Jan 01, 2022

Strategy Bulletin Vol.297

Japanese Stocks in 2022, Positive Surprise Expected

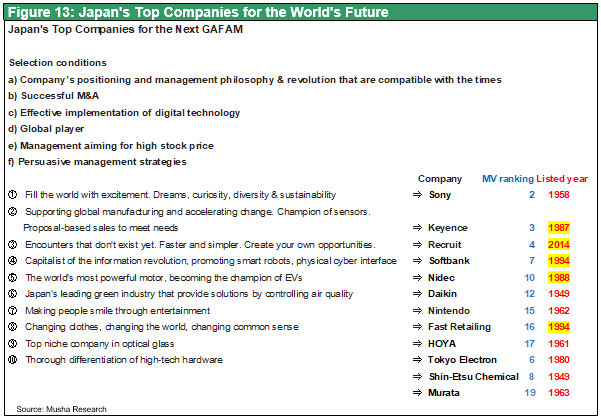

- Focus on the business models of Japanese companies that will lead the NEXT GAFAM

Happy New Year to you all.

I hope you have a happy and healthy new year.

Thank you for reading Musha Research's reports.

We are pleased to present the New Year issue here. We hope you will enjoy reading it.

New Year's Day, 2022

The year 2021 has been a parade of self-defeating thoughts, with defeats in high-tech, green, finance, and Corona. So far, our pessimism is at a negative extreme. All defeats are merely the result of things that happened in the past, or negative seeds that were sown in the past, and do not mean that Japan will continue to lose in the future.

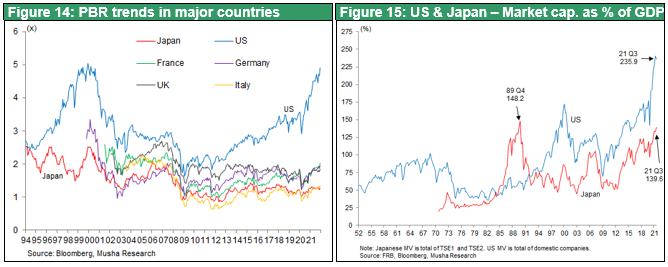

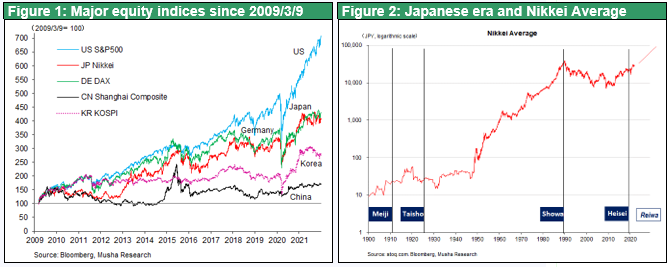

Looking back at the past, we can see that Japan's worst period was a long time ago. The post-bubble low for Japanese stocks (Nikkei 225) was 7,054 yen on March 10, 2009, and the recent high was 30,795 yen on September 14, 2021. Over the past 12 years, Japanese stocks have increased 4.37 times (13.1% annualized). This performance is an honorable mention in the world, except for the United States. Japan was really inferior to the rest of the world until eight years ago, when Abenomics began, and since then it has been in a process of steady catch-up. This is supported by a major transformation in the business models of Japanese companies and a dramatic increase in corporate profits. Since value creation in companies is the most important factor in shaping the future, there is a great possibility that stock prices will maintain this pace of growth. If this is the case, the Nikkei 225 will reach 100,000 yen in 2031, 10 years from now. Let us consider why we can expect value creation by corporations in Japan.

There is an extreme disparity in wealth creation between pessimists and optimists. Critics of stock investment who blames the disparity should reflect on their own ignorance rather than denouncing politics and the system.

(1) Why we should be optimistic about the market outlook for 2022

2022 will continue to be a positive year for the economy and markets. Firstly, the global investment environment is favorable. Secondly, Japanese equities are beginning to revalue and valuations may improve.

