Aug 13, 2025

Strategy Bulletin Vol.385

Under Mr. Ishiba, the Nikkei average hits a record high

~Why are pessimists wrong?~

Lagging Japanese stocks rapidly catch up

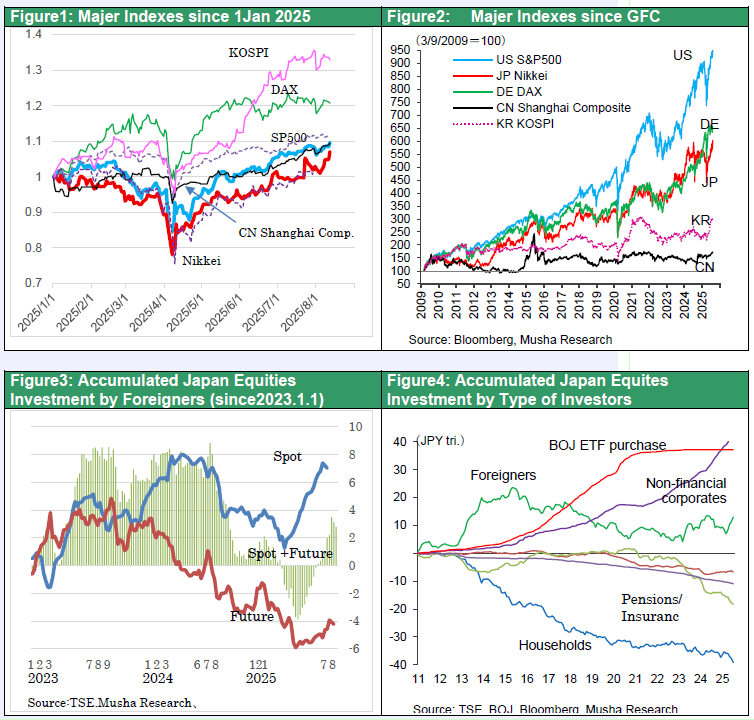

The Nikkei average hit a record high for the first time in a year and a month. After the biggest crash in history following the Ueda shock on August 5 last year and the crash caused by Trump's reciprocal tariff announcement on April 8 this year, the Nikkei average appears to have started a sharp rise after forming a W-shaped bottom at around 30,700 yen in overnight trading. During the recovery process from the reciprocal tariff shock, Japanese stocks lagged significantly behind. The German DAX reached a new all-time high on May 8, and the US S&P 500 on June 27, while the Nikkei Average lagged Germany by three months and the US by one and a half months. Additionally, year-to-date, the DAX

has risen by 21%, the Korean KOSPI by 33%, and the US S&P 500 by 10%, with Japan finally beginning to catch up.

Figure1: Japan's stock market begins to catch up

Figure 2: Japan's stock market begins to catch up

Figure 3: Major shift from foreign selling to buying

Figure 4: Cumulative investment amounts by investor type in Japan's stock market

The supply and demand for Japanese stocks has been favorable since the beginning of the year. This was due to a boom in share buybacks, which increased at a pace of 30-50% year-on-year, foreign investors buying Japanese stocks after selling 12 trillion-yen worth of Japanese stocks between August last year and April this year, thereby excessively reducing their weighting in Japanese stocks, and domestic investors such as NISA and pension funds buying Japanese stocks. Despite the risk of declining profits due to Trump tariffs, valuations remained undervalued.

Then why did Japanese stocks lag so far behind? It is solely due to the economic stagnation. According to the IMF's July economic outlook (comparing 2024, 2025, and 2026), the US is projected to grow at 2.8% → 1.9% → 2.0%, the Eurozone at 0.9% → 1.0% → 1.2%, while Japan is projected to grow at 0.2% → 0.7% → 0.5%, lagging significantly behind. Japan's inflation rate is projected to rise to 3.3% in 2025 and 2.1% in 2026, exceeding that of Europe and the US, which could suppress real growth. However, why is Japan alone experiencing such suppressed real growth?

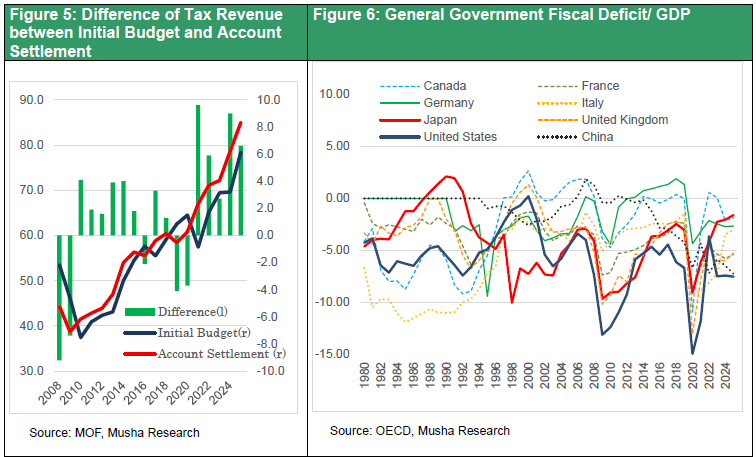

Japan's slump is due to excessive taxation

The answer lies in excessive taxation. Since 2012, the “integrated reform of social security and taxation” has led to increases in social insurance premiums and consumption taxes, creating a system that ensures tax revenue even in deflationary conditions. However, unexpected inflation has caused tax revenue to increase significantly, severely disrupting the economic balance. Since 2021, tax revenue has consistently exceeded the initial budget by 7 to 10 trillion yen (Figure 1). The excess tax revenue amounts to 1.2–1.6% of GDP. If this is retained within the government under the guise of fiscal reconstruction, it will exert significant downward pressure on private demand. In fact, when comparing the general government fiscal balance to GDP among G7 countries using OECD data (June Economic Outlook supplementary data), Japan, which has the lowest economic growth rate, stands out in terms of reducing its fiscal deficit. As shown in Figure 2, Japan's fiscal deficit/GDP ratio will continue to be the smallest among the G7 countries, at 4.2% in 2022, 2.3% in 2023, 2.05% in 2024, and 1.6% in 2025. If the additional tax revenue from inflation were fully returned to households, Japan could achieve high growth on par with the United States.

Figure 5: Tax revenue surplus trends

Figure 6: Fiscal deficit/GDP ratio trends in major countries

Takaichi-Tamaki alliance is best for Japanese economy and stock prices

Will a policy be introduced to shift the fiscal reconstruction course and return excess taxes to the people? Recent political developments are full of events that give us confidence that this will happen.

This Upper House election has three historical characteristics: (1) the fall of the LDP-Komeito minority coalition following last year's Lower House election, (2) the rise of the three reformist conservative parties (the Democratic Party for the People, the Sanseito Party(Party of Do It Yourself ), and the Japan Conservative Party), and (3) support for parties advocating proactive fiscal policy. According to exit poll data on age-specific proportional representation district voting preferences (Kyodo News), the LDP-Komeito support rate stands at 16% for those aged 10–30, 20% for those in their 40s, and 26% for those in their 50s. In contrast, the combined support rate for the three reformist conservative parties is over 50% for those aged 10–30, 38% for those in their 40s, and 31% for those in their 50s, surpassing the LDP-Komeito ruling coalition across all working-age generations. Due to the strong support for the ruling party among the elderly, the total number of votes in the proportional representation system is closely contested, with the LDP and Komeito receiving 18.01 million votes and the three reformist conservative parties combined receiving 18.02 million votes. However, public sentiment is clearly shifting.

Prime Minister Ishiba has refused to step down, stating that a comprehensive review of the election results is necessary. However, it is now almost certain that the LDP will hold a meeting of its Diet members to elect the next party leader. The next party leader will face two key decisions: first, given that the public (especially the working-age generation) is demanding the return of excess taxes, an active fiscal policy aimed at growth is essential; second, as a minority ruling party, the choice will be between cooperating with the Constitutional Democratic Party, which advocates fiscal consolidation and liberalism, or the three reformist conservative parties, which advocate tax cut policy. The LDP will abandon Ishiba's fiscal consolidation policy and shift its policy focus to a conservative, aggressive fiscal policy. Considering this, the conclusion is that Ms. Takaichi is the most suitable candidate to become the new president and savior of the LDP. It is also likely that the new president, Ms. Takaichi, will govern with the cooperation of the Democratic Party for the People the Sanseito Party (Party of Do It Yourself) and the Japan Conservative Party. Ms. Takaichi is the next leader picked up by Mr. Abe who obtain Trump and Treasury Secretary Bessent’s deep respect and is expected to be a good match for the United States. Mr. Bessent also expressed his expectations for the promotion of consumption in Japan, stating, “Japan has high savings, so it should increase consumption, while the United States should increase production” (in an interview with the Nikkei newspaper on August 11).

Will we see a return of Abenomics or a repeat of the Ueda and Ishiba shocks?

The reason for the sudden rise in Japanese stock prices, which had been lagging behind, is thought to be the resignation of Ishiba and the establishment of new leader who will pursue aggressive fiscal policy. If market expectations are disappointed, stock prices could repeat last year's Ueda Shock and Ishiba Shock. If expectations are realized, a return of the Abenomics market could be anticipated. A target of 50,000 yen by year-end and 60,000 yen by 2027 may come into view.

Questioning the academic integrity of fiscal consolidation advocates

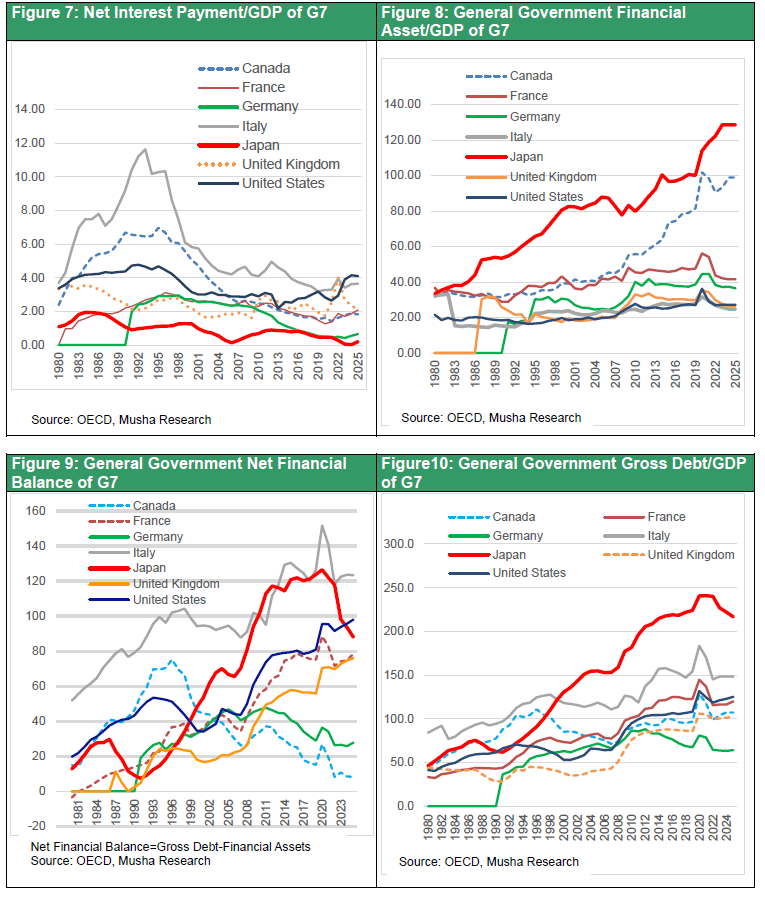

Do experts who continue to advocate fiscal consolidation at this stage possess academic integrity? On August 8, the Nikkei newspaper published a paper by former University of Tokyo professor Toshihiro Ihori titled “Face the Crisis in Fiscal Conditions,” which included a chart (equivalent to Figure 7 below) showing that Japan's debt burden is the worst in the world, worse than Greece's.

The latest data from the OECD shows that Japan's fiscal situation is among the best in the G7. I will leave the details for next time, but please refer to the following charts.

Figure 5: Government net interest payments/GDP

Figure 6: Government-held financial assets/GDP (%)

Figure7: Gross government debt/GDP (%)

Figure 8: Government net financial debt/GDP (%)

The fundamental fallacy of pessimists

Once again, many investors misread the strength of the market. At the root of this mistake is the misguided concern that Japan is on the verge of a fiscal crisis and that fiscal stimulus will lead to rising interest rates and currency collapse, triggering a financial crisis. If there are surplus funds in the fiscal budget but they cannot be used, then it is only natural that the economy will deteriorate as the government absorbs private savings and hoards them.

Such individuals argue that there is no reason to expect growth, citing Japan's aging population, the lack of progress in reforms, and the failure to achieve productivity levels on par with other countries. Naturally, their investment strategies are pessimistic. It is time to move away from the belief in a fiscal crisis.