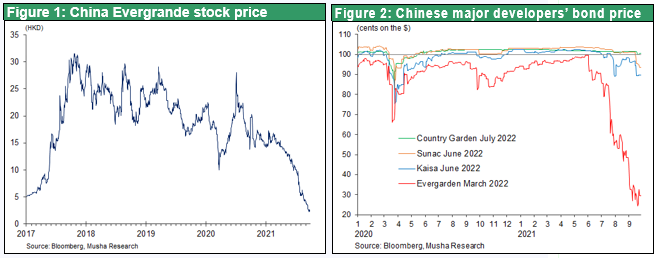

The stock price of Evergrande Group, which peaked at 20.2 HK dollars last year (October 8, 2020), plummeted to 2.11 HK dollars on September 20 this year, a tenth of its value. Corporate bonds have also fallen to less than 30% of their face value, factoring in the bankruptcy. There are concerns that the company will suspend interest payments and default on its debt. Evergrande Group has announced interest payments in yuan, but interest payments in dollars appear to have been delayed. It is reported that the authorities have supported the company's efforts to avoid default, but we cannot be too sure.

The main cause of the crisis is not only the hyper-aggressive and debt-dependent management of the Evergrande Group, but also the tightening of financial regulations in response to the bubble that has been building for several years. In 2020, the Xi administration announced restrictions on the total amount of real estate loans (no more than 40% of bank loans), stricter restrictions on second mortgages, and controls on condominium prices. The real estate lending restrictions in particular were specific and effective immediately, with the eligibility conditions being (1) an asset-to-liability ratio of over 70%, (2) an equity -to- net debt ratio of over 100%, and (3) holding cash in excess of short-term liabilities. Development loans fell to a record low of 2.8% growth in June this year, while home sales fell 19.7% year-on-year in August.

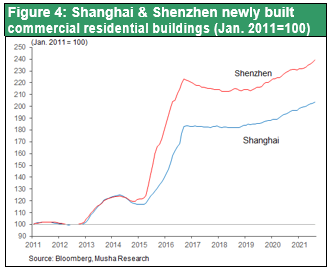

Housing prices soaring beyond limits

It is true that China's real estate bubble has exceeded the acceptable limit. Housing prices in major cities such as Beijing, Shanghai, and Guangzhou have risen 50-60% over the past five years, and have reached almost 50 times the average annual income in each city, almost five times that of Tokyo, New York, and London, which are around 10 times higher, making it commonplace for young people to be unable to afford a home for the rest of their lives. The authorities could no longer tolerate this public dissatisfaction.

In addition, the Xi Jinping administration has abandoned Deng Xiaoping's "wealth first" policy, which allowed market forces to drive inequality, in favor of a "common prosperity" policy that requires the wealthy to donate to the lower income groups. Real estate regulation was an important pillar of this policy shift.

No financial crisis, no bubble to burst in the near term

Some in the market are concerned about a repeat of the GFC. "As of the end of June, China's real estate loans had ballooned to 50.78 trillion yuan, five times the size of a decade ago and equivalent to about half of China's nominal GDP. In addition, land sales accounted for 31% of local government revenue in 2020. Real estate, construction, and mortgages account for 41% of Bank of China's loans in mainland China. The ratio of non-performing loans in real estate lending has risen to 4.9% as of June this year from 0.4% a year earlier. Household borrowing has risen sharply on the back of the boom, with household debt to GDP rising to 62% from 44% five years ago." (Wall Street Journal, 9/7/21)

However, the Chinese government appears to have the ability to avoid a total collapse of the Evergrande group. China has a closed financial system, its major banks are state-owned, and the rule of law is loose. The government can take charge of corporate restructuring and avoid a systemic collapse, which is completely different from the situation in Japan, where it took five or six years to inject public funds. If a solution emerges early and the Chinese authorities move to further ease monetary policy, a serious real estate downturn can be avoided for the time being. Housing prices in major cities in coastal areas continued to rise in August. In addition, housing inventories nationwide are much lower than during the last housing market downturn in 2015. It is inevitable that China's economic growth will be severely braked in the early fall of 2021 and early 2022, but the Chinese authorities can take decisive action to prevent the situation from deteriorating further. Global stock prices, including Japan's, have remained strong, and the prevailing view is that a global financial crisis originating in China will not occur.

However, there is no doubt that China's growth story of the past 20 years, supported by extreme excess debt and over-investment, has turned a corner with the Evergrande Group crisis.

(2) Toward the end of China's investment-debt expansionary growth, the Xi administration may be launching a contingency plan

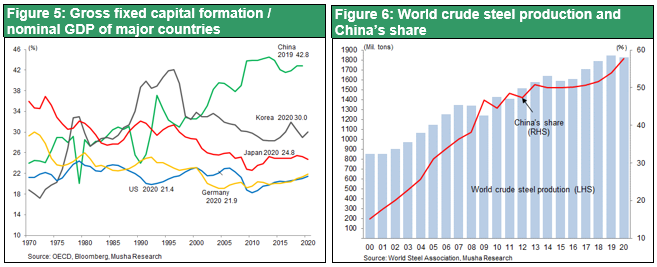

Unusual investment-led growth structure, huge accumulation of production capacity

The high growth of the Chinese economy has been supported by massive investment. As can be seen in Figure 5, the ratio of fixed capital formation to GDP is an outstandingly high 43%. In the past, this investment was mainly in manufacturing companies' facilities and infrastructure, but now it is mainly in real estate. As a result of this high investment, China's construction-related industries have become extremely bloated. While China's share of the world's population is 20% and its share of the world's GDP is 17%, its industrial production capacity is over 30%. In particular, China's share of the world's cement production is 60% in terms of investment. Almost all of this is consumed domestically. While the U.S. consumed 4.5 billion tons of cement in the past 100 years (1901-2000), China consumed 6.6 billion tons in the past three years (2011-2013), a 50% bigger than the U. S’s century’s consumption. China's crude steel production was 128 million tons in 2000, a mere 15% share of global production (850 million tons), but by 2020 it will be 930 million tons, a 57% share of global production (1.79 billion tons). This means that 85% of the global production increase (940 million tons) in the 20years since 2000 has been carried by China.

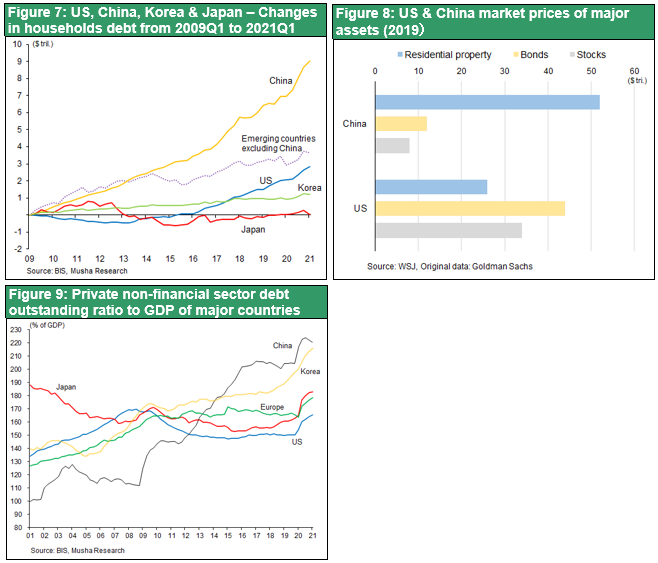

This real estate investment has been supported by increasing debt and soaring real estate and housing prices, but this has reached a major turning point with the Evergrande Group's business crisis. Figure 7 shows the increase in household debt over the 11 years since the GFC, with China accounting for $9.0 trillion, far more than any other country ($2.8 trillion in the U.S., $1.22 trillion in South Korea, and $0.04 trillion in Japan). As a result, the housing bubble has been unusually high as mentioned above. Figure 8 compares the market values of the U.S. and China (estimated by Goldman Sachs) and shows that China's residential real estate is worth $52 trillion (3.6 times the GDP), twice as much as the U.S. $26 trillion (1.2 times the GDP). The skyrocketing housing prices and rising debt, which significantly exceed this annual income, have reached their limits.

Xi Jinping's contingency plan in effect?

It is important to note, however, that the Xi Jinping administration appears to have recognized that this erratic growth pattern is unsustainable and has begun to address it. The real estate lending restrictions that led to the Evergrande Group's financial crisis are an initiative of the administration. This would inevitably lead to: (1) a contraction in the size of the huge real estate and construction investment-related industries, which are estimated to account for 30% of GDP, and a decline in employment; (2) difficulties in local government finances, which had been 30% dependent on revenues from land sales; (3) a deterioration in consumer confidence as asset prices stop rising; and (4) a marked slowdown in economic growth. If the real estate bubble were to burst, it would trigger a credit crunch due to the significant depreciation of household and bank assets, and the consequences could be frightening.

Is Xi's concentration of power and return to socialism a way to deal with the coming crisis?

In order to overcome the potential difficulties, strong social control and centralization of power will be essential. Xi Jinping's seemingly reactionary policy of strengthening despotism and rejecting capitalism may be a way of consolidating the system against the coming economic difficulties.