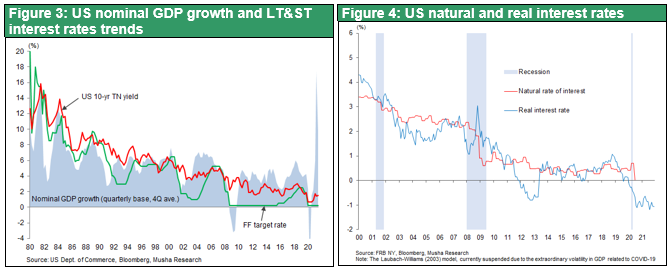

The uncertainty surrounding the market has largely disappeared. The confrontation between the US and China is still fierce, but on the economic front it has become more like a war of attrition and the uncertainty is disappearing. The coronary pandemic is not yet under control due to the emergence of mutants such as Omicron, but the negative impact on the economy is diminishing. In addition to accelerating innovation, the environment is likely to remain conducive to risk-taking, with mild inflation and friendly monetary policy. Political events such as the US mid-term elections and the presidential elections in France and South Korea are unlikely to be major disruptors. Political upheaval in China (?), the victory of the conservative candidate in the South Korean presidential election (?) Surprises such as political upheaval in China, appeasement of Japan and South Korea due to the victory of the conservative party candidate in the South Korean presidential election, etc. are likely to be more positive. We expect the Nikkei average to be 28500-35000 yen, the NY Dow Jones Industrial Average to be 35000-40000 dollars, US long-term interest rates to be 1.25-1.90%, and the US dollar to be 113-123 yen. The index-driven and futures-driven structure of the market has been reinforced by the increasing inflow of individual funds into the market via ETFs. As a result, volatility is likely to increase. We may have to expect a certain amount of stock market correction somewhere in the middle of the year.

The negative impact of US monetary tightening on stock prices is not a cause for concern

There is no need to worry too much about US monetary tightening. The market participants are more cautious than ever, so this could be a surprisingly solid year. This is because (1) inflation is temporary and (2) the long-term trend of lower interest rates will continue. The TINA (There is no alternative) situation will continue in 2022, and risk-taking will continue to be rewarded.

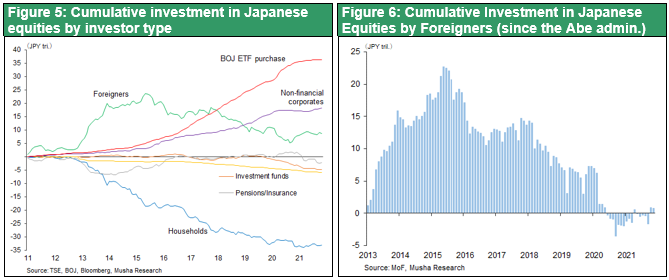

Japanese equities firm in 2021 after hitting 30,000 at the start of the year

Japanese equities have been surprisingly strong in 2021. Even though the Bank of Japan and foreign investors, the two main buyers of Japanese stocks, stopped supporting the market, Japanese stocks remained in positive territory year on year. (1) The Bank of Japan almost stopped purchasing ETFs, (2) foreigners sold Japanese stocks, partly due to the decline in the number of stocks included in the MSIC indexes, and (3) SoftBank Group (7% of the index), which has a large influence on the index, saw its profits fall sharply (from ¥5 trillion in FY2020 to less than ¥3 trillion due to the sharp fall in Alibaba's share price). In spite of the bad news, the adjustment from the post-bubble high of 30,700 yen was modest. In 2022, these negative factors will have run their course.

New players and new investment entities (individual savings accounts) to increase the attractiveness of Japanese equities

If Japanese equities are to become relatively more attractive in 2022, there are four reasons for this.

- Large upward revision of economic expansion → Japan, which suffered the least health damage from the pandemic , suffered the largest economic damage (decline in economic growth) in the developed world. The IMF and others may revise upward Japan's economic outlook significantly.

- Geopolitical winds: A weaker yen, the return of high-tech clusters to Japan, and the gods of fate smiling on Japan.

- Inflows of private investors' funds will improve the supply-demand balance for stocks and help Japan break out of the value trap (i.e., correct the undervaluation of Japanese stocks).

- Japan's potentially superior business models will be re-evaluated.

It is particularly important to explain points iii. and iv. here.

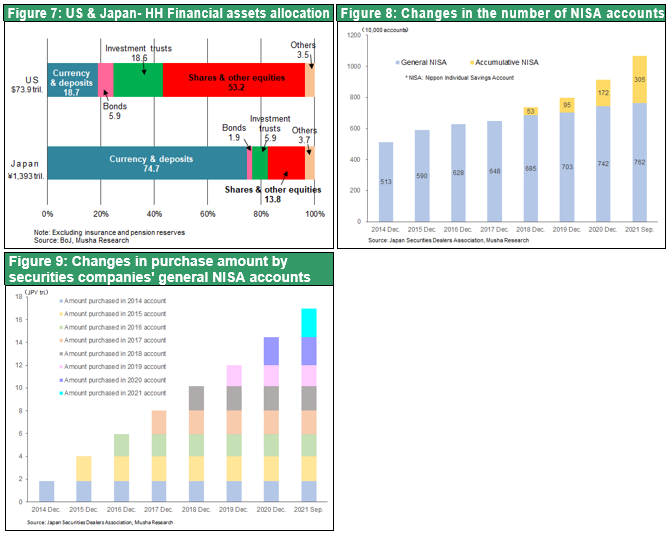

Japan has the world's largest waiting list for potential equity investment and steadily increasing securities investment courses

Japanese households hold 1,072 trillion yen in cash and deposits that earn no interest at all. This is the world's largest waiting list for equity investments. If even a small part of this money were to go into the stock market, where dividends alone can return 2%, share prices would rise sharply. We are beginning to see the beginnings of this. Young people, who need to think seriously about their future, have begun to take advantage of asset building schemes such as Accumulative (Tsumitate) NISA and iDeCo. As can be seen in Figure 8, the pace of growth in the number of securities accounts has been accelerating. In the near future, individual stock savings accounts will become the largest source of stock purchases.

(2) A group of Japanese companies qualified for the NEXT GAFAM

The change in the leading role of Japanese industry is proceeding rapidly

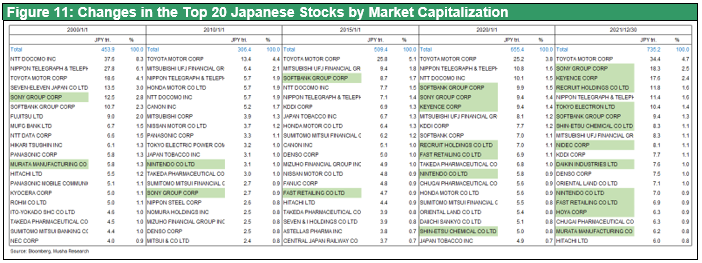

It is a pleasant surprise to see that the leading players in the Japanese economy are not the banks, heavy industries (steel, chemicals, heavy duty industries, heavy electric industries), automobiles and electronics companies that have been core member of the Keidanren and Keizai Doyukai since the Showa era. The market capitalization rankings show that Japan's leading companies are changing rapidly. These companies may have the potential to rival GAFAM in the future.

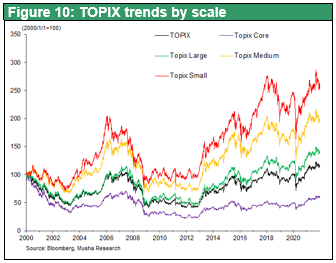

Unlike the U.S., the metabolism of leading companies did not occur in Japan for a long time. However, in the years following the Corona pandemic crisis, a group of companies with sufficient qualifications to be entrusted with Japan's future has emerged. The green shadows in Figure 11, which Musha Research has arbitrarily rated as Japan's leading companies in the NEXT GAFAM era, show a sharp increase from around two out of 20 companies in the top 20 by 2015 to 12 by the end of December 2022. The pattern of the stagnation and fall of old-style large companies and the rise of new medium-sized companies has been going on for more than a decade, as can be seen in Figure 10, which shows the TOPIX share price performance by size. It is now time to see a change in the cast of characters on the main stage.

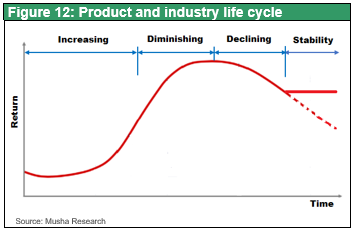

GAFAM is in a transition period from increasing return to diminishing return

GAFAM is thriving at a rapid pace around the world, and US stock prices have continued to perform strongly as a result. This is because the Internet platform industry dominated by GAFAM is in a period of diminishing returns.

Every product or industry has a life cycle of (1) increasing return phase, (2) diminishing return phase, (3) declining phase, and (4) stability (or extinction) phase. Let's look at this in terms of the relationship between beer consumption and utility. The first small glass of beer is not enough to satisfy you, but when you quench your thirst with a large mug of beer, you will be very satisfied. Up to this point, the more you drink, the more satisfying the next drink is than the first. However, as you drink more and more, you enter a period of diminishing returns, where the pleasure gradually fades. The more you drink, the more you start to get drunk, the more unpleasant the sensations become, and finally you stop drinking beer, which is the decline phase. Looking back at the history of agriculture, the period from 4000 BC, or around 200 AC in Japan, when mankind began farming and dramatically increased its productivity, was a period of increasing returns, with excess returns leading to population growth and huge construction structures such as pyramids and burial mounds. However, at the end of the Medieval Ages and the beginning of the Modern era, when classical economics made agriculture an object of analysis, it entered a period of diminishing returns, and with the Industrial Revolution it entered a period of decline.

GAFAM are seeking for frontier which make them possible to stay increasing return phase

It has been more than 20 years since the internet became widely used. During this time, the US has seen the emergence of tech giants such as Google, Apple, Facebook (Meta) and Amazon, and the US stock market has enjoyed a golden age. However, it seems that this momentum is beginning to slow down. The period of increasing returns has been passing, and we will be entering a period of diminishing returns. For example, in the music and video streaming (auto-distribution) genres, many companies have entered the market, causing price competition and worsening profitability. GAFAM has pioneered many conveniences in the internet and cyber world, gaining a dominant user base and using its monopoly to dominate various external content providers. However, the surprise of new features added to new phone models is becoming less and less. As smartphone manufacturers compete and prices fall, finally the role of the platformer may be likely to become a mere conduit for the flow of content from right to left. In the future, it will not be the pipes that create added value, but the content provided through them. In addition, giant platformers such as GAFAM are using their monopoly power to control and acquire online app providers and content makers to create conglomerates, which may soon face antitrust charges.

Facebook has changed its name to Meta and has announced plans to step up development of a virtual space called the Metaverse. As its current platform business looks less profitable, it is looking to the virtual world for new sources of revenue. But while virtual spaces such as the Metaverse will make us feel more real, will they generate the same level of enthusiasm as past? Metaverse will require huge investment for data processing, but will it be cost-effective?

Another new frontier in the cyber world is the world of blockchains, such as crypto currencies, but this is a decentralized data management space that is difficult for platformers to dominate.

The next frontier: 1) cyber physical interface

The next frontier will not be the deepening of the cyber world, but the use of high technology to solve problems in the real world. The IoT is a fusion of cyber and reality. At SoftBank World 2021, Masayoshi Son, Chairman and CEO of the SoftBank Group, gave a keynote speech on the theme of "The coming of the age of the smart robot", referring to robots that can learn from AI and move flexibly ". If 100 million Smabos (smart robots) are introduced to Japan, the country will be reborn with a workforce equivalent to one billion people. If 100 million of these robots were introduced into Japan, the country would be reborn with a workforce equivalent to one billion people, which would directly solve the social problems of a country with a declining birthrate, a super-aged society and a shrinking workforce.

The elemental technologies required for the Smabos are the various sensors that serve as the eyes of the Smabos and the actuators that enable it to move smoothly. Japan has the world's strongest players in these technologies. Keyence, the world's leading manufacturer of sensors (ranked 3rd in terms of market capitalization), Nidec, the world's leading manufacturer of high-performance motors (ranked 10th), Murata Manufacturing, the world's leading manufacturer of high-performance components (ranked 19th), Tokyo Electron, the world's leading manufacturer of semiconductor production equipment (ranked 6th), Shin-Etsu Chemical, the world's leading manufacturer of semiconductor wafers (ranked 8th), and HOYA, the world's leading manufacturer of optical glass (ranked 17) are the world's top players in the era of "cyber-physical interfaces", which combines cyber and physical technologies.

The next frontier, 2) Content

As the clay pipes provided by GAFAM become cheaper, the content carried by them will become the main source of value creation. Sony (ranked. 2nd) is probably the world's largest company that has distinguished itself from GAFAM by focusing on content. Sony's corporate philosophy is to "deliver excitement to customers" and it has established the world's strongest base in film, video, music and games. Nintendo (ranked 15th) is another global player specializing in game content.

Masayoshi Son, the world's most powerful capitalist

Others include the Softbank Group (7th), led by Masayoshi Son, the most powerful capitalist in the age of the information revolution ; Fast Retailing (16th), led by the revolutionary Yanai; and Recruit (4th), which has been a leader in the matchmaking business since long before the advent of Facebook. and Daikin Industries (12th), which advocates "a company that answers questions with air" in the environmental field, are all global players with established business models that qualify for the NEXT GAFAM. Japan has all the companies that can win on the world stage, or already have the world's top market share in their respective fields. If these companies are properly evaluated and the pessimistic mood is lifted, the unusually undervalued Japanese stock market is expected to change dramatically